sandersn sandersn sandersn sandersn A135 Debt IssuanceIntere

Solution

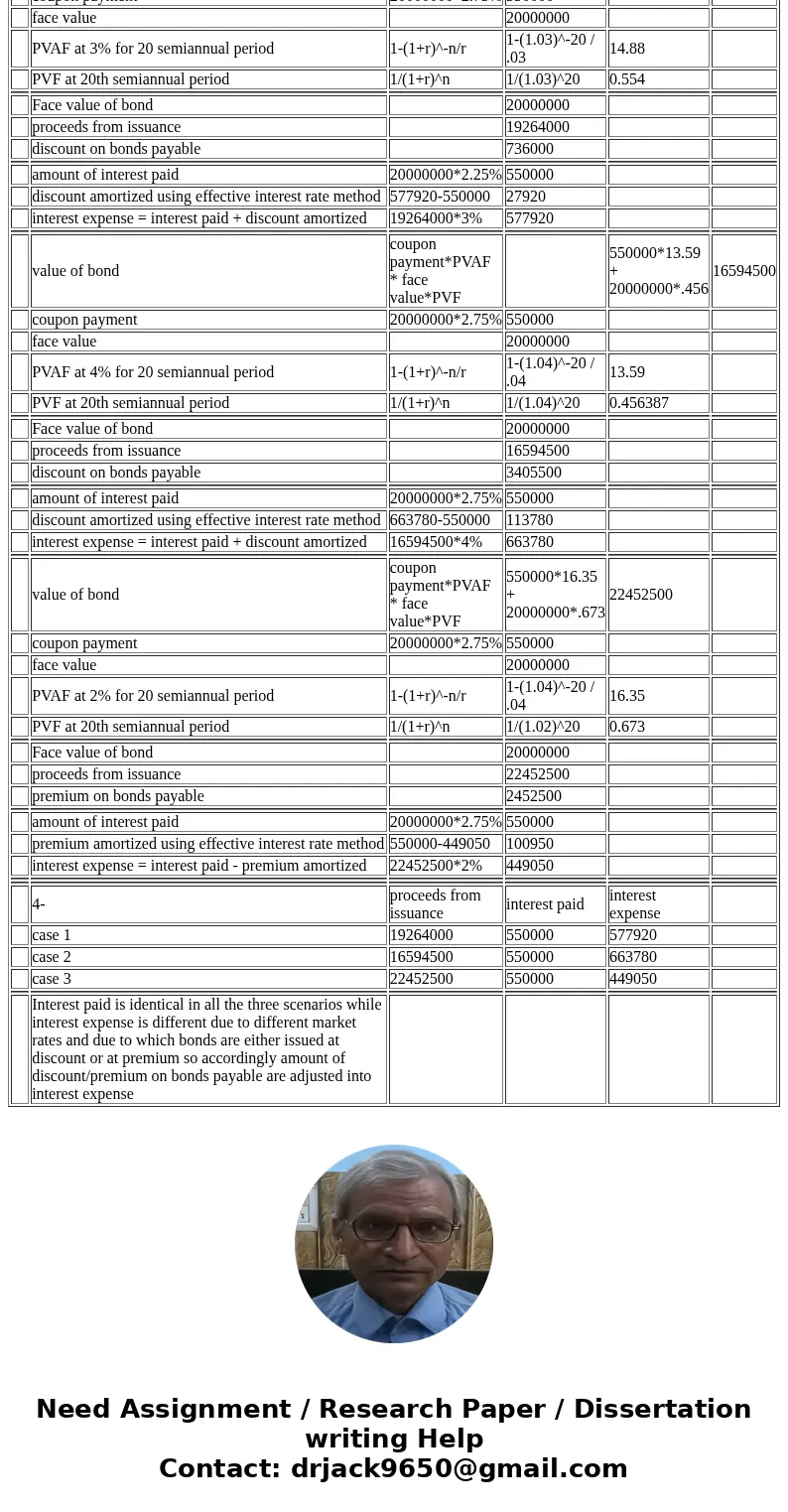

1-

value of bond

coupon payment*PVAF * face value*PVF

550000*14.88 + 20000000*.554

19264000

coupon payment

20000000*2.75%

550000

face value

20000000

PVAF at 3% for 20 semiannual period

1-(1+r)^-n/r

1-(1.03)^-20 / .03

14.88

PVF at 20th semiannual period

1/(1+r)^n

1/(1.03)^20

0.554

Face value of bond

20000000

proceeds from issuance

19264000

discount on bonds payable

736000

amount of interest paid

20000000*2.25%

550000

discount amortized using effective interest rate method

577920-550000

27920

interest expense = interest paid + discount amortized

19264000*3%

577920

value of bond

coupon payment*PVAF * face value*PVF

550000*13.59 + 20000000*.456

16594500

coupon payment

20000000*2.75%

550000

face value

20000000

PVAF at 4% for 20 semiannual period

1-(1+r)^-n/r

1-(1.04)^-20 / .04

13.59

PVF at 20th semiannual period

1/(1+r)^n

1/(1.04)^20

0.456387

Face value of bond

20000000

proceeds from issuance

16594500

discount on bonds payable

3405500

amount of interest paid

20000000*2.75%

550000

discount amortized using effective interest rate method

663780-550000

113780

interest expense = interest paid + discount amortized

16594500*4%

663780

value of bond

coupon payment*PVAF * face value*PVF

550000*16.35 + 20000000*.673

22452500

coupon payment

20000000*2.75%

550000

face value

20000000

PVAF at 2% for 20 semiannual period

1-(1+r)^-n/r

1-(1.04)^-20 / .04

16.35

PVF at 20th semiannual period

1/(1+r)^n

1/(1.02)^20

0.673

Face value of bond

20000000

proceeds from issuance

22452500

premium on bonds payable

2452500

amount of interest paid

20000000*2.75%

550000

premium amortized using effective interest rate method

550000-449050

100950

interest expense = interest paid - premium amortized

22452500*2%

449050

4-

proceeds from issuance

interest paid

interest expense

case 1

19264000

550000

577920

case 2

16594500

550000

663780

case 3

22452500

550000

449050

Interest paid is identical in all the three scenarios while interest expense is different due to different market rates and due to which bonds are either issued at discount or at premium so accordingly amount of discount/premium on bonds payable are adjusted into interest expense

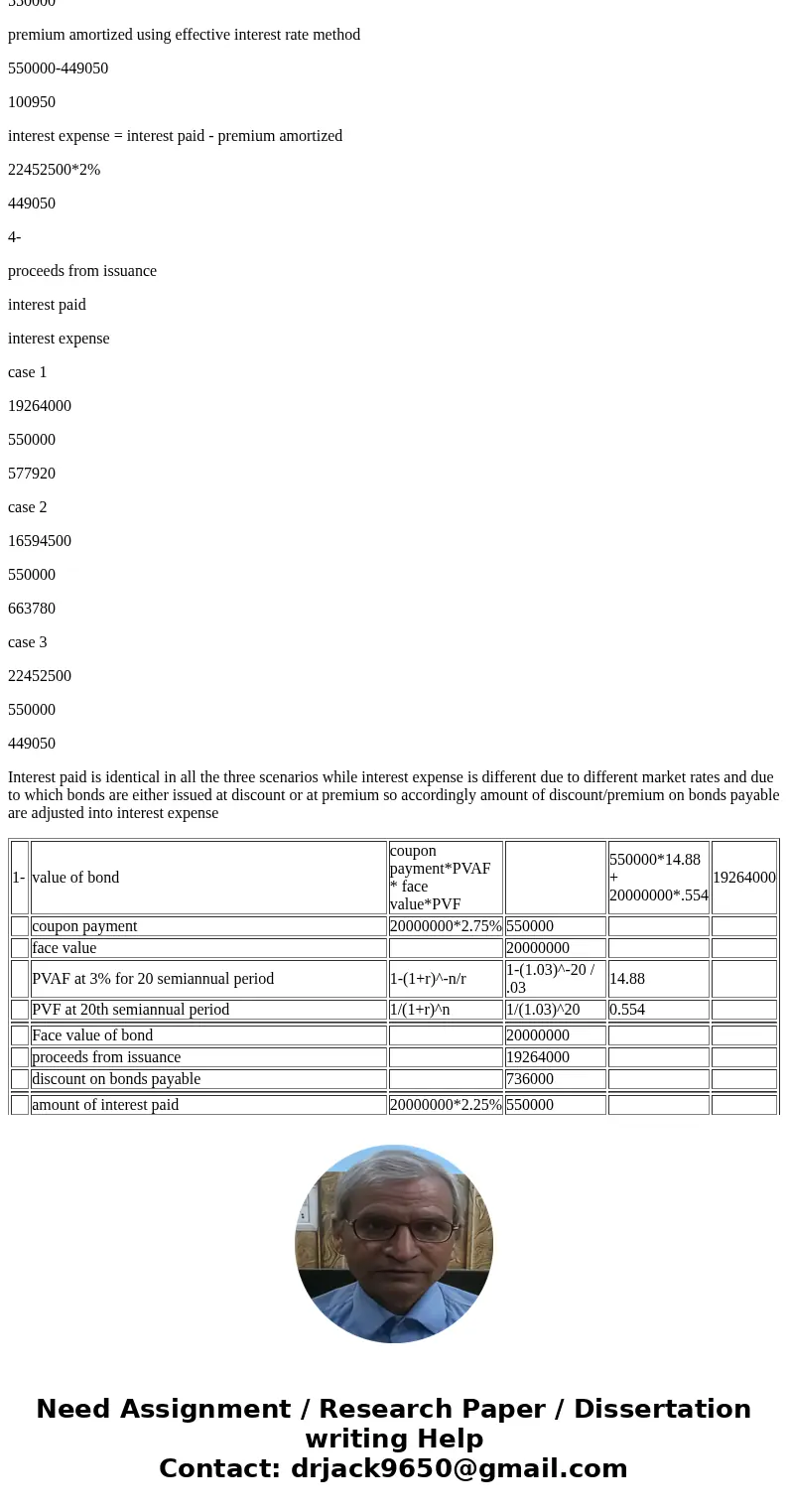

| 1- | value of bond | coupon payment*PVAF * face value*PVF | 550000*14.88 + 20000000*.554 | 19264000 | |

| coupon payment | 20000000*2.75% | 550000 | |||

| face value | 20000000 | ||||

| PVAF at 3% for 20 semiannual period | 1-(1+r)^-n/r | 1-(1.03)^-20 / .03 | 14.88 | ||

| PVF at 20th semiannual period | 1/(1+r)^n | 1/(1.03)^20 | 0.554 | ||

| Face value of bond | 20000000 | ||||

| proceeds from issuance | 19264000 | ||||

| discount on bonds payable | 736000 | ||||

| amount of interest paid | 20000000*2.25% | 550000 | |||

| discount amortized using effective interest rate method | 577920-550000 | 27920 | |||

| interest expense = interest paid + discount amortized | 19264000*3% | 577920 | |||

| value of bond | coupon payment*PVAF * face value*PVF | 550000*13.59 + 20000000*.456 | 16594500 | ||

| coupon payment | 20000000*2.75% | 550000 | |||

| face value | 20000000 | ||||

| PVAF at 4% for 20 semiannual period | 1-(1+r)^-n/r | 1-(1.04)^-20 / .04 | 13.59 | ||

| PVF at 20th semiannual period | 1/(1+r)^n | 1/(1.04)^20 | 0.456387 | ||

| Face value of bond | 20000000 | ||||

| proceeds from issuance | 16594500 | ||||

| discount on bonds payable | 3405500 | ||||

| amount of interest paid | 20000000*2.75% | 550000 | |||

| discount amortized using effective interest rate method | 663780-550000 | 113780 | |||

| interest expense = interest paid + discount amortized | 16594500*4% | 663780 | |||

| value of bond | coupon payment*PVAF * face value*PVF | 550000*16.35 + 20000000*.673 | 22452500 | ||

| coupon payment | 20000000*2.75% | 550000 | |||

| face value | 20000000 | ||||

| PVAF at 2% for 20 semiannual period | 1-(1+r)^-n/r | 1-(1.04)^-20 / .04 | 16.35 | ||

| PVF at 20th semiannual period | 1/(1+r)^n | 1/(1.02)^20 | 0.673 | ||

| Face value of bond | 20000000 | ||||

| proceeds from issuance | 22452500 | ||||

| premium on bonds payable | 2452500 | ||||

| amount of interest paid | 20000000*2.75% | 550000 | |||

| premium amortized using effective interest rate method | 550000-449050 | 100950 | |||

| interest expense = interest paid - premium amortized | 22452500*2% | 449050 | |||

| 4- | proceeds from issuance | interest paid | interest expense | ||

| case 1 | 19264000 | 550000 | 577920 | ||

| case 2 | 16594500 | 550000 | 663780 | ||

| case 3 | 22452500 | 550000 | 449050 | ||

| Interest paid is identical in all the three scenarios while interest expense is different due to different market rates and due to which bonds are either issued at discount or at premium so accordingly amount of discount/premium on bonds payable are adjusted into interest expense |

Homework Sourse

Homework Sourse