Baird Company began operations on January 1 2018 by issuing

Baird Company began operations on January 1, 2018, by issuing common stock for $32,000 cash. During 2018, Baird received $56,400 cash from revenue and incurred costs that required $38,400 of cash payments.

Prepare a GAAP-based income statement and balance sheet for Baird Company for 2018, under each of the following independent scenarios:

B. Baird is in the car rental business. The $38,400 was paid to purchase automobiles. The automobiles were purchased on January 1, 2018, and have three-year useful lives, with no expected salvage value. Baird uses straight-line depreciation. The revenue was generated by leasing the automobiles.

**** Can you please help with the balance sheet***

Solution

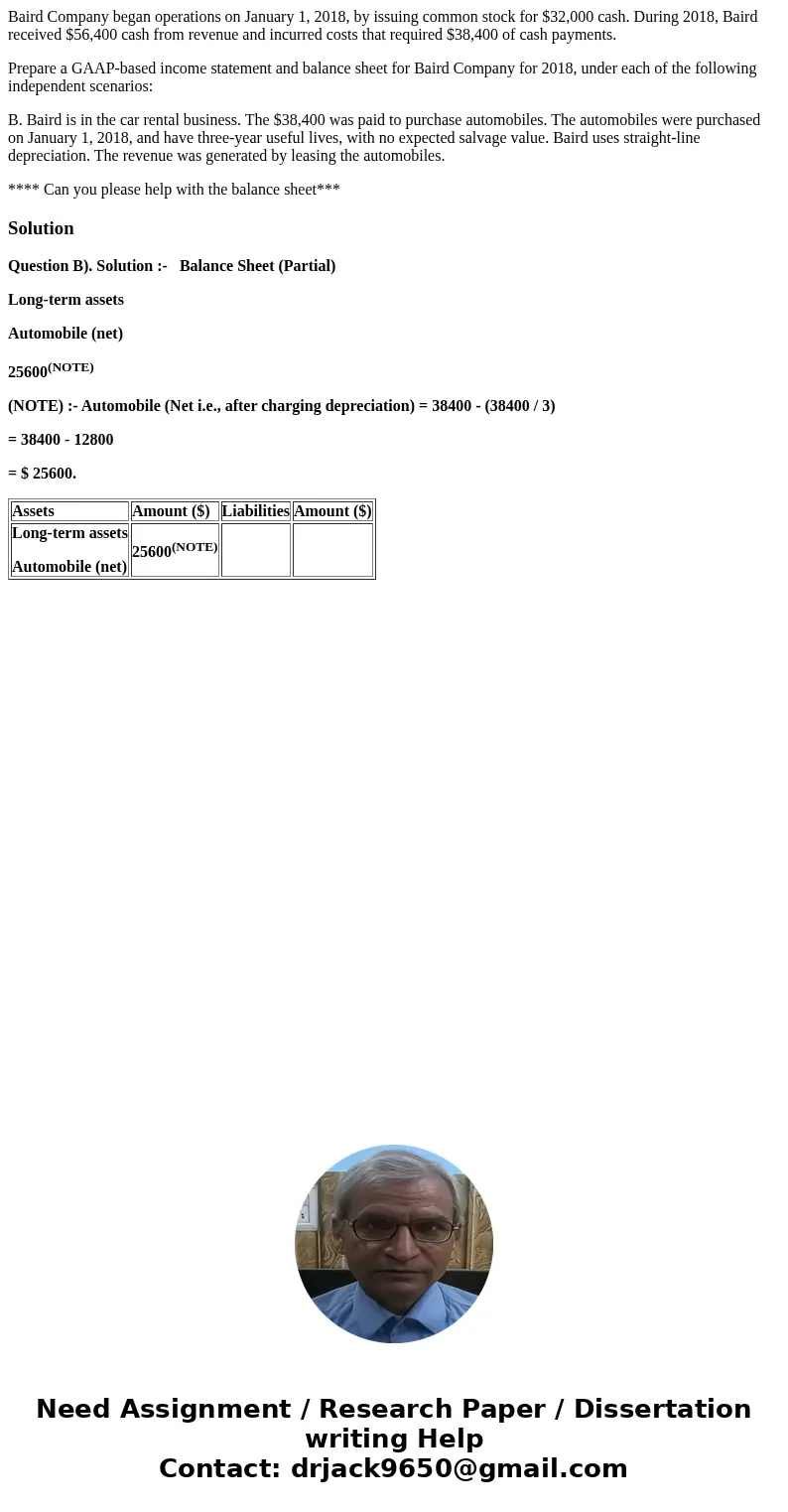

Question B). Solution :- Balance Sheet (Partial)

Long-term assets

Automobile (net)

25600(NOTE)

(NOTE) :- Automobile (Net i.e., after charging depreciation) = 38400 - (38400 / 3)

= 38400 - 12800

= $ 25600.

| Assets | Amount ($) | Liabilities | Amount ($) |

| Long-term assets Automobile (net) | 25600(NOTE) |

Homework Sourse

Homework Sourse