McKenna Sports Authority is getting ready to produce a new l

McKenna Sports Authority is getting ready to produce a new line of gold clubs by investing $1.85 million. The investment will result in additional cash flows of $525,000, $827,500, and $1,215,000 over the next three years. What is the payback period for this project?

Solution

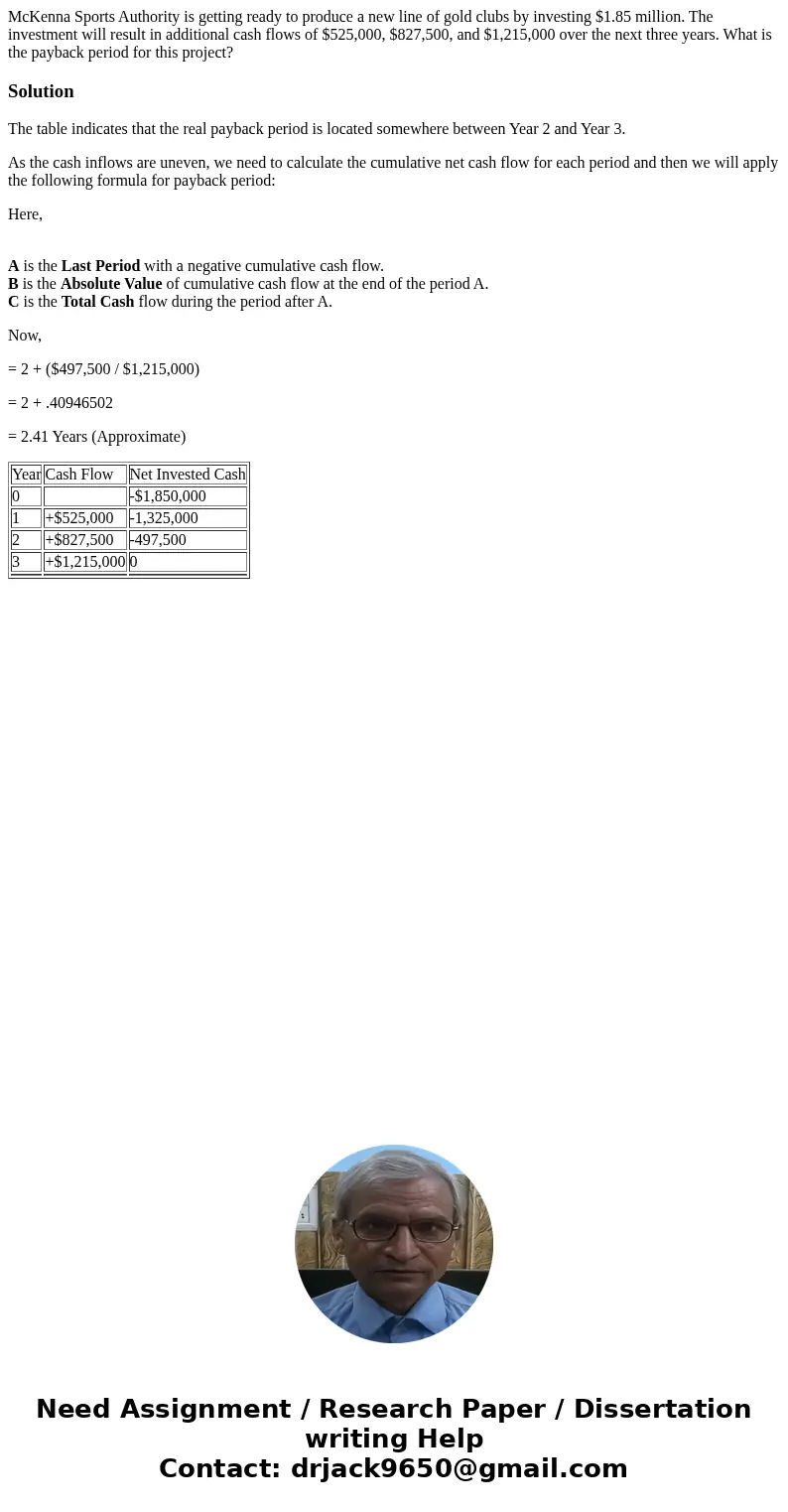

The table indicates that the real payback period is located somewhere between Year 2 and Year 3.

As the cash inflows are uneven, we need to calculate the cumulative net cash flow for each period and then we will apply the following formula for payback period:

Here,

A is the Last Period with a negative cumulative cash flow.

B is the Absolute Value of cumulative cash flow at the end of the period A.

C is the Total Cash flow during the period after A.

Now,

= 2 + ($497,500 / $1,215,000)

= 2 + .40946502

= 2.41 Years (Approximate)

| Year | Cash Flow | Net Invested Cash |

| 0 | -$1,850,000 | |

| 1 | +$525,000 | -1,325,000 |

| 2 | +$827,500 | -497,500 |

| 3 | +$1,215,000 | 0 |

Homework Sourse

Homework Sourse