ork Chapter 10 Homework omew core 0 of 30 pts 1023 similar t

Solution

a.

NPV of project A: $18,867.08

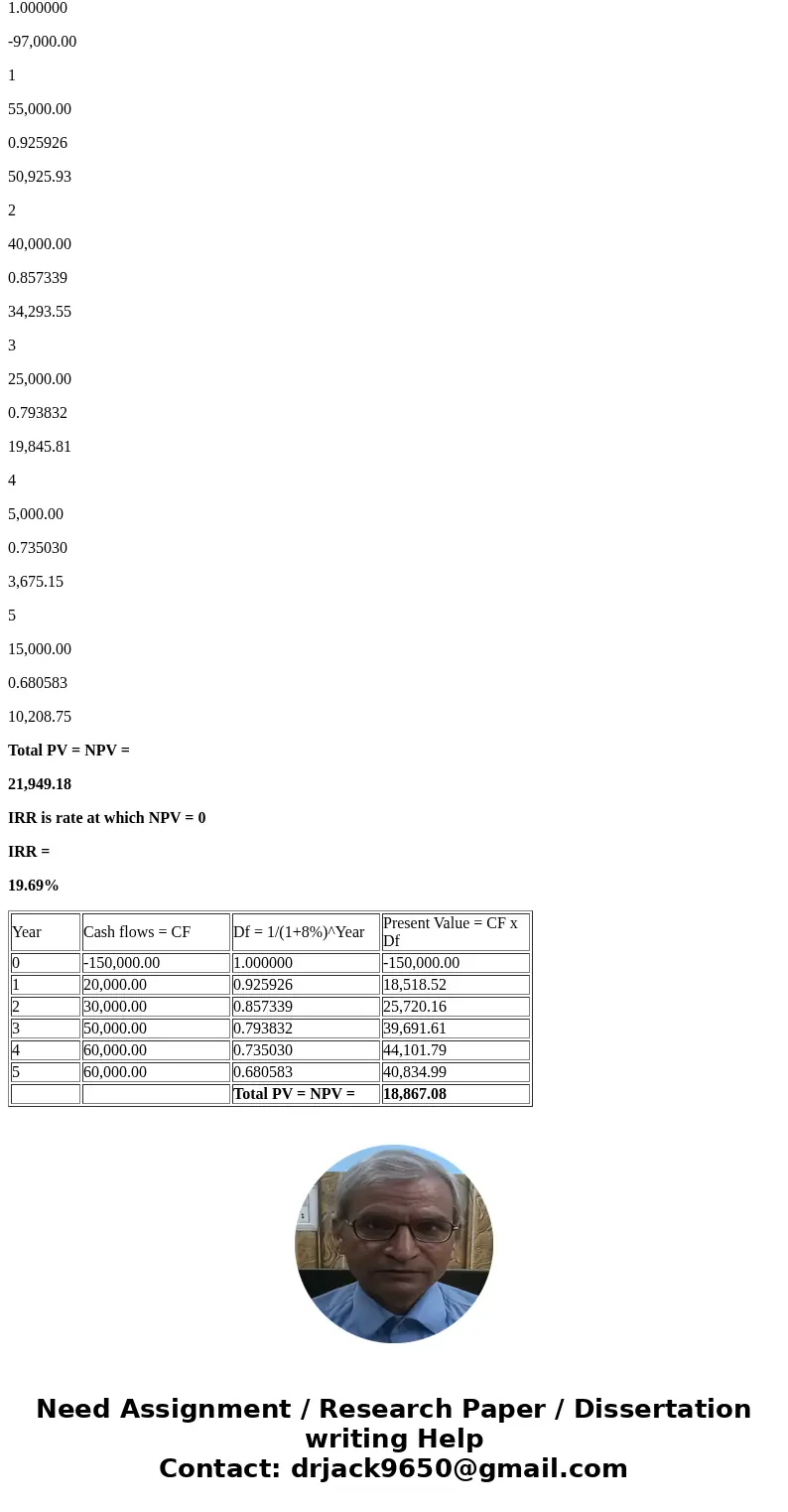

Project A:

Year

Cash flows = CF

Df = 1/(1+8%)^Year

Present Value = CF x Df

0

-150,000.00

1.000000

-150,000.00

1

20,000.00

0.925926

18,518.52

2

30,000.00

0.857339

25,720.16

3

50,000.00

0.793832

39,691.61

4

60,000.00

0.735030

44,101.79

5

60,000.00

0.680583

40,834.99

Total PV = NPV =

18,867.08

Obtain IRR by trial error. We have to use different rates to get NPV = 0 for a particular rate. That rate is IRR.

IRR is rate at which NPV = 0

IRR =

11.90%

------------------------------

Additional work for your reference:

Project B:

Year

Cash flows = CF

Df = 1/(1+8%)^Year

Present Value = CF x Df

0

-97,000.00

1.000000

-97,000.00

1

55,000.00

0.925926

50,925.93

2

40,000.00

0.857339

34,293.55

3

25,000.00

0.793832

19,845.81

4

5,000.00

0.735030

3,675.15

5

15,000.00

0.680583

10,208.75

Total PV = NPV =

21,949.18

IRR is rate at which NPV = 0

IRR =

19.69%

| Year | Cash flows = CF | Df = 1/(1+8%)^Year | Present Value = CF x Df |

| 0 | -150,000.00 | 1.000000 | -150,000.00 |

| 1 | 20,000.00 | 0.925926 | 18,518.52 |

| 2 | 30,000.00 | 0.857339 | 25,720.16 |

| 3 | 50,000.00 | 0.793832 | 39,691.61 |

| 4 | 60,000.00 | 0.735030 | 44,101.79 |

| 5 | 60,000.00 | 0.680583 | 40,834.99 |

| Total PV = NPV = | 18,867.08 |

Homework Sourse

Homework Sourse