NPV Project L costs 60000 its expected cash inflows are 1300

Solution

NPV = $10885.53

--------------------------------------------------------------------------------------------------------------------------

NPV is the difference between the present value of all cash inflow and the initial cost of an asset or project.

All the future cash flows are discounted using discounting rate or required rate and the sum of all the discounted cash flows will be subtracted with the initial cost.

NPV = PV of future cash inflow - initial cost

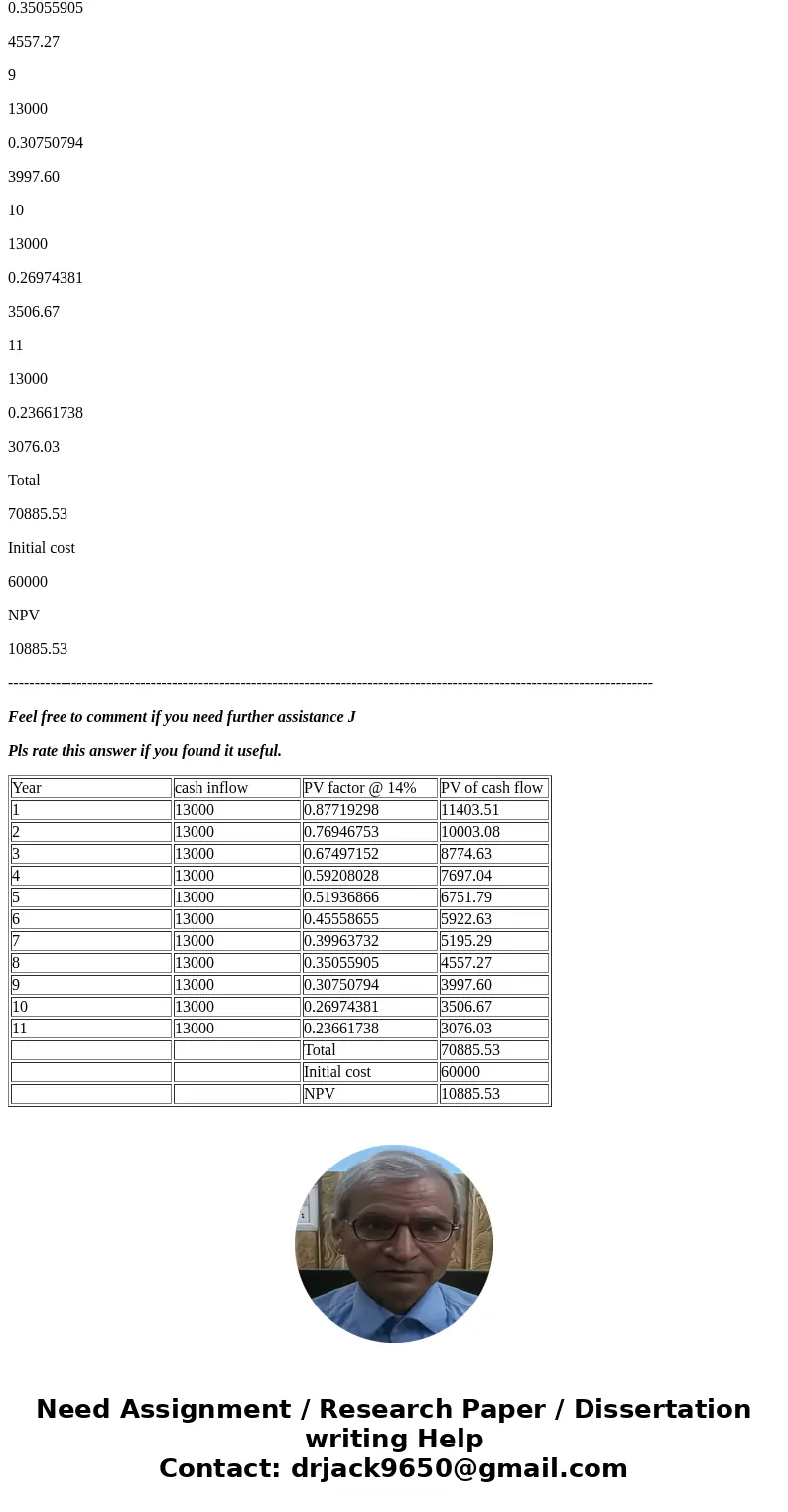

Pls refer below table for NPV calculation,

Year

cash inflow

PV factor @ 14%

PV of cash flow

1

13000

0.87719298

11403.51

2

13000

0.76946753

10003.08

3

13000

0.67497152

8774.63

4

13000

0.59208028

7697.04

5

13000

0.51936866

6751.79

6

13000

0.45558655

5922.63

7

13000

0.39963732

5195.29

8

13000

0.35055905

4557.27

9

13000

0.30750794

3997.60

10

13000

0.26974381

3506.67

11

13000

0.23661738

3076.03

Total

70885.53

Initial cost

60000

NPV

10885.53

--------------------------------------------------------------------------------------------------------------------------

Feel free to comment if you need further assistance J

Pls rate this answer if you found it useful.

| Year | cash inflow | PV factor @ 14% | PV of cash flow |

| 1 | 13000 | 0.87719298 | 11403.51 |

| 2 | 13000 | 0.76946753 | 10003.08 |

| 3 | 13000 | 0.67497152 | 8774.63 |

| 4 | 13000 | 0.59208028 | 7697.04 |

| 5 | 13000 | 0.51936866 | 6751.79 |

| 6 | 13000 | 0.45558655 | 5922.63 |

| 7 | 13000 | 0.39963732 | 5195.29 |

| 8 | 13000 | 0.35055905 | 4557.27 |

| 9 | 13000 | 0.30750794 | 3997.60 |

| 10 | 13000 | 0.26974381 | 3506.67 |

| 11 | 13000 | 0.23661738 | 3076.03 |

| Total | 70885.53 | ||

| Initial cost | 60000 | ||

| NPV | 10885.53 |

Homework Sourse

Homework Sourse