OS 26 Analyzing transactions and preparing journal entries L

OS 2-6 Analyzing transactions and preparing journal entries LO P1 a. On May 15, DeShawn Tyler opens a landscaping company called Elegant Lawns by investing $88,000 in cash along with equipment having a $48,000 value. b. On May 21, Elegant Lawns purchases office supplies on credit for $640. c. On May 25, Elegant Lawns receives $9,600 cash for performing landscaping services d. On May 30, Elegant Lawns receives $2,800 cash in advance of providing landscaping services to a customer. For each transaction,(1) analyze the transaction using the accounting equation, (2) record the transaction in journal entry form, and (3) post the entry using T-accounts to represent ledger accounts. Use the following (partial) chart of accounts-account numbers in parentheses: Cash (101); Accounts Receivable (106); Office Supplies (124); Trucks (153); Equipment (167); Accounts Payable (201); Unearned Landscaping Revenue (236); D. Tyler, Capital (301; D. Tyler, Withdrawals (302); Landscaping Revenue (403): Wages Expense (601), and Landscaping Expense (696) Complete this question by entering your answers in the tabs below General Journal Analyze T accounts For each of the above transaction, analyze the transaction using the accounting equation. (Enter total amounts only.) Liabilities + Equity Assets =| a. b. C. d.

Solution

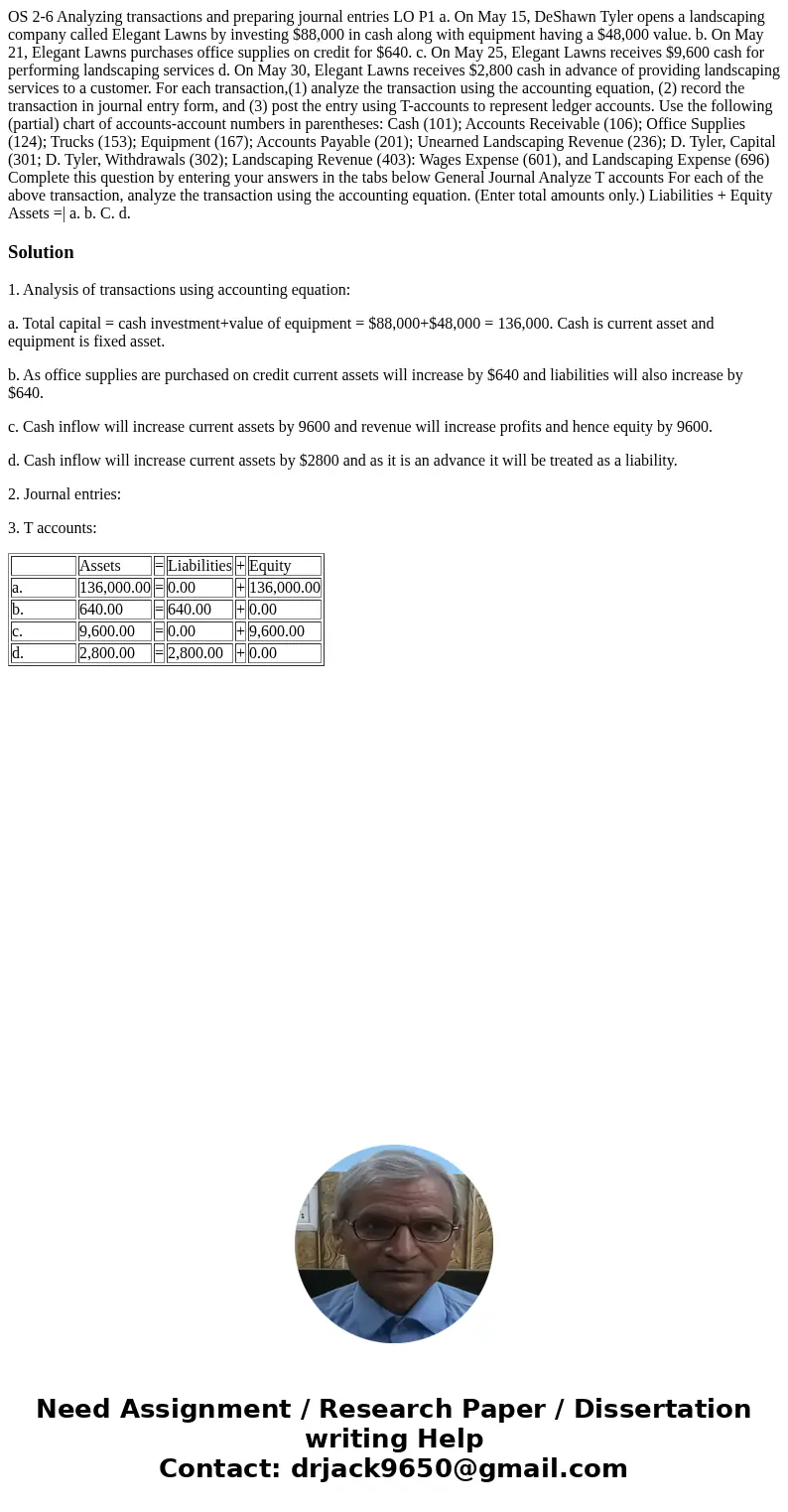

1. Analysis of transactions using accounting equation:

a. Total capital = cash investment+value of equipment = $88,000+$48,000 = 136,000. Cash is current asset and equipment is fixed asset.

b. As office supplies are purchased on credit current assets will increase by $640 and liabilities will also increase by $640.

c. Cash inflow will increase current assets by 9600 and revenue will increase profits and hence equity by 9600.

d. Cash inflow will increase current assets by $2800 and as it is an advance it will be treated as a liability.

2. Journal entries:

3. T accounts:

| Assets | = | Liabilities | + | Equity | |

| a. | 136,000.00 | = | 0.00 | + | 136,000.00 |

| b. | 640.00 | = | 640.00 | + | 0.00 |

| c. | 9,600.00 | = | 0.00 | + | 9,600.00 |

| d. | 2,800.00 | = | 2,800.00 | + | 0.00 |

Homework Sourse

Homework Sourse