This data set is from an article by Frederick Schutt and Pet

This data set is from an article by Frederick Schutt and Peter VanBergeijk in which they attempted to see if the pharmaceutical industry practiced international price discrimination by estimating a model of the prices of pharmaceuticals in a cross section of 32 countries. The authors felt that if price discrimination existed, then the coefficient of per capita income in a properly specified price equation would be strongly positive.[1] In addition, the authors expected that prices would be higher if pharmaceutical patents were allowed and that prices would be lower if price controls existed, if competition was encouraged, or if the pharmaceutical market in the country was particularly large.

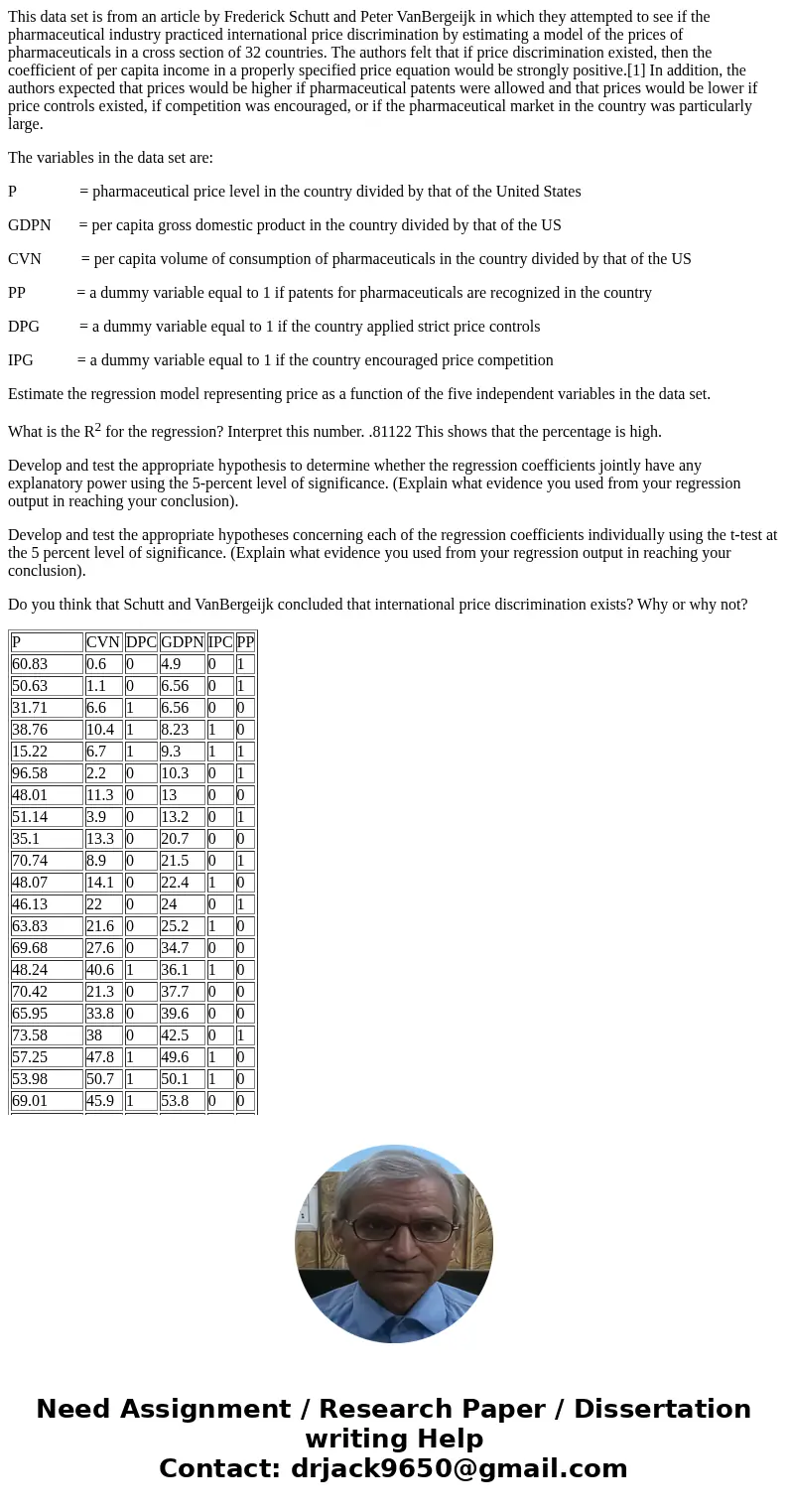

The variables in the data set are:

P = pharmaceutical price level in the country divided by that of the United States

GDPN = per capita gross domestic product in the country divided by that of the US

CVN = per capita volume of consumption of pharmaceuticals in the country divided by that of the US

PP = a dummy variable equal to 1 if patents for pharmaceuticals are recognized in the country

DPG = a dummy variable equal to 1 if the country applied strict price controls

IPG = a dummy variable equal to 1 if the country encouraged price competition

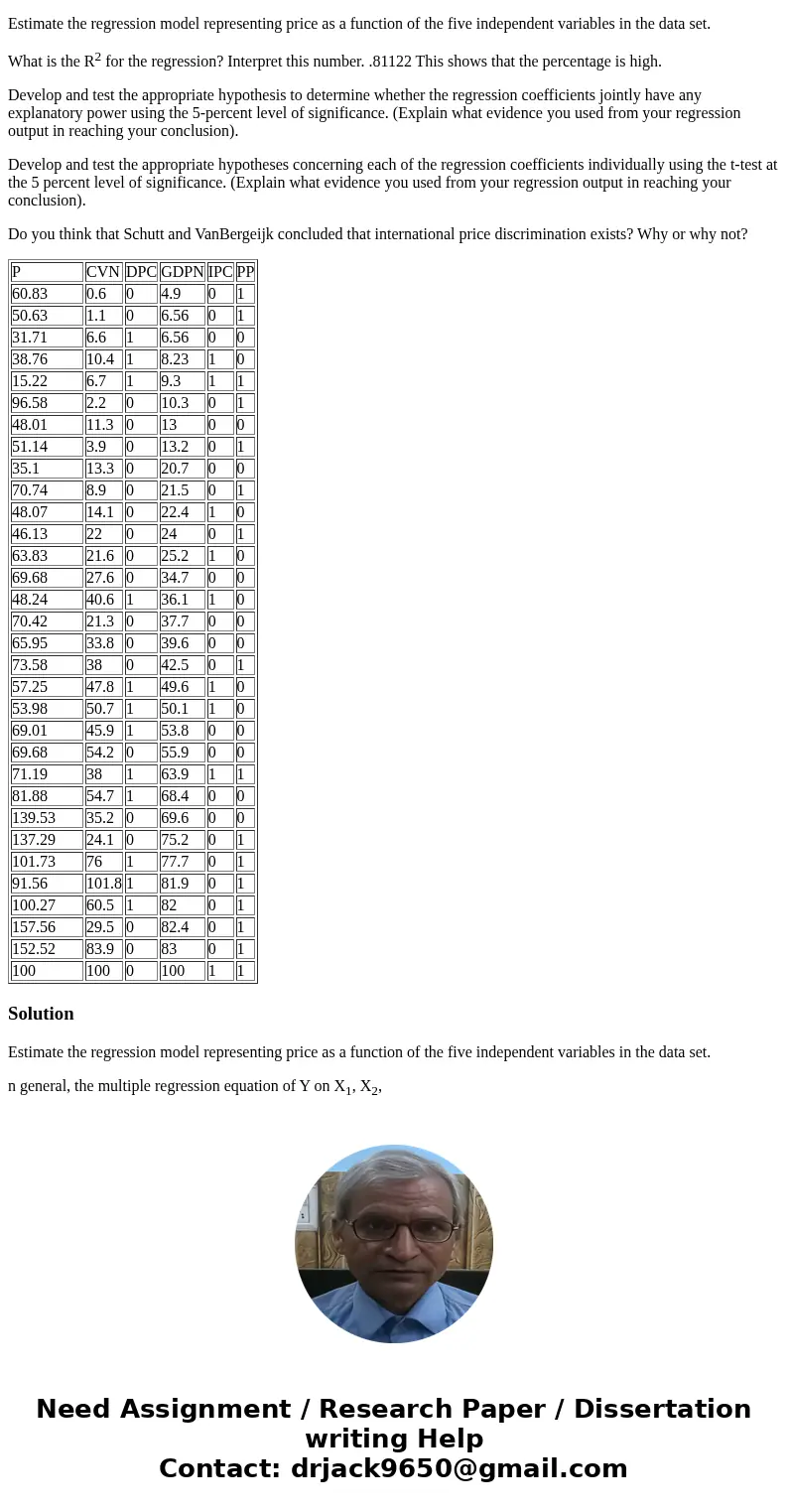

Estimate the regression model representing price as a function of the five independent variables in the data set.

What is the R2 for the regression? Interpret this number. .81122 This shows that the percentage is high.

Develop and test the appropriate hypothesis to determine whether the regression coefficients jointly have any explanatory power using the 5-percent level of significance. (Explain what evidence you used from your regression output in reaching your conclusion).

Develop and test the appropriate hypotheses concerning each of the regression coefficients individually using the t-test at the 5 percent level of significance. (Explain what evidence you used from your regression output in reaching your conclusion).

Do you think that Schutt and VanBergeijk concluded that international price discrimination exists? Why or why not?

| P | CVN | DPC | GDPN | IPC | PP |

| 60.83 | 0.6 | 0 | 4.9 | 0 | 1 |

| 50.63 | 1.1 | 0 | 6.56 | 0 | 1 |

| 31.71 | 6.6 | 1 | 6.56 | 0 | 0 |

| 38.76 | 10.4 | 1 | 8.23 | 1 | 0 |

| 15.22 | 6.7 | 1 | 9.3 | 1 | 1 |

| 96.58 | 2.2 | 0 | 10.3 | 0 | 1 |

| 48.01 | 11.3 | 0 | 13 | 0 | 0 |

| 51.14 | 3.9 | 0 | 13.2 | 0 | 1 |

| 35.1 | 13.3 | 0 | 20.7 | 0 | 0 |

| 70.74 | 8.9 | 0 | 21.5 | 0 | 1 |

| 48.07 | 14.1 | 0 | 22.4 | 1 | 0 |

| 46.13 | 22 | 0 | 24 | 0 | 1 |

| 63.83 | 21.6 | 0 | 25.2 | 1 | 0 |

| 69.68 | 27.6 | 0 | 34.7 | 0 | 0 |

| 48.24 | 40.6 | 1 | 36.1 | 1 | 0 |

| 70.42 | 21.3 | 0 | 37.7 | 0 | 0 |

| 65.95 | 33.8 | 0 | 39.6 | 0 | 0 |

| 73.58 | 38 | 0 | 42.5 | 0 | 1 |

| 57.25 | 47.8 | 1 | 49.6 | 1 | 0 |

| 53.98 | 50.7 | 1 | 50.1 | 1 | 0 |

| 69.01 | 45.9 | 1 | 53.8 | 0 | 0 |

| 69.68 | 54.2 | 0 | 55.9 | 0 | 0 |

| 71.19 | 38 | 1 | 63.9 | 1 | 1 |

| 81.88 | 54.7 | 1 | 68.4 | 0 | 0 |

| 139.53 | 35.2 | 0 | 69.6 | 0 | 0 |

| 137.29 | 24.1 | 0 | 75.2 | 0 | 1 |

| 101.73 | 76 | 1 | 77.7 | 0 | 1 |

| 91.56 | 101.8 | 1 | 81.9 | 0 | 1 |

| 100.27 | 60.5 | 1 | 82 | 0 | 1 |

| 157.56 | 29.5 | 0 | 82.4 | 0 | 1 |

| 152.52 | 83.9 | 0 | 83 | 0 | 1 |

| 100 | 100 | 0 | 100 | 1 | 1 |

Solution

Estimate the regression model representing price as a function of the five independent variables in the data set.

n general, the multiple regression equation of Y on X1, X2,

Homework Sourse

Homework Sourse