Exercise 98B Current liabilities The following transactions

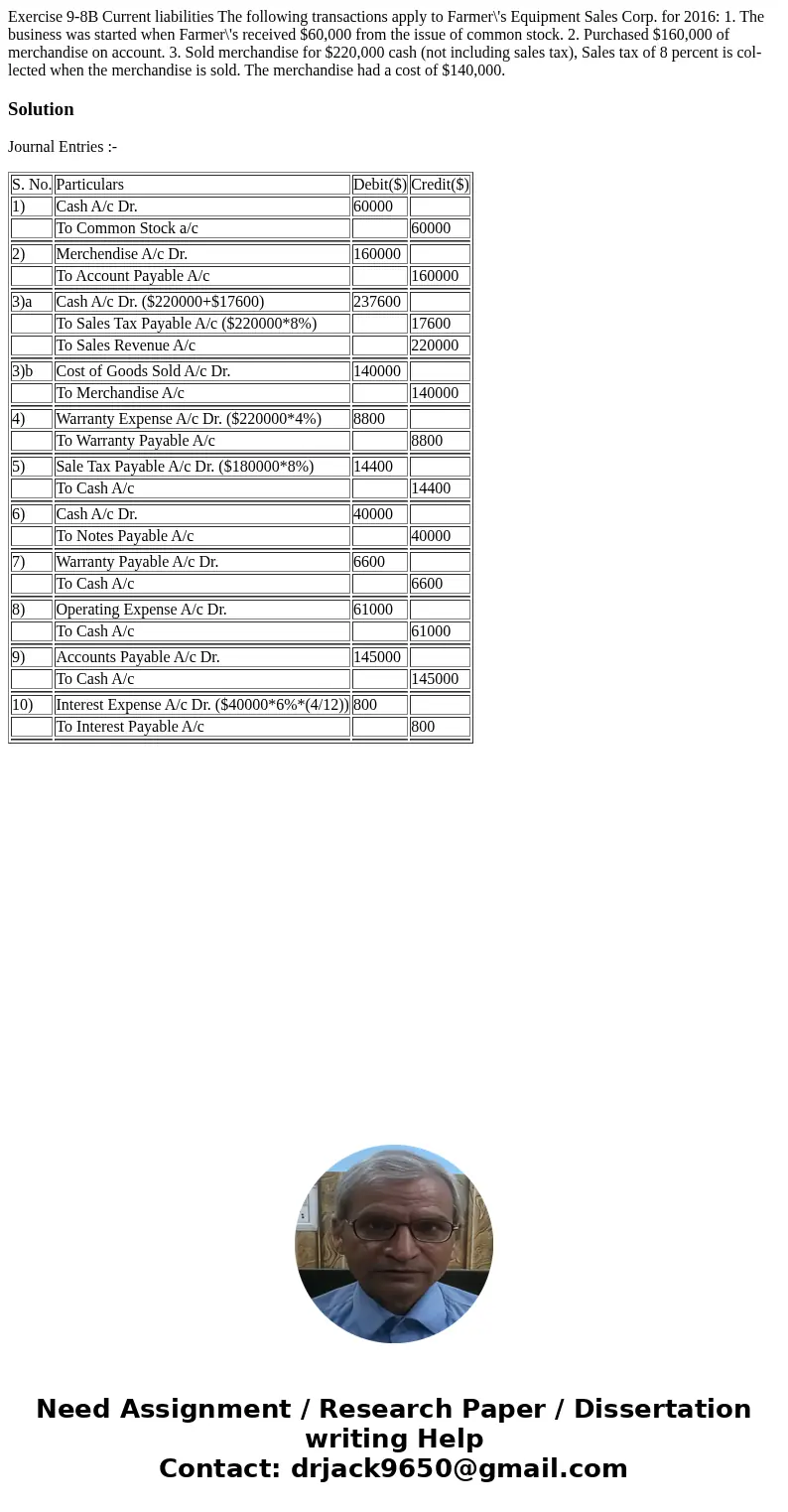

Exercise 9-8B Current liabilities The following transactions apply to Farmer\'s Equipment Sales Corp. for 2016: 1. The business was started when Farmer\'s received $60,000 from the issue of common stock. 2. Purchased $160,000 of merchandise on account. 3. Sold merchandise for $220,000 cash (not including sales tax), Sales tax of 8 percent is col- lected when the merchandise is sold. The merchandise had a cost of $140,000.

Solution

Journal Entries :-

| S. No. | Particulars | Debit($) | Credit($) |

| 1) | Cash A/c Dr. | 60000 | |

| To Common Stock a/c | 60000 | ||

| 2) | Merchendise A/c Dr. | 160000 | |

| To Account Payable A/c | 160000 | ||

| 3)a | Cash A/c Dr. ($220000+$17600) | 237600 | |

| To Sales Tax Payable A/c ($220000*8%) | 17600 | ||

| To Sales Revenue A/c | 220000 | ||

| 3)b | Cost of Goods Sold A/c Dr. | 140000 | |

| To Merchandise A/c | 140000 | ||

| 4) | Warranty Expense A/c Dr. ($220000*4%) | 8800 | |

| To Warranty Payable A/c | 8800 | ||

| 5) | Sale Tax Payable A/c Dr. ($180000*8%) | 14400 | |

| To Cash A/c | 14400 | ||

| 6) | Cash A/c Dr. | 40000 | |

| To Notes Payable A/c | 40000 | ||

| 7) | Warranty Payable A/c Dr. | 6600 | |

| To Cash A/c | 6600 | ||

| 8) | Operating Expense A/c Dr. | 61000 | |

| To Cash A/c | 61000 | ||

| 9) | Accounts Payable A/c Dr. | 145000 | |

| To Cash A/c | 145000 | ||

| 10) | Interest Expense A/c Dr. ($40000*6%*(4/12)) | 800 | |

| To Interest Payable A/c | 800 | ||

Homework Sourse

Homework Sourse