Rodriguez Company pays 390000 for real estate plus 20670 in

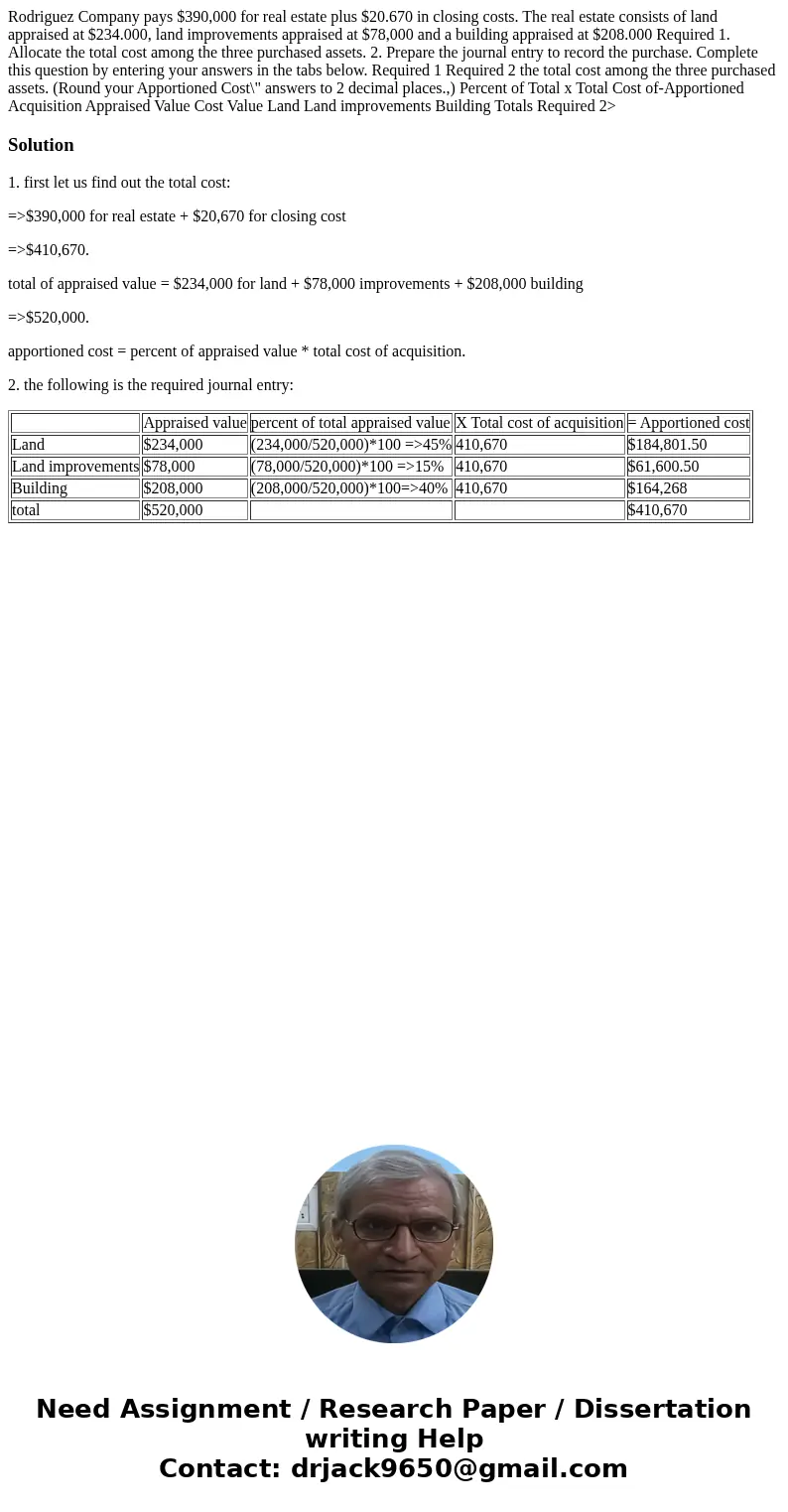

Rodriguez Company pays $390,000 for real estate plus $20.670 in closing costs. The real estate consists of land appraised at $234.000, land improvements appraised at $78,000 and a building appraised at $208.000 Required 1. Allocate the total cost among the three purchased assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required 1 Required 2 the total cost among the three purchased assets. (Round your Apportioned Cost\" answers to 2 decimal places.,) Percent of Total x Total Cost of-Apportioned Acquisition Appraised Value Cost Value Land Land improvements Building Totals Required 2>

Solution

1. first let us find out the total cost:

=>$390,000 for real estate + $20,670 for closing cost

=>$410,670.

total of appraised value = $234,000 for land + $78,000 improvements + $208,000 building

=>$520,000.

apportioned cost = percent of appraised value * total cost of acquisition.

2. the following is the required journal entry:

| Appraised value | percent of total appraised value | X Total cost of acquisition | = Apportioned cost | |

| Land | $234,000 | (234,000/520,000)*100 =>45% | 410,670 | $184,801.50 |

| Land improvements | $78,000 | (78,000/520,000)*100 =>15% | 410,670 | $61,600.50 |

| Building | $208,000 | (208,000/520,000)*100=>40% | 410,670 | $164,268 |

| total | $520,000 | $410,670 |

Homework Sourse

Homework Sourse