I do not understand how the the tutor came to the answer wit

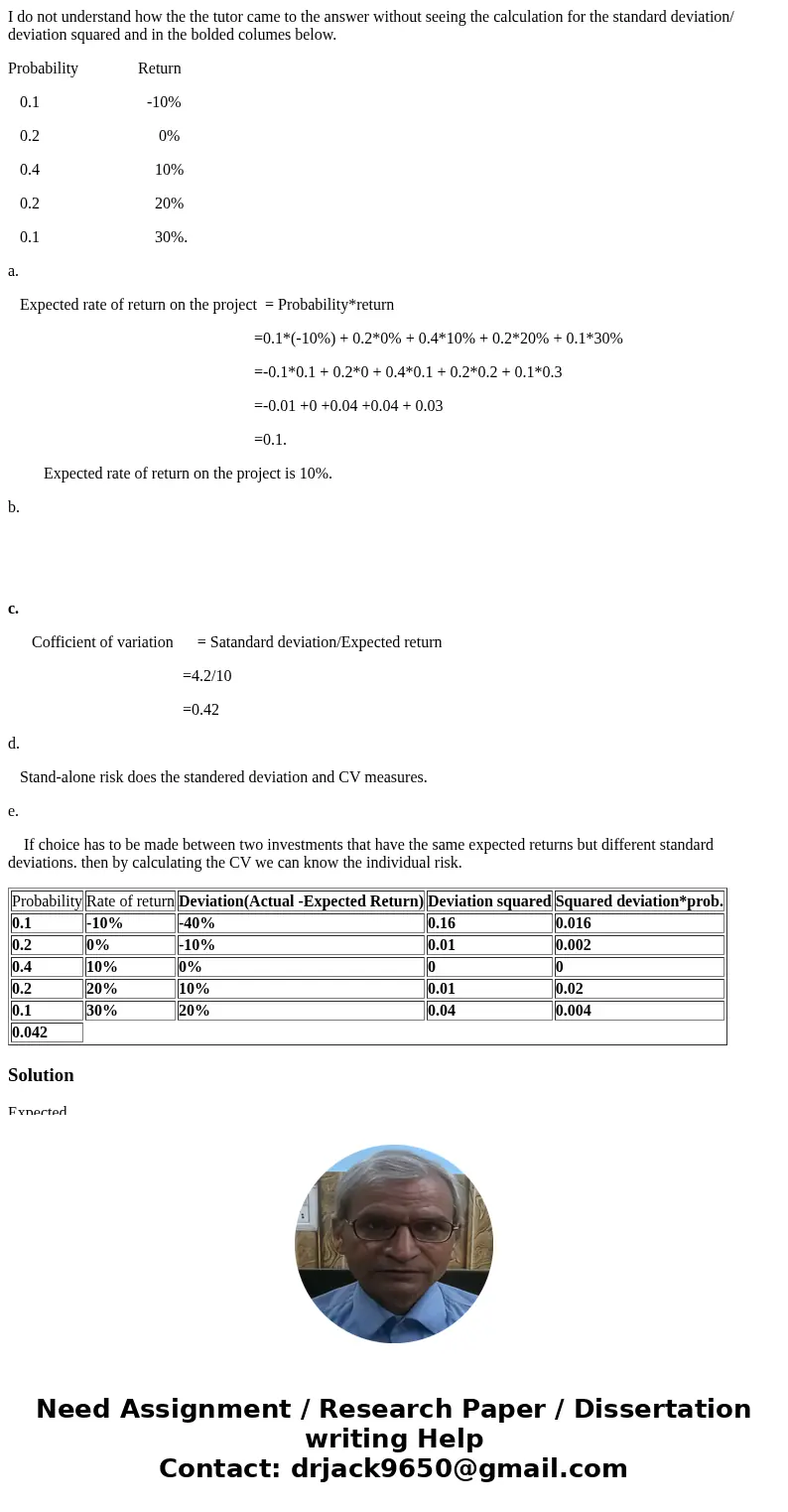

I do not understand how the the tutor came to the answer without seeing the calculation for the standard deviation/ deviation squared and in the bolded columes below.

Probability Return

0.1 -10%

0.2 0%

0.4 10%

0.2 20%

0.1 30%.

a.

Expected rate of return on the project = Probability*return

=0.1*(-10%) + 0.2*0% + 0.4*10% + 0.2*20% + 0.1*30%

=-0.1*0.1 + 0.2*0 + 0.4*0.1 + 0.2*0.2 + 0.1*0.3

=-0.01 +0 +0.04 +0.04 + 0.03

=0.1.

Expected rate of return on the project is 10%.

b.

c.

Cofficient of variation = Satandard deviation/Expected return

=4.2/10

=0.42

d.

Stand-alone risk does the standered deviation and CV measures.

e.

If choice has to be made between two investments that have the same expected returns but different standard deviations. then by calculating the CV we can know the individual risk.

| Probability | Rate of return | Deviation(Actual -Expected Return) | Deviation squared | Squared deviation*prob. |

| 0.1 | -10% | -40% | 0.16 | 0.016 |

| 0.2 | 0% | -10% | 0.01 | 0.002 |

| 0.4 | 10% | 0% | 0 | 0 |

| 0.2 | 20% | 10% | 0.01 | 0.02 |

| 0.1 | 30% | 20% | 0.04 | 0.004 |

| 0.042 |

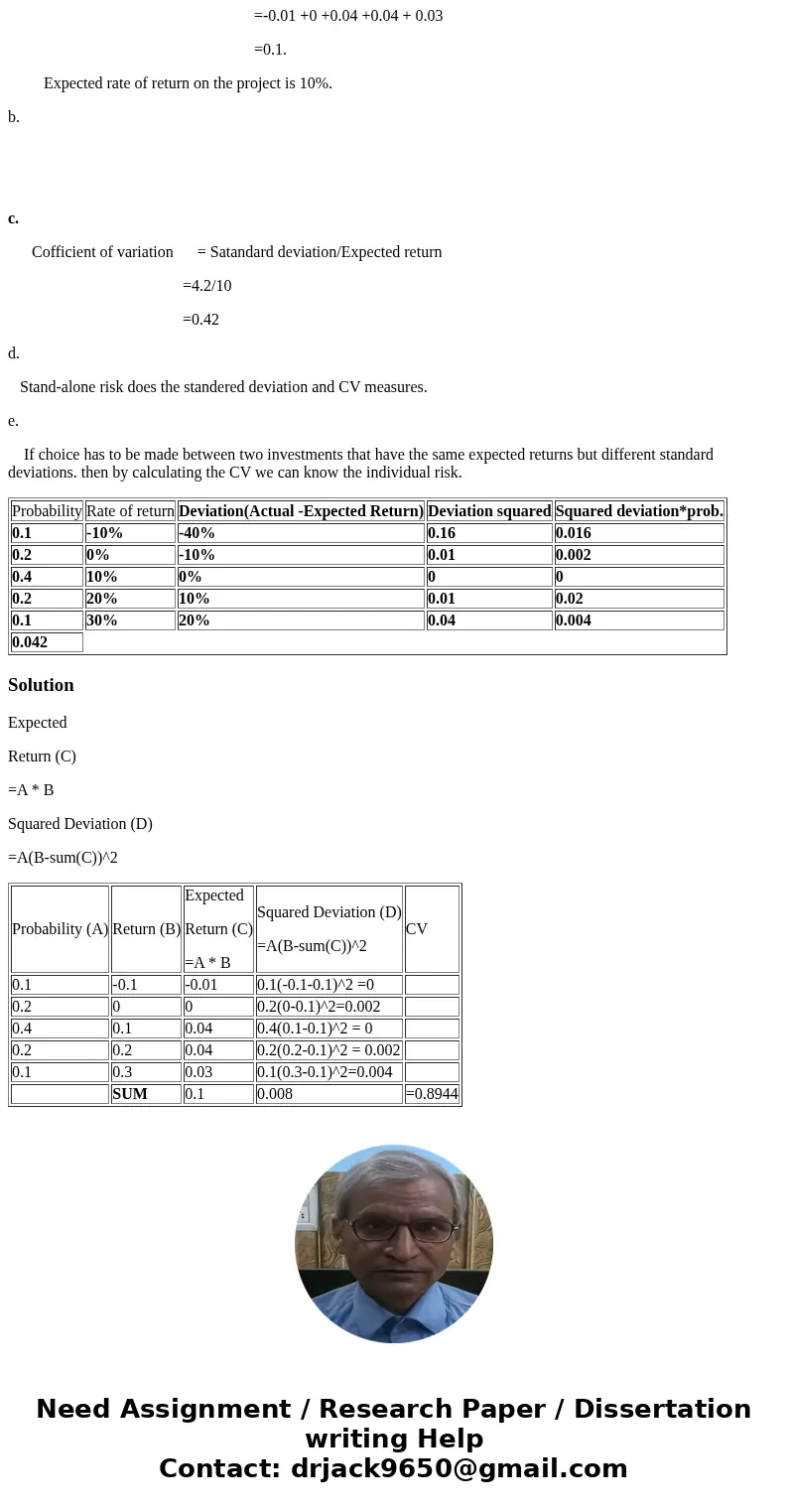

Solution

Expected

Return (C)

=A * B

Squared Deviation (D)

=A(B-sum(C))^2

| Probability (A) | Return (B) | Expected Return (C) =A * B | Squared Deviation (D) =A(B-sum(C))^2 | CV |

| 0.1 | -0.1 | -0.01 | 0.1(-0.1-0.1)^2 =0 | |

| 0.2 | 0 | 0 | 0.2(0-0.1)^2=0.002 | |

| 0.4 | 0.1 | 0.04 | 0.4(0.1-0.1)^2 = 0 | |

| 0.2 | 0.2 | 0.04 | 0.2(0.2-0.1)^2 = 0.002 | |

| 0.1 | 0.3 | 0.03 | 0.1(0.3-0.1)^2=0.004 | |

| SUM | 0.1 | 0.008 | =0.8944 |

Homework Sourse

Homework Sourse