On January 1 Year One the Pulaski Corporation issues bonds w

On January 1, Year One, the Pulaski Corporation issues bonds with a face value of $1 million. These bonds come due in twenty years and pay an annual stated interest rate (each December 31) of 5 percent. An investor offers to buy the entire group of bonds for an amount that will yield an effective interest rate of 10 percent per year. Company officials negotiate and are able to reduce the effective rate by 2 percent to 8 percent per year. The present value of $1 at a 10 percent interest rate in twenty years is $0.14864. The present value of an ordinary annuity of $1 at a 10 percent interest rate over twenty years is $8.51356. The present value of $1 at an 8 percent interest rate in twenty years is $0.21455. The present value of an ordinary annuity of $1 at an 8 percent interest rate over twenty years is $9.81815. a. As a result of the 2 percent reduction in the annual effective interest for this bond, what is the decrease in the amount of interest expense that Pulaski recognizes in Year One? b. As a result of the 2 percent reduction in the annual effective interest for this bond, what is the decrease in the amount of interest expense that Pulaski recognizes in Year Two?

Solution

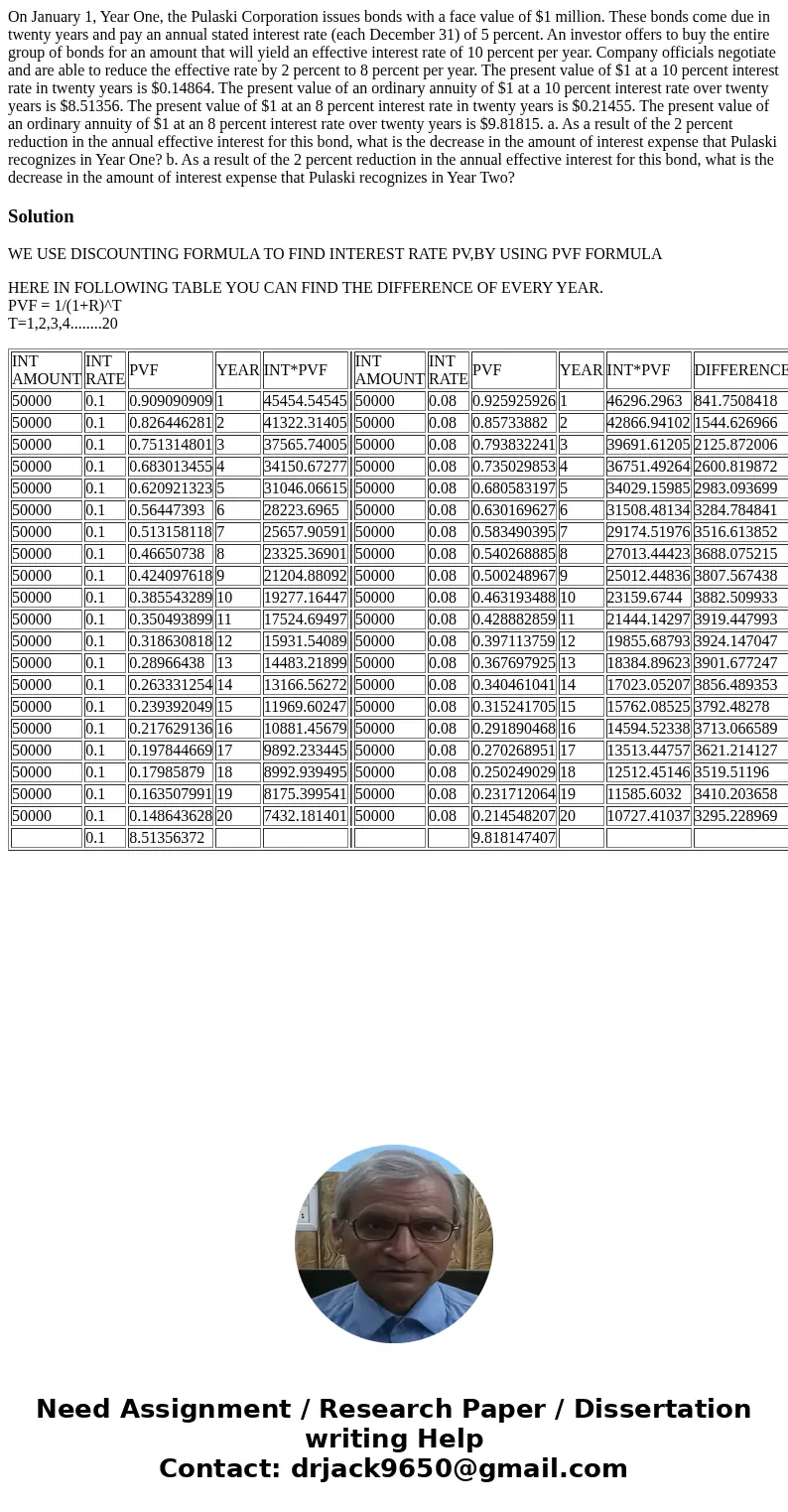

WE USE DISCOUNTING FORMULA TO FIND INTEREST RATE PV,BY USING PVF FORMULA

HERE IN FOLLOWING TABLE YOU CAN FIND THE DIFFERENCE OF EVERY YEAR.

PVF = 1/(1+R)^T

T=1,2,3,4........20

| INT AMOUNT | INT RATE | PVF | YEAR | INT*PVF | INT AMOUNT | INT RATE | PVF | YEAR | INT*PVF | DIFFERENCE | |

| 50000 | 0.1 | 0.909090909 | 1 | 45454.54545 | 50000 | 0.08 | 0.925925926 | 1 | 46296.2963 | 841.7508418 | |

| 50000 | 0.1 | 0.826446281 | 2 | 41322.31405 | 50000 | 0.08 | 0.85733882 | 2 | 42866.94102 | 1544.626966 | |

| 50000 | 0.1 | 0.751314801 | 3 | 37565.74005 | 50000 | 0.08 | 0.793832241 | 3 | 39691.61205 | 2125.872006 | |

| 50000 | 0.1 | 0.683013455 | 4 | 34150.67277 | 50000 | 0.08 | 0.735029853 | 4 | 36751.49264 | 2600.819872 | |

| 50000 | 0.1 | 0.620921323 | 5 | 31046.06615 | 50000 | 0.08 | 0.680583197 | 5 | 34029.15985 | 2983.093699 | |

| 50000 | 0.1 | 0.56447393 | 6 | 28223.6965 | 50000 | 0.08 | 0.630169627 | 6 | 31508.48134 | 3284.784841 | |

| 50000 | 0.1 | 0.513158118 | 7 | 25657.90591 | 50000 | 0.08 | 0.583490395 | 7 | 29174.51976 | 3516.613852 | |

| 50000 | 0.1 | 0.46650738 | 8 | 23325.36901 | 50000 | 0.08 | 0.540268885 | 8 | 27013.44423 | 3688.075215 | |

| 50000 | 0.1 | 0.424097618 | 9 | 21204.88092 | 50000 | 0.08 | 0.500248967 | 9 | 25012.44836 | 3807.567438 | |

| 50000 | 0.1 | 0.385543289 | 10 | 19277.16447 | 50000 | 0.08 | 0.463193488 | 10 | 23159.6744 | 3882.509933 | |

| 50000 | 0.1 | 0.350493899 | 11 | 17524.69497 | 50000 | 0.08 | 0.428882859 | 11 | 21444.14297 | 3919.447993 | |

| 50000 | 0.1 | 0.318630818 | 12 | 15931.54089 | 50000 | 0.08 | 0.397113759 | 12 | 19855.68793 | 3924.147047 | |

| 50000 | 0.1 | 0.28966438 | 13 | 14483.21899 | 50000 | 0.08 | 0.367697925 | 13 | 18384.89623 | 3901.677247 | |

| 50000 | 0.1 | 0.263331254 | 14 | 13166.56272 | 50000 | 0.08 | 0.340461041 | 14 | 17023.05207 | 3856.489353 | |

| 50000 | 0.1 | 0.239392049 | 15 | 11969.60247 | 50000 | 0.08 | 0.315241705 | 15 | 15762.08525 | 3792.48278 | |

| 50000 | 0.1 | 0.217629136 | 16 | 10881.45679 | 50000 | 0.08 | 0.291890468 | 16 | 14594.52338 | 3713.066589 | |

| 50000 | 0.1 | 0.197844669 | 17 | 9892.233445 | 50000 | 0.08 | 0.270268951 | 17 | 13513.44757 | 3621.214127 | |

| 50000 | 0.1 | 0.17985879 | 18 | 8992.939495 | 50000 | 0.08 | 0.250249029 | 18 | 12512.45146 | 3519.51196 | |

| 50000 | 0.1 | 0.163507991 | 19 | 8175.399541 | 50000 | 0.08 | 0.231712064 | 19 | 11585.6032 | 3410.203658 | |

| 50000 | 0.1 | 0.148643628 | 20 | 7432.181401 | 50000 | 0.08 | 0.214548207 | 20 | 10727.41037 | 3295.228969 | |

| 0.1 | 8.51356372 | 9.818147407 |

Homework Sourse

Homework Sourse