Problem Statement A city must construct a new bridge Four pr

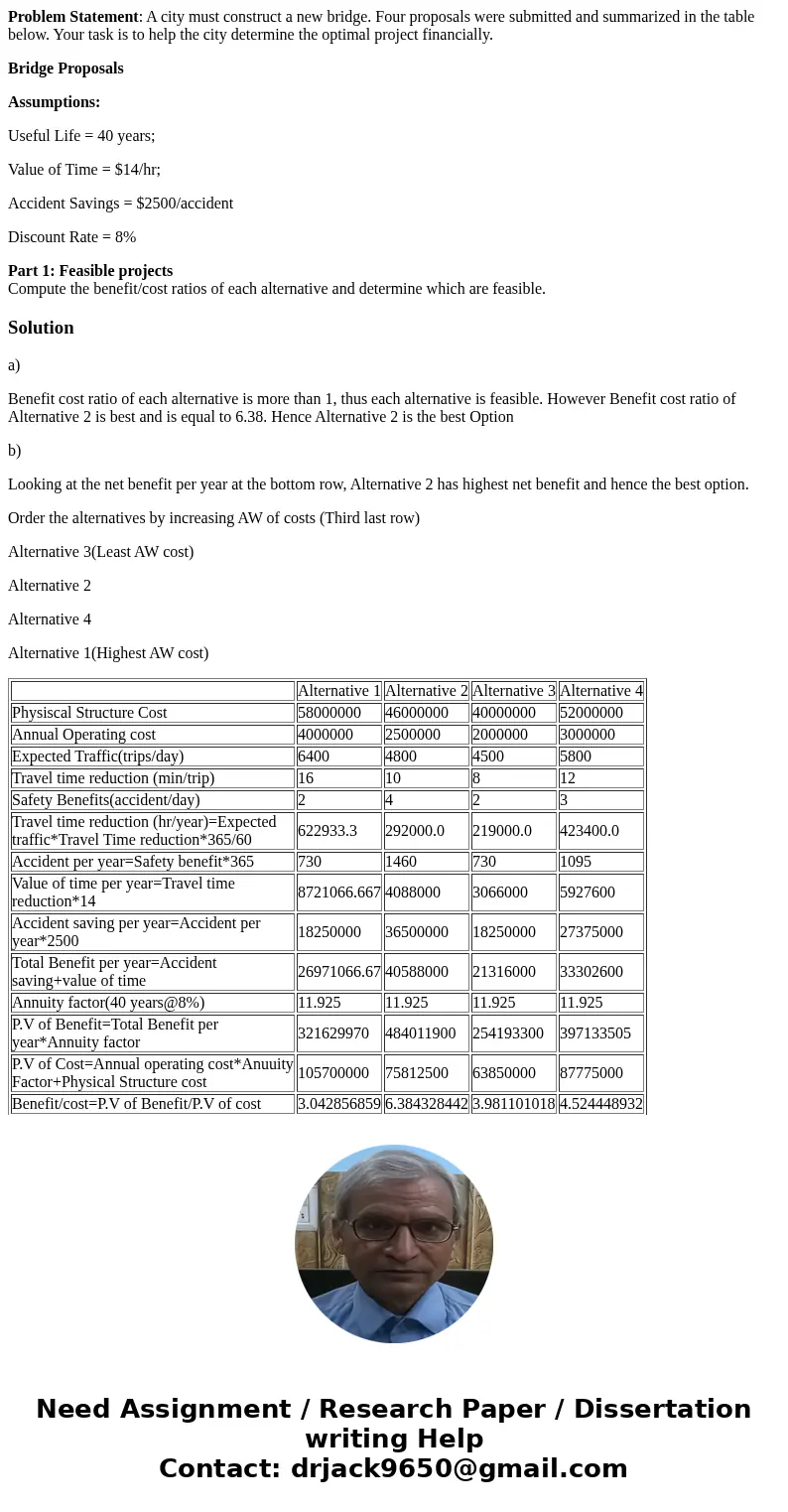

Problem Statement: A city must construct a new bridge. Four proposals were submitted and summarized in the table below. Your task is to help the city determine the optimal project financially.

Bridge Proposals

Assumptions:

Useful Life = 40 years;

Value of Time = $14/hr;

Accident Savings = $2500/accident

Discount Rate = 8%

Part 1: Feasible projects

Compute the benefit/cost ratios of each alternative and determine which are feasible.

Solution

a)

Benefit cost ratio of each alternative is more than 1, thus each alternative is feasible. However Benefit cost ratio of Alternative 2 is best and is equal to 6.38. Hence Alternative 2 is the best Option

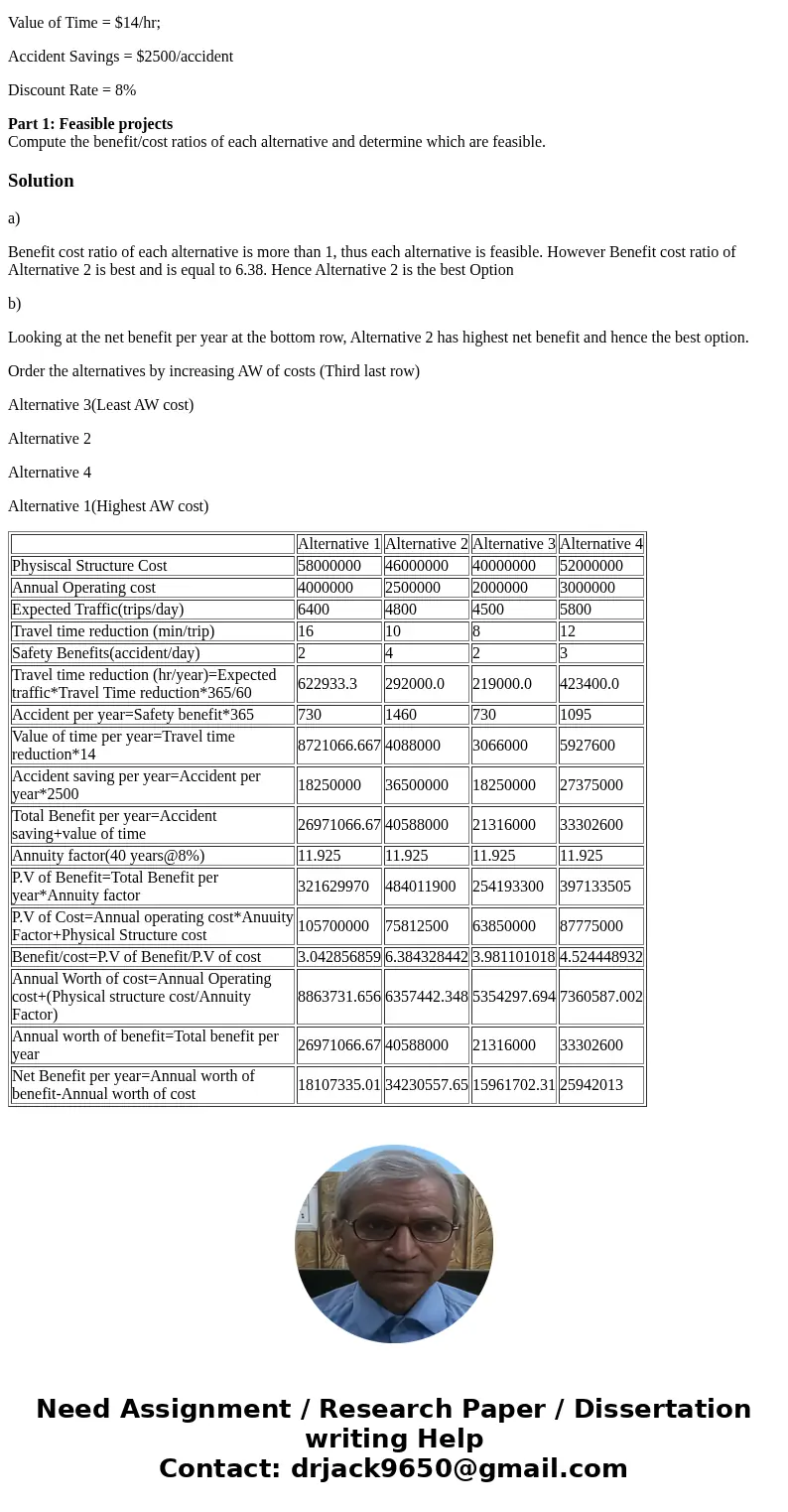

b)

Looking at the net benefit per year at the bottom row, Alternative 2 has highest net benefit and hence the best option.

Order the alternatives by increasing AW of costs (Third last row)

Alternative 3(Least AW cost)

Alternative 2

Alternative 4

Alternative 1(Highest AW cost)

| Alternative 1 | Alternative 2 | Alternative 3 | Alternative 4 | |

| Physiscal Structure Cost | 58000000 | 46000000 | 40000000 | 52000000 |

| Annual Operating cost | 4000000 | 2500000 | 2000000 | 3000000 |

| Expected Traffic(trips/day) | 6400 | 4800 | 4500 | 5800 |

| Travel time reduction (min/trip) | 16 | 10 | 8 | 12 |

| Safety Benefits(accident/day) | 2 | 4 | 2 | 3 |

| Travel time reduction (hr/year)=Expected traffic*Travel Time reduction*365/60 | 622933.3 | 292000.0 | 219000.0 | 423400.0 |

| Accident per year=Safety benefit*365 | 730 | 1460 | 730 | 1095 |

| Value of time per year=Travel time reduction*14 | 8721066.667 | 4088000 | 3066000 | 5927600 |

| Accident saving per year=Accident per year*2500 | 18250000 | 36500000 | 18250000 | 27375000 |

| Total Benefit per year=Accident saving+value of time | 26971066.67 | 40588000 | 21316000 | 33302600 |

| Annuity factor(40 years@8%) | 11.925 | 11.925 | 11.925 | 11.925 |

| P.V of Benefit=Total Benefit per year*Annuity factor | 321629970 | 484011900 | 254193300 | 397133505 |

| P.V of Cost=Annual operating cost*Anuuity Factor+Physical Structure cost | 105700000 | 75812500 | 63850000 | 87775000 |

| Benefit/cost=P.V of Benefit/P.V of cost | 3.042856859 | 6.384328442 | 3.981101018 | 4.524448932 |

| Annual Worth of cost=Annual Operating cost+(Physical structure cost/Annuity Factor) | 8863731.656 | 6357442.348 | 5354297.694 | 7360587.002 |

| Annual worth of benefit=Total benefit per year | 26971066.67 | 40588000 | 21316000 | 33302600 |

| Net Benefit per year=Annual worth of benefit-Annual worth of cost | 18107335.01 | 34230557.65 | 15961702.31 | 25942013 |

Homework Sourse

Homework Sourse