Weygandt Financial Managerial Accounting 2e Problem 113A Th

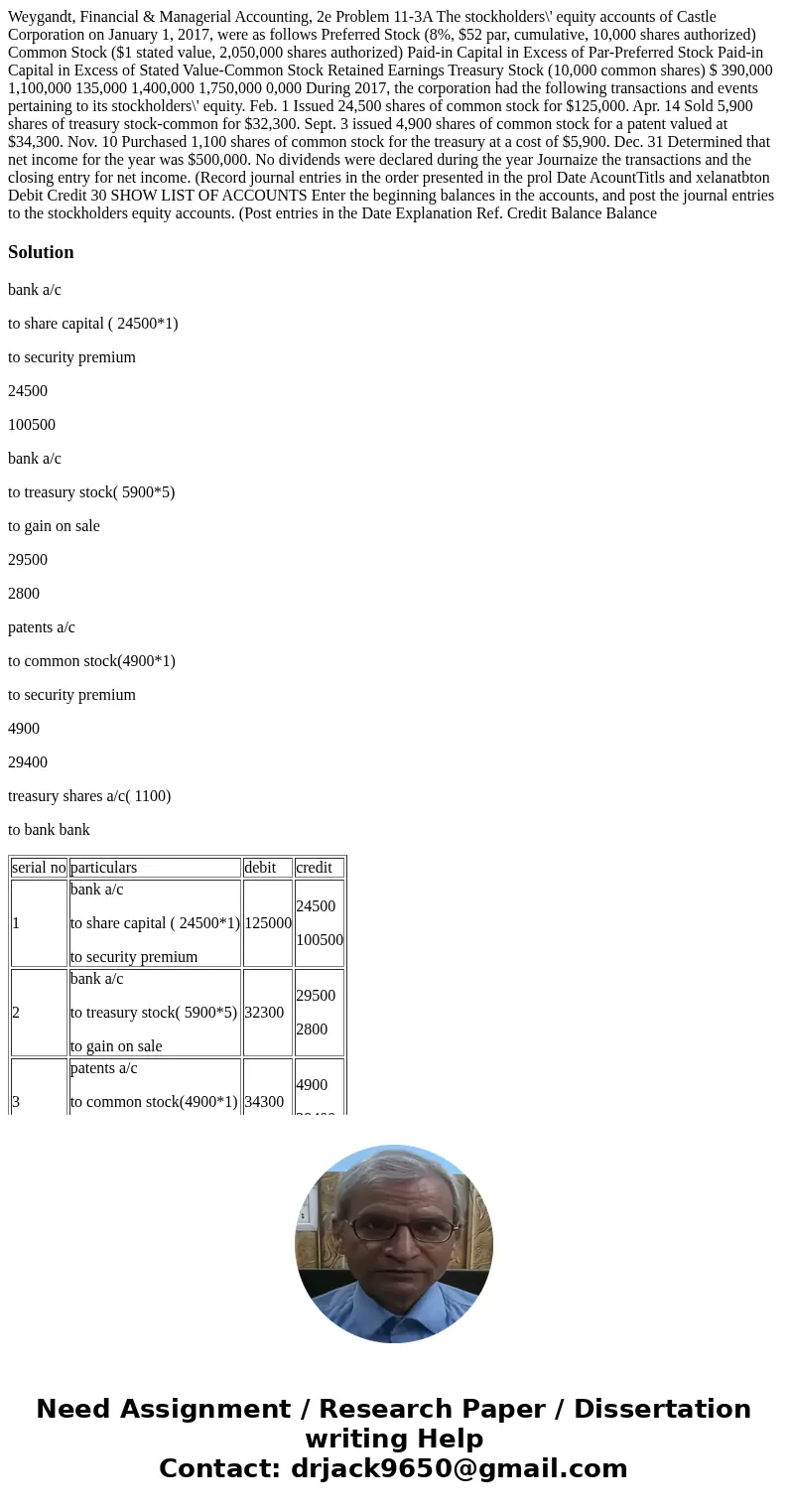

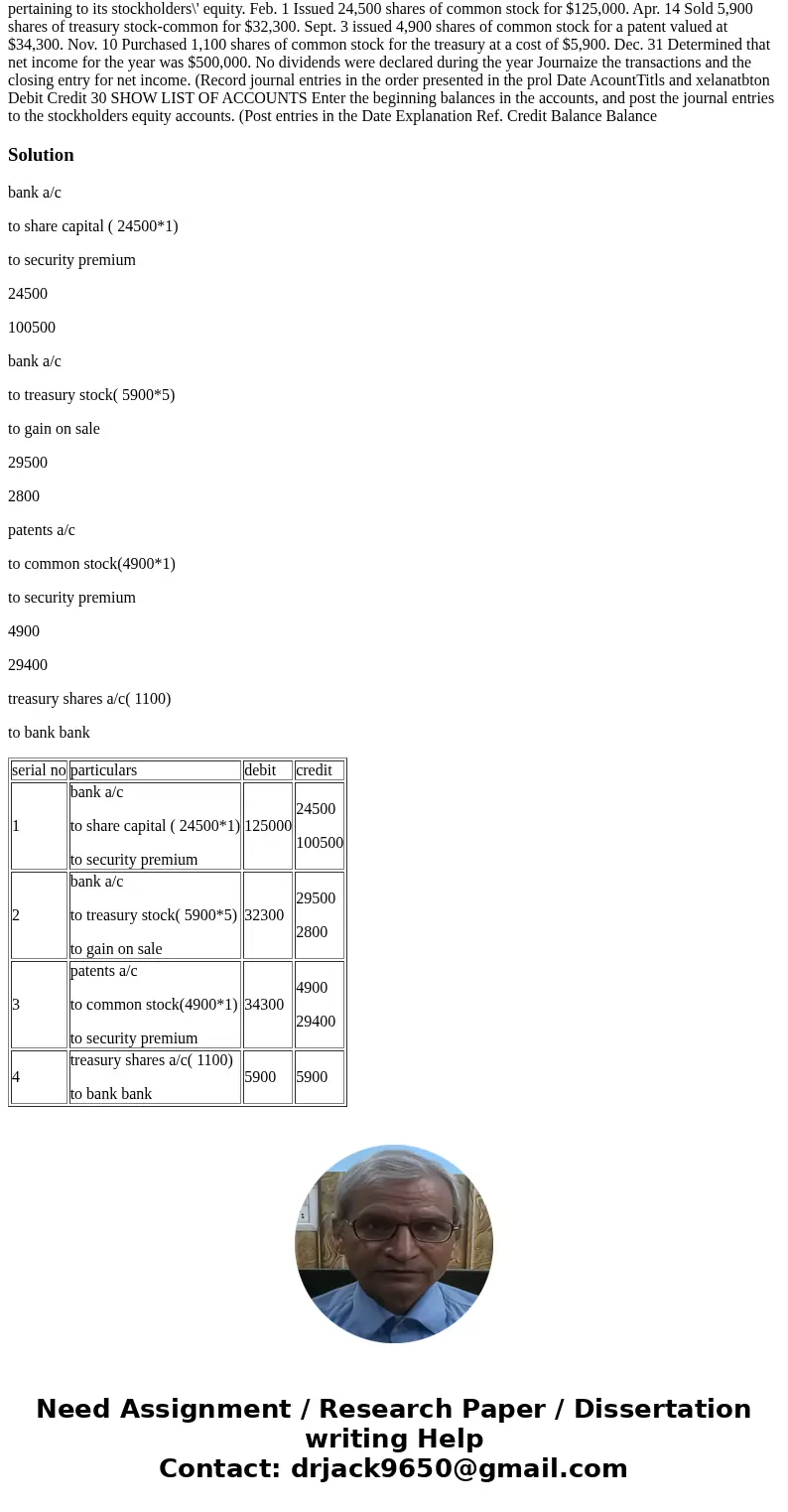

Weygandt, Financial & Managerial Accounting, 2e Problem 11-3A The stockholders\' equity accounts of Castle Corporation on January 1, 2017, were as follows Preferred Stock (8%, $52 par, cumulative, 10,000 shares authorized) Common Stock ($1 stated value, 2,050,000 shares authorized) Paid-in Capital in Excess of Par-Preferred Stock Paid-in Capital in Excess of Stated Value-Common Stock Retained Earnings Treasury Stock (10,000 common shares) $ 390,000 1,100,000 135,000 1,400,000 1,750,000 0,000 During 2017, the corporation had the following transactions and events pertaining to its stockholders\' equity. Feb. 1 Issued 24,500 shares of common stock for $125,000. Apr. 14 Sold 5,900 shares of treasury stock-common for $32,300. Sept. 3 issued 4,900 shares of common stock for a patent valued at $34,300. Nov. 10 Purchased 1,100 shares of common stock for the treasury at a cost of $5,900. Dec. 31 Determined that net income for the year was $500,000. No dividends were declared during the year Journaize the transactions and the closing entry for net income. (Record journal entries in the order presented in the prol Date AcountTitls and xelanatbton Debit Credit 30 SHOW LIST OF ACCOUNTS Enter the beginning balances in the accounts, and post the journal entries to the stockholders equity accounts. (Post entries in the Date Explanation Ref. Credit Balance Balance

Solution

bank a/c

to share capital ( 24500*1)

to security premium

24500

100500

bank a/c

to treasury stock( 5900*5)

to gain on sale

29500

2800

patents a/c

to common stock(4900*1)

to security premium

4900

29400

treasury shares a/c( 1100)

to bank bank

| serial no | particulars | debit | credit |

| 1 | bank a/c to share capital ( 24500*1) to security premium | 125000 | 24500 100500 |

| 2 | bank a/c to treasury stock( 5900*5) to gain on sale | 32300 | 29500 2800 |

| 3 | patents a/c to common stock(4900*1) to security premium | 34300 | 4900 29400 |

| 4 | treasury shares a/c( 1100) to bank bank | 5900 | 5900 |

Homework Sourse

Homework Sourse