Vernon Manufacturing started in 2018 with the following acco

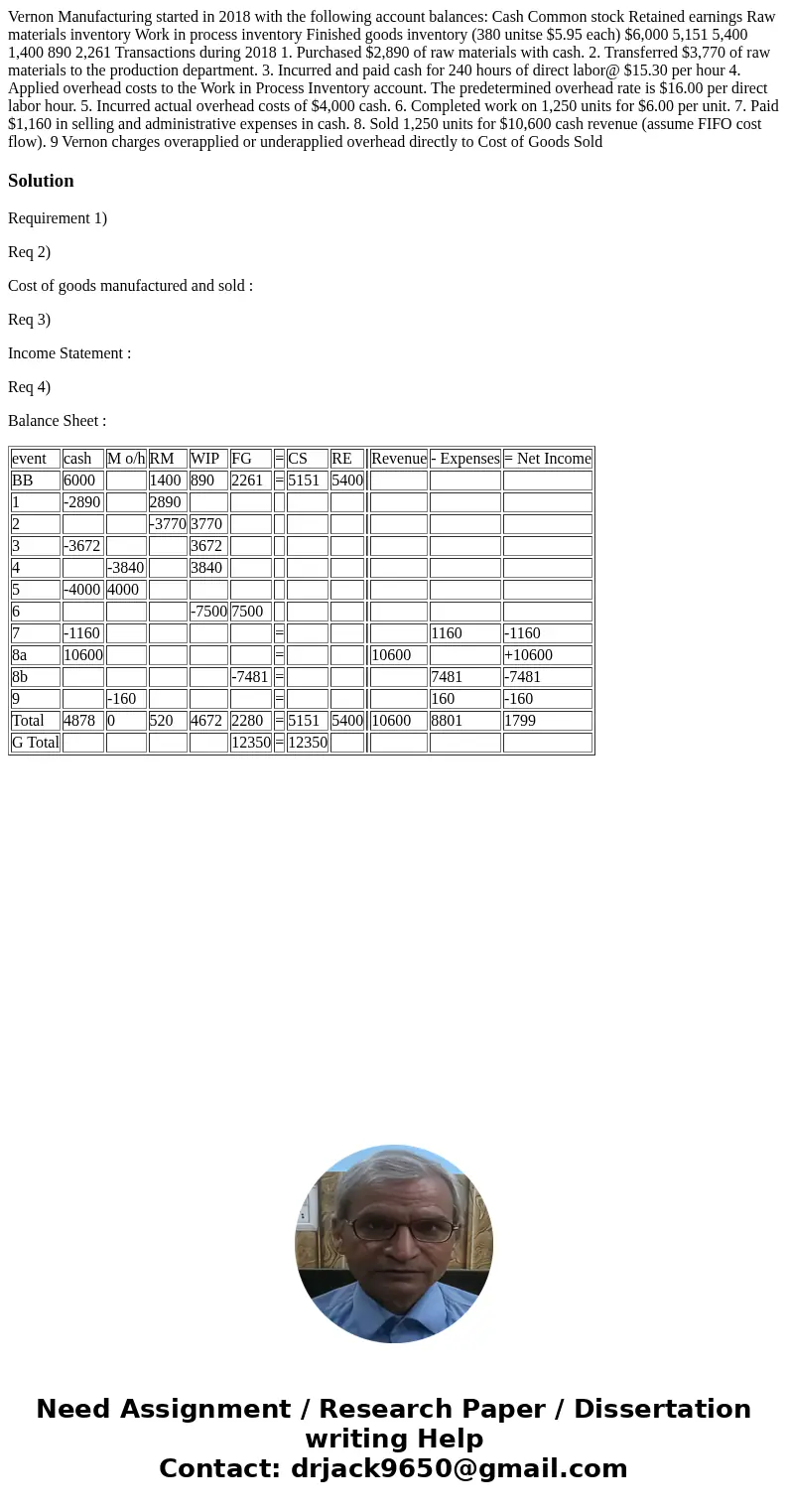

Vernon Manufacturing started in 2018 with the following account balances: Cash Common stock Retained earnings Raw materials inventory Work in process inventory Finished goods inventory (380 unitse $5.95 each) $6,000 5,151 5,400 1,400 890 2,261 Transactions during 2018 1. Purchased $2,890 of raw materials with cash. 2. Transferred $3,770 of raw materials to the production department. 3. Incurred and paid cash for 240 hours of direct labor@ $15.30 per hour 4. Applied overhead costs to the Work in Process Inventory account. The predetermined overhead rate is $16.00 per direct labor hour. 5. Incurred actual overhead costs of $4,000 cash. 6. Completed work on 1,250 units for $6.00 per unit. 7. Paid $1,160 in selling and administrative expenses in cash. 8. Sold 1,250 units for $10,600 cash revenue (assume FIFO cost flow). 9 Vernon charges overapplied or underapplied overhead directly to Cost of Goods Sold

Solution

Requirement 1)

Req 2)

Cost of goods manufactured and sold :

Req 3)

Income Statement :

Req 4)

Balance Sheet :

| event | cash | M o/h | RM | WIP | FG | = | CS | RE | Revenue | - Expenses | = Net Income | |

| BB | 6000 | 1400 | 890 | 2261 | = | 5151 | 5400 | |||||

| 1 | -2890 | 2890 | ||||||||||

| 2 | -3770 | 3770 | ||||||||||

| 3 | -3672 | 3672 | ||||||||||

| 4 | -3840 | 3840 | ||||||||||

| 5 | -4000 | 4000 | ||||||||||

| 6 | -7500 | 7500 | ||||||||||

| 7 | -1160 | = | 1160 | -1160 | ||||||||

| 8a | 10600 | = | 10600 | +10600 | ||||||||

| 8b | -7481 | = | 7481 | -7481 | ||||||||

| 9 | -160 | = | 160 | -160 | ||||||||

| Total | 4878 | 0 | 520 | 4672 | 2280 | = | 5151 | 5400 | 10600 | 8801 | 1799 | |

| G Total | 12350 | = | 12350 |

Homework Sourse

Homework Sourse