Ch 123 Exercises and Problems i Statement of Partnership Liq

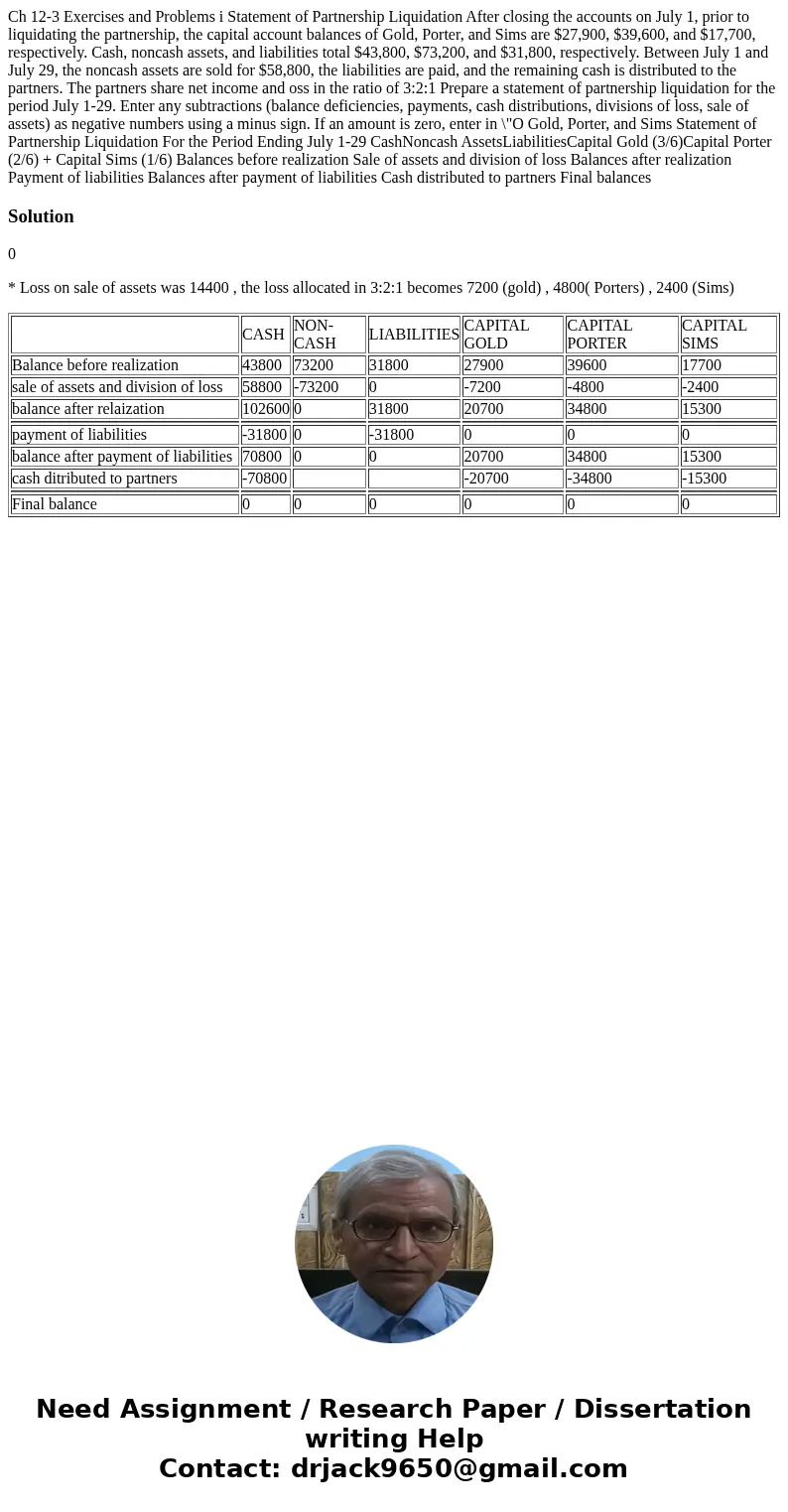

Ch 12-3 Exercises and Problems i Statement of Partnership Liquidation After closing the accounts on July 1, prior to liquidating the partnership, the capital account balances of Gold, Porter, and Sims are $27,900, $39,600, and $17,700, respectively. Cash, noncash assets, and liabilities total $43,800, $73,200, and $31,800, respectively. Between July 1 and July 29, the noncash assets are sold for $58,800, the liabilities are paid, and the remaining cash is distributed to the partners. The partners share net income and oss in the ratio of 3:2:1 Prepare a statement of partnership liquidation for the period July 1-29. Enter any subtractions (balance deficiencies, payments, cash distributions, divisions of loss, sale of assets) as negative numbers using a minus sign. If an amount is zero, enter in \"O Gold, Porter, and Sims Statement of Partnership Liquidation For the Period Ending July 1-29 CashNoncash AssetsLiabilitiesCapital Gold (3/6)Capital Porter (2/6) + Capital Sims (1/6) Balances before realization Sale of assets and division of loss Balances after realization Payment of liabilities Balances after payment of liabilities Cash distributed to partners Final balances

Solution

0

* Loss on sale of assets was 14400 , the loss allocated in 3:2:1 becomes 7200 (gold) , 4800( Porters) , 2400 (Sims)

| CASH | NON-CASH | LIABILITIES | CAPITAL GOLD | CAPITAL PORTER | CAPITAL SIMS | |

| Balance before realization | 43800 | 73200 | 31800 | 27900 | 39600 | 17700 |

| sale of assets and division of loss | 58800 | -73200 | 0 | -7200 | -4800 | -2400 |

| balance after relaization | 102600 | 0 | 31800 | 20700 | 34800 | 15300 |

| payment of liabilities | -31800 | 0 | -31800 | 0 | 0 | 0 |

| balance after payment of liabilities | 70800 | 0 | 0 | 20700 | 34800 | 15300 |

| cash ditributed to partners | -70800 | -20700 | -34800 | -15300 | ||

| Final balance | 0 | 0 | 0 | 0 | 0 | 0 |

Homework Sourse

Homework Sourse