So i tried looking for these questions and see how to do the

So i tried looking for these questions and see how to do them but all the solutions i find are marked wrong so I do not know what to do. For example I found a solution for #2 in chegg and the answers for home is 108.4 and work 136.4 so can someone explain how to actually do them because my hw is marking them wrong.

Harbour Company makes two models of electronic tablets, the Home and the Work. Basic production information follows Direct materials cost per unit Direct labor cost per unit Sales price per unit Expected production per montlh Home $ 30 20 300 Work $ 48 30 500 700 units 400 units Harbour has monthly overhead of $175,200, which is divided into the following cost pools Setup costs Quality control Maintenance $68,800 58,400 48,000 $175,200 Total The company has also compiled the following information about the chosen cost drivers Home Work Total 58 390 1,700 1,300 3,000 Number of setups Number of inspections Number of machine hours 42 340 100 730Solution

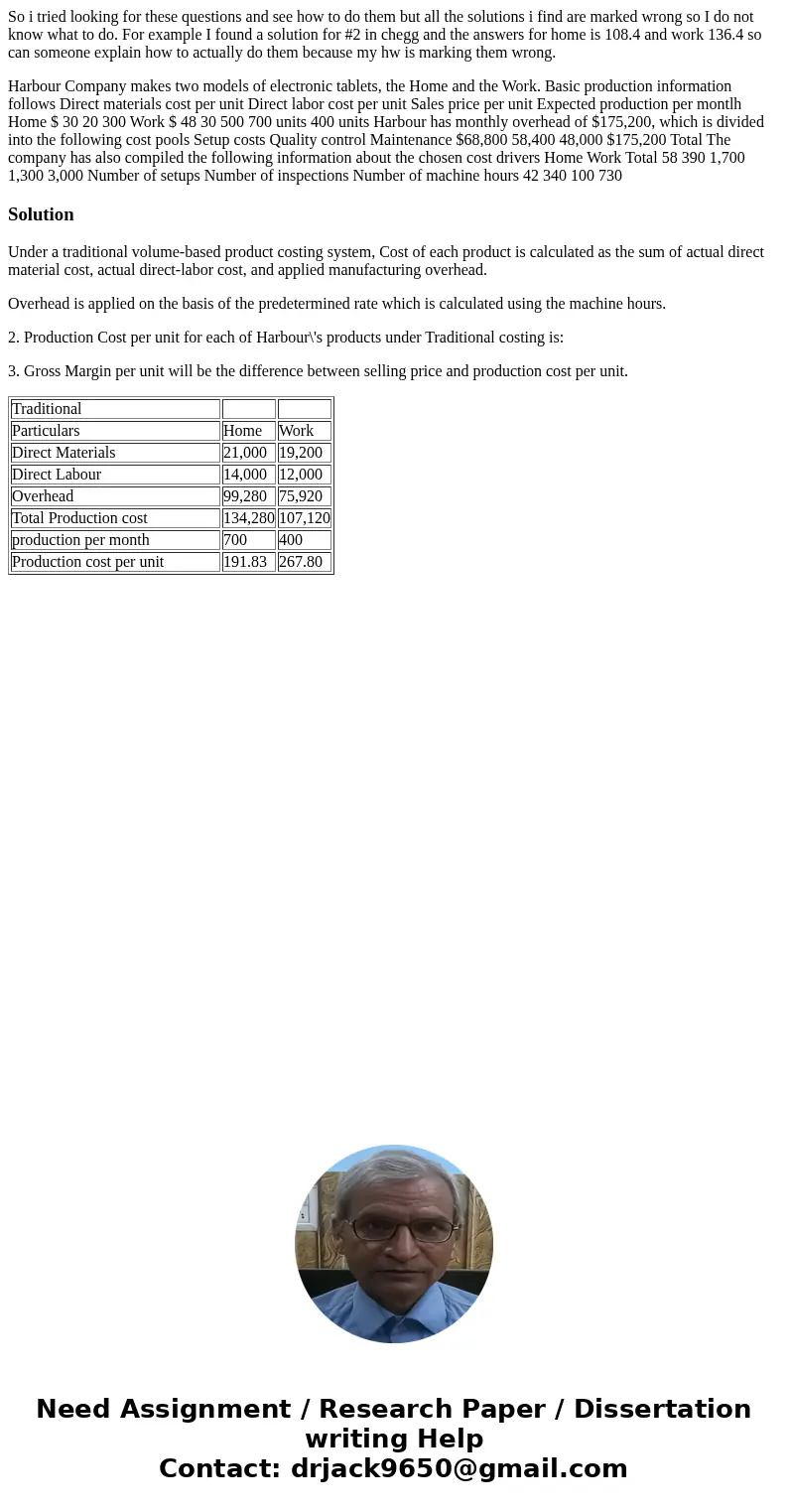

Under a traditional volume-based product costing system, Cost of each product is calculated as the sum of actual direct material cost, actual direct-labor cost, and applied manufacturing overhead.

Overhead is applied on the basis of the predetermined rate which is calculated using the machine hours.

2. Production Cost per unit for each of Harbour\'s products under Traditional costing is:

3. Gross Margin per unit will be the difference between selling price and production cost per unit.

| Traditional | ||

| Particulars | Home | Work |

| Direct Materials | 21,000 | 19,200 |

| Direct Labour | 14,000 | 12,000 |

| Overhead | 99,280 | 75,920 |

| Total Production cost | 134,280 | 107,120 |

| production per month | 700 | 400 |

| Production cost per unit | 191.83 | 267.80 |

Homework Sourse

Homework Sourse