In the RAND study two plans had full coverage for spending w

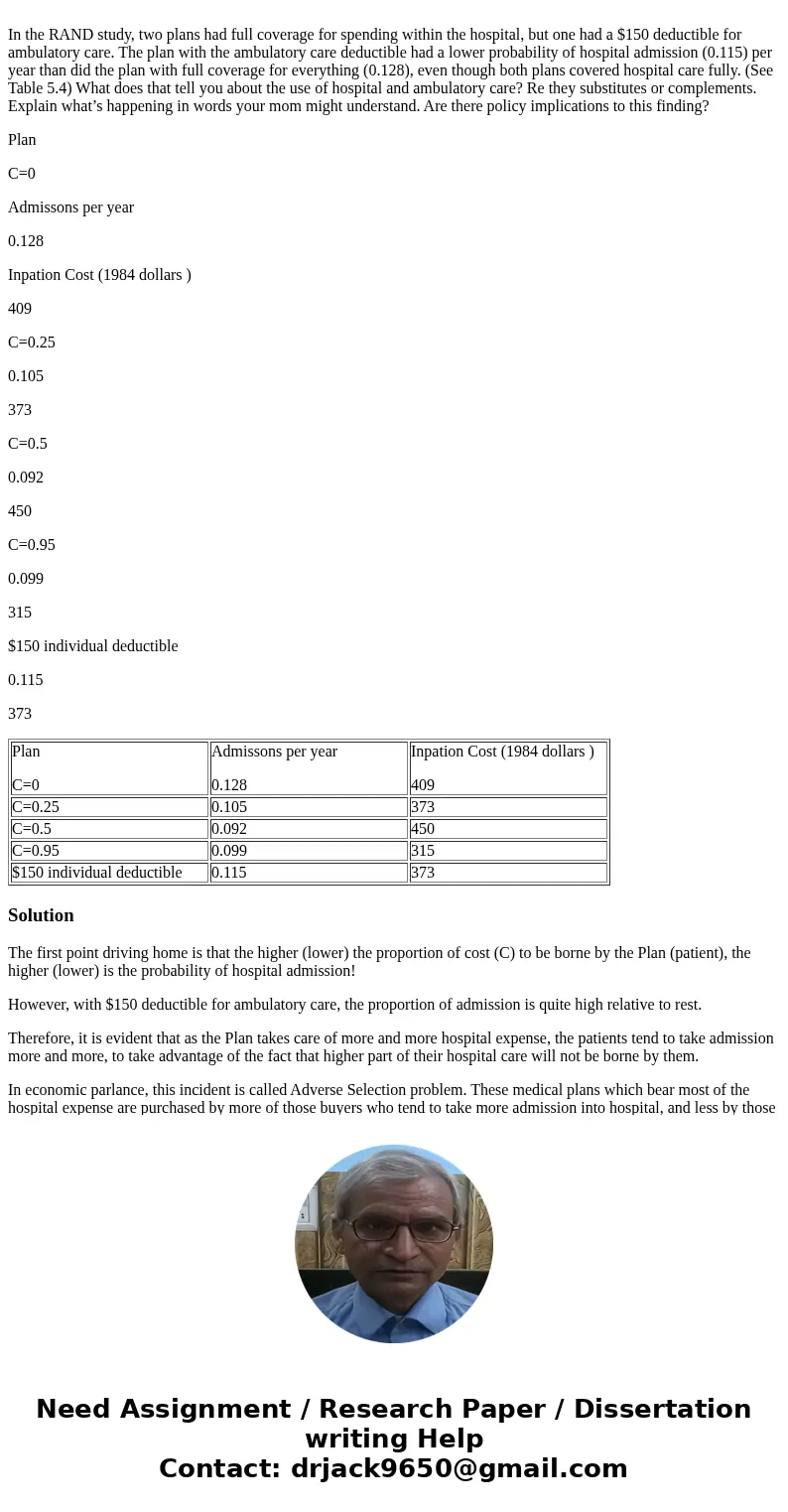

In the RAND study, two plans had full coverage for spending within the hospital, but one had a $150 deductible for ambulatory care. The plan with the ambulatory care deductible had a lower probability of hospital admission (0.115) per year than did the plan with full coverage for everything (0.128), even though both plans covered hospital care fully. (See Table 5.4) What does that tell you about the use of hospital and ambulatory care? Re they substitutes or complements. Explain what’s happening in words your mom might understand. Are there policy implications to this finding?

Plan

C=0

Admissons per year

0.128

Inpation Cost (1984 dollars )

409

C=0.25

0.105

373

C=0.5

0.092

450

C=0.95

0.099

315

$150 individual deductible

0.115

373

| Plan C=0 | Admissons per year 0.128 | Inpation Cost (1984 dollars ) 409 |

| C=0.25 | 0.105 | 373 |

| C=0.5 | 0.092 | 450 |

| C=0.95 | 0.099 | 315 |

| $150 individual deductible | 0.115 | 373 |

Solution

The first point driving home is that the higher (lower) the proportion of cost (C) to be borne by the Plan (patient), the higher (lower) is the probability of hospital admission!

However, with $150 deductible for ambulatory care, the proportion of admission is quite high relative to rest.

Therefore, it is evident that as the Plan takes care of more and more hospital expense, the patients tend to take admission more and more, to take advantage of the fact that higher part of their hospital care will not be borne by them.

In economic parlance, this incident is called Adverse Selection problem. These medical plans which bear most of the hospital expense are purchased by more of those buyers who tend to take more admission into hospital, and less by those buyers who do not opt for admission each time they feel unwell. The policy implication for the Plan sellers is to do a complete risk assessment of the potential buyers in order to minimize the loss from hospitalization.

Homework Sourse

Homework Sourse