Exercise 15-5 Ikerd Company applies manufacturing overhead to jobs on the basis of machine hours used. Overhead costs are expected to total $294,138 for the year, and machine usage is estimated at 125,700 hours. For the year, $419,736 of overhead costs are incurmed and 130,400 hours are used. Your answer is comect. Compute the manufacturing overhead rate for the year. (Round answer to 2 decimal places, e.g. 1.52.) Manufacturing overhead rate 2.34 per machine hour SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT VIDEO: APPLIED SKILLS Your answer is partially correct. Try again. What is the amount of under- or overapplied overhead at December 31? Manufacturing Overhead 305136 SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT VIDEO: APPLIED SKILLS Your answer is partially correct. Try again. overhead for the year to cost of goods sold. (Credit account titles are automatically indented Prepare the adjusting entry to assign the under- on when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit of Goods Sold Click if you would like to Show Work for this question: SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT VIDEO: APPLIED SKILLS Question Attempts: 1 of 15 used SAVE FOR LATER SUBMIT ANSWER

Answer:

manufacturing overhead rate

=Estimated overhead cost/ Estimated machine Hour

=294138/125700

=2.34

manufacturing overhead rate=$2.34

_______________________________________

2

Calculation of the Under applied or Overapplied Over Head cost

Under applied or Overapplied Over Head cost

=Accumulated manufacturing Overhead cost - Manufacturing Overhead cost applied

=419736-(130,400*2.34)

=114,600 Under apllied

________________________________________

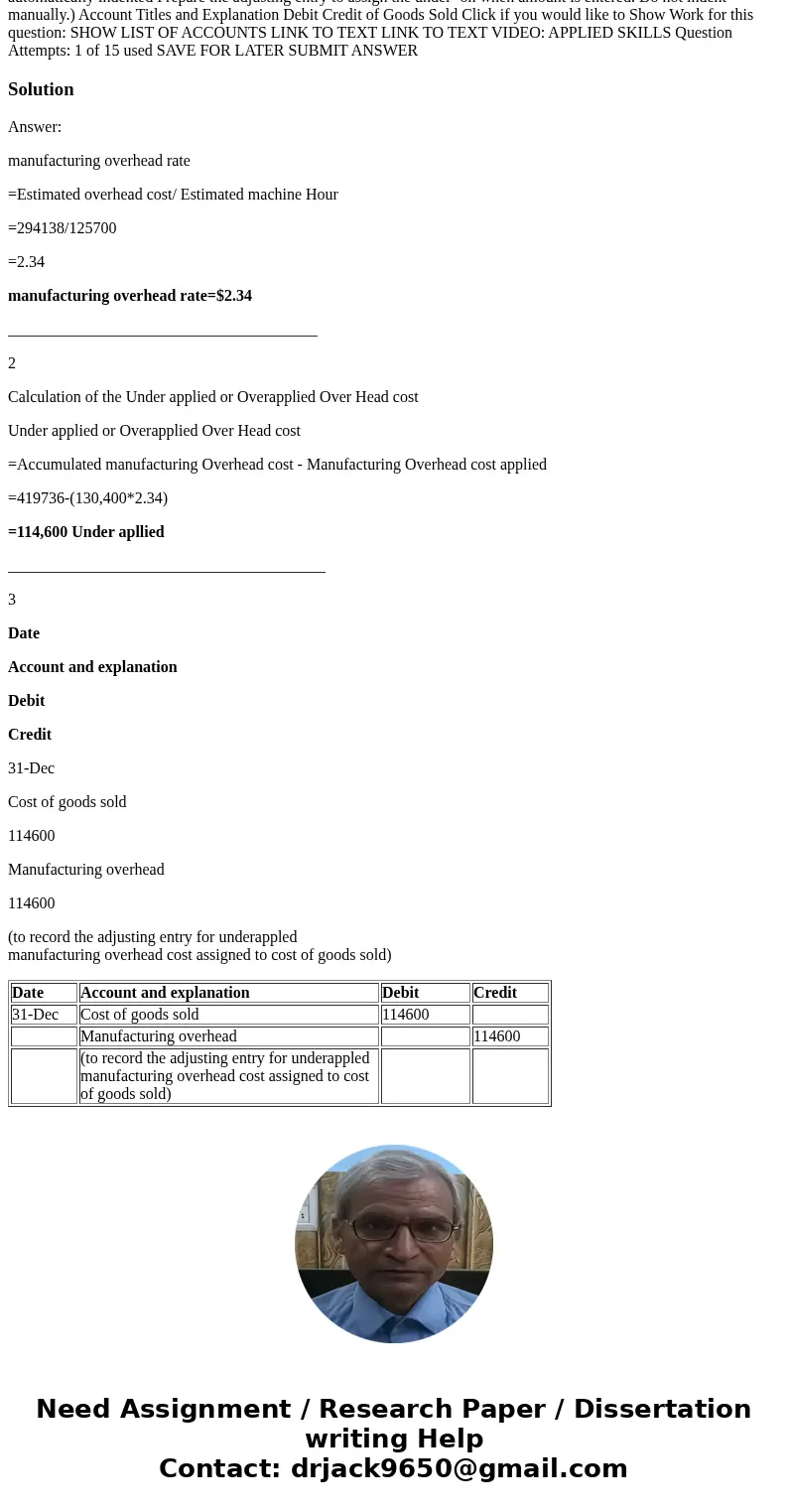

3

Date

Account and explanation

Debit

Credit

31-Dec

Cost of goods sold

114600

Manufacturing overhead

114600

(to record the adjusting entry for underappled

manufacturing overhead cost assigned to cost of goods sold)

| Date | Account and explanation | Debit | Credit |

| 31-Dec | Cost of goods sold | 114600 | |

| Manufacturing overhead | | 114600 |

| (to record the adjusting entry for underappled

manufacturing overhead cost assigned to cost of goods sold) | | |

Homework Sourse

Homework Sourse