Your company is considering three independent projects Given

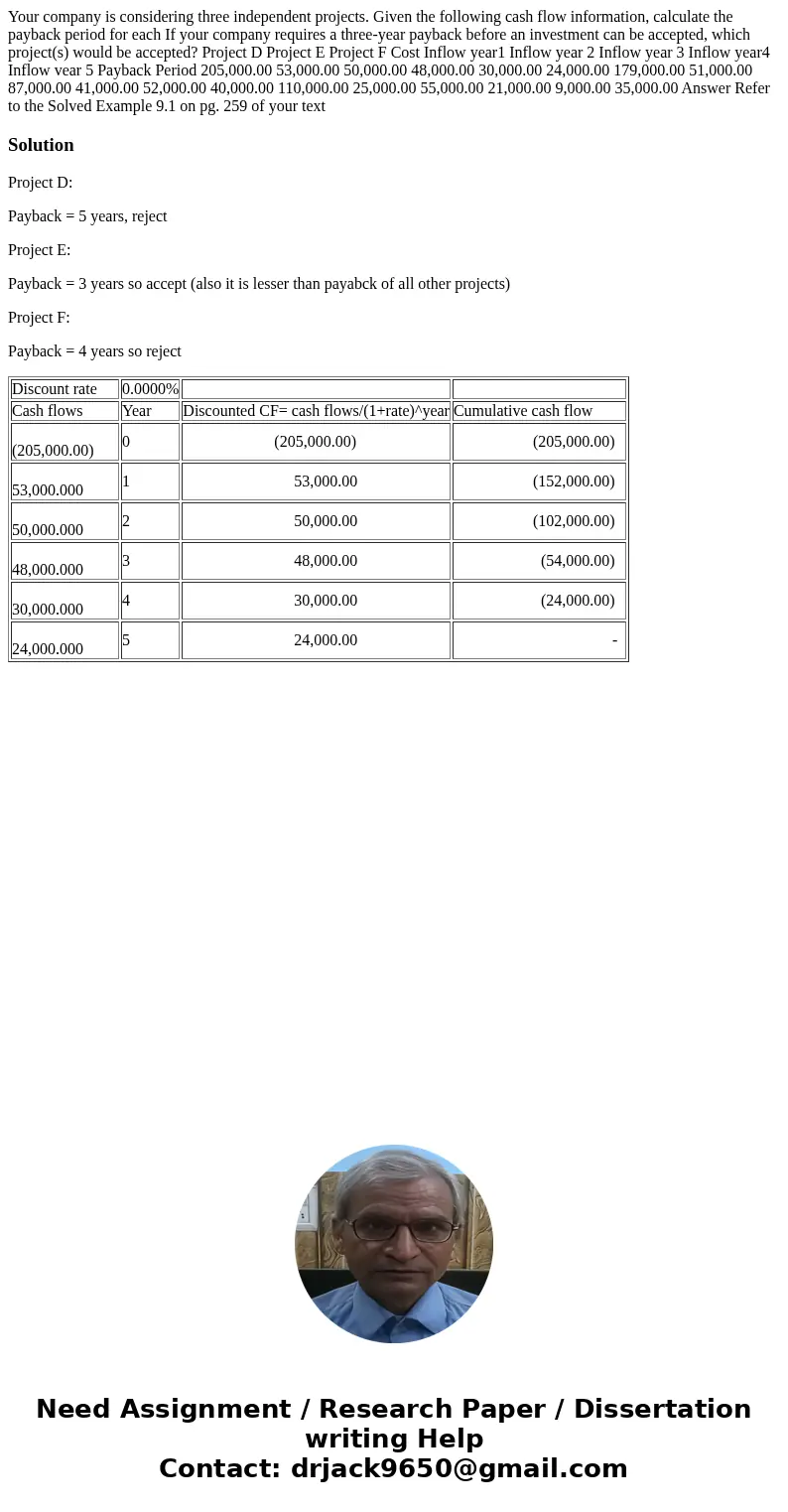

Your company is considering three independent projects. Given the following cash flow information, calculate the payback period for each If your company requires a three-year payback before an investment can be accepted, which project(s) would be accepted? Project D Project E Project F Cost Inflow year1 Inflow year 2 Inflow year 3 Inflow year4 Inflow vear 5 Payback Period 205,000.00 53,000.00 50,000.00 48,000.00 30,000.00 24,000.00 179,000.00 51,000.00 87,000.00 41,000.00 52,000.00 40,000.00 110,000.00 25,000.00 55,000.00 21,000.00 9,000.00 35,000.00 Answer Refer to the Solved Example 9.1 on pg. 259 of your text

Solution

Project D:

Payback = 5 years, reject

Project E:

Payback = 3 years so accept (also it is lesser than payabck of all other projects)

Project F:

Payback = 4 years so reject

| Discount rate | 0.0000% | ||

| Cash flows | Year | Discounted CF= cash flows/(1+rate)^year | Cumulative cash flow |

| (205,000.00) | 0 | (205,000.00) | (205,000.00) |

| 53,000.000 | 1 | 53,000.00 | (152,000.00) |

| 50,000.000 | 2 | 50,000.00 | (102,000.00) |

| 48,000.000 | 3 | 48,000.00 | (54,000.00) |

| 30,000.000 | 4 | 30,000.00 | (24,000.00) |

| 24,000.000 | 5 | 24,000.00 | - |

Homework Sourse

Homework Sourse