IThe following information applies to the questions displaye

IThe following information applies to the questions displayed below. Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories.It started only two jobs during March-Job P and Job Q. Job P was completed and sold by the end of th March and Job Q was incomplete at the end of the March. The company uses a plantwide predetermi overhead rate based on direct labor-hours. The following additional Information is avallable for the cor as a whole and for Jobs P and O (all data and questions relate to the month of March) Estimated total fixed manufacturing overhead Estimated variable manufacturing overhead per direct labor-hour Estimated total direct labor-hours to be worked Total actuel manufacturing overhead costs incurred $ 14.000 $ 140 3.500 $ 19.000 Job P Job Q Direct materials Direct labor cost Actual direct labor-hours worked $ 15.000 $ 9500 $ 52.000 $15.000 2600 750

Solution

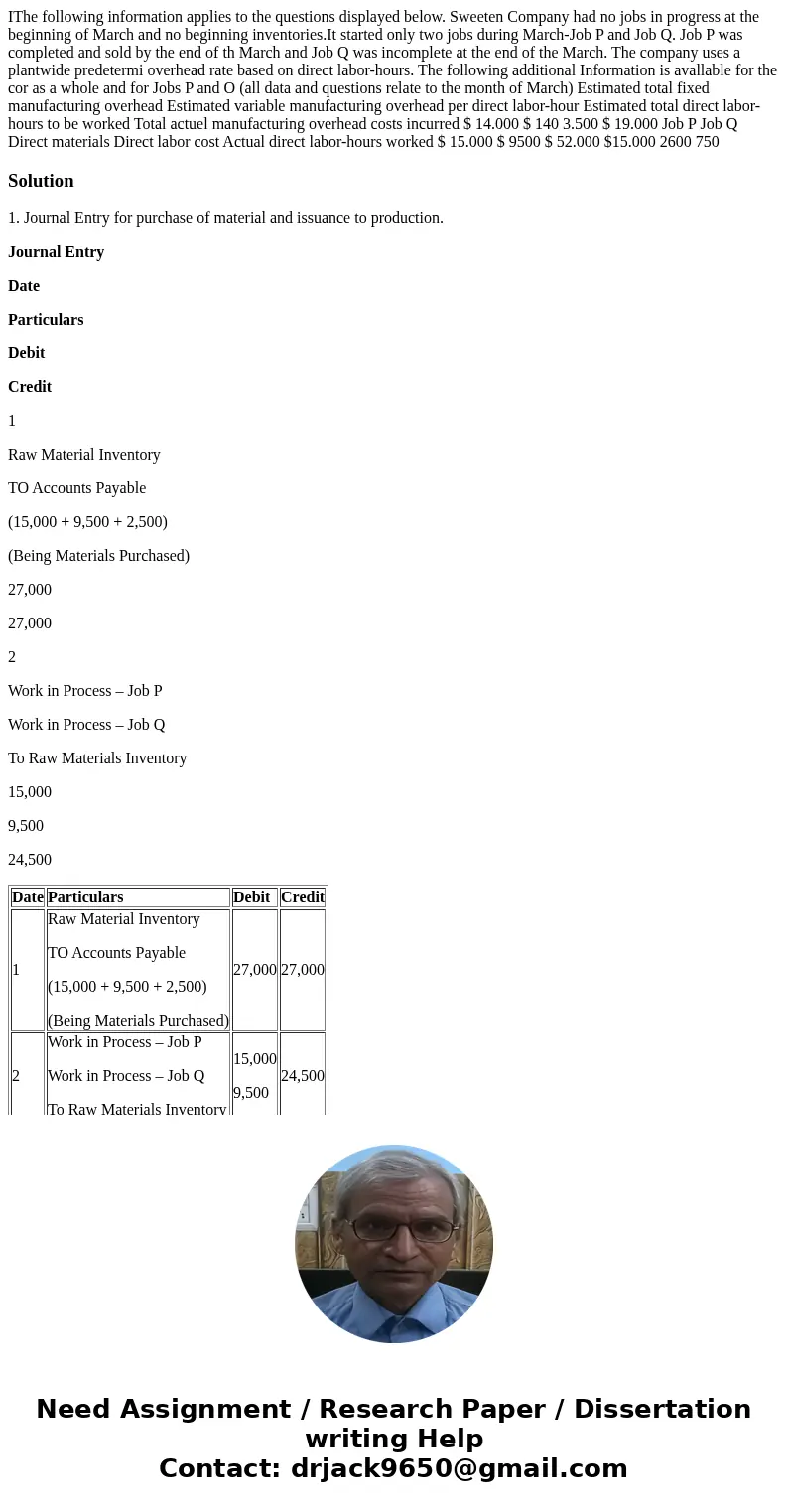

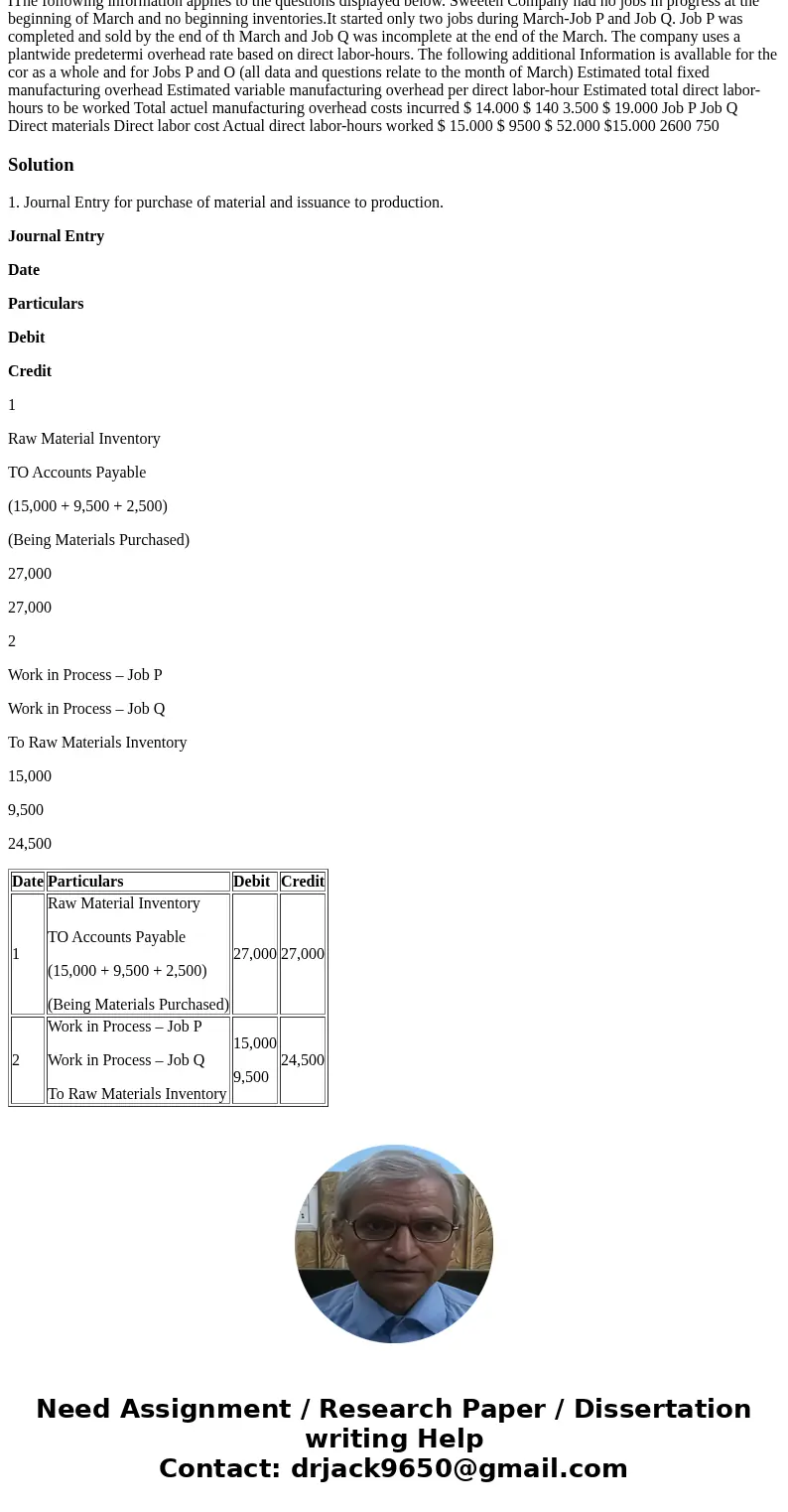

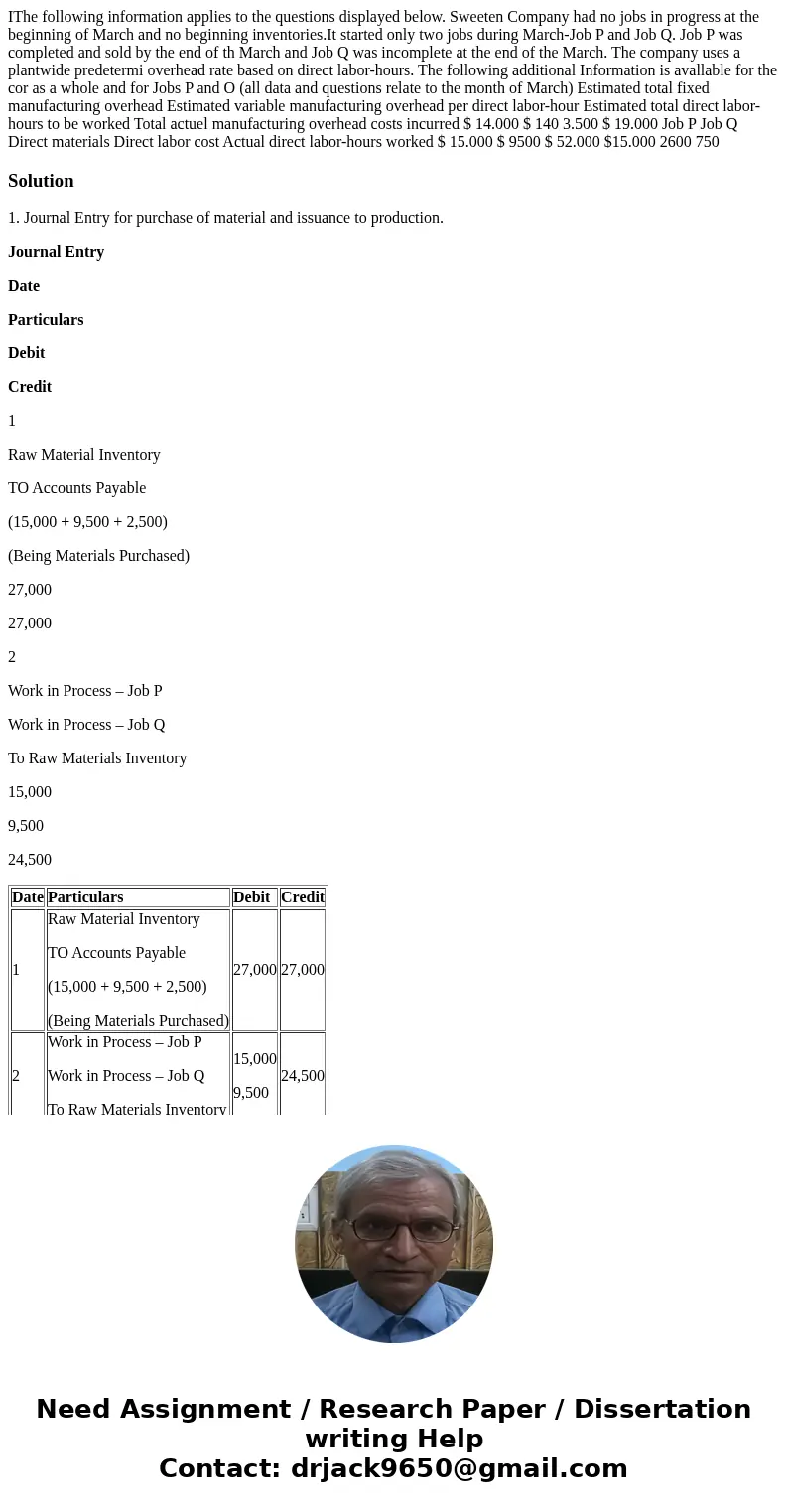

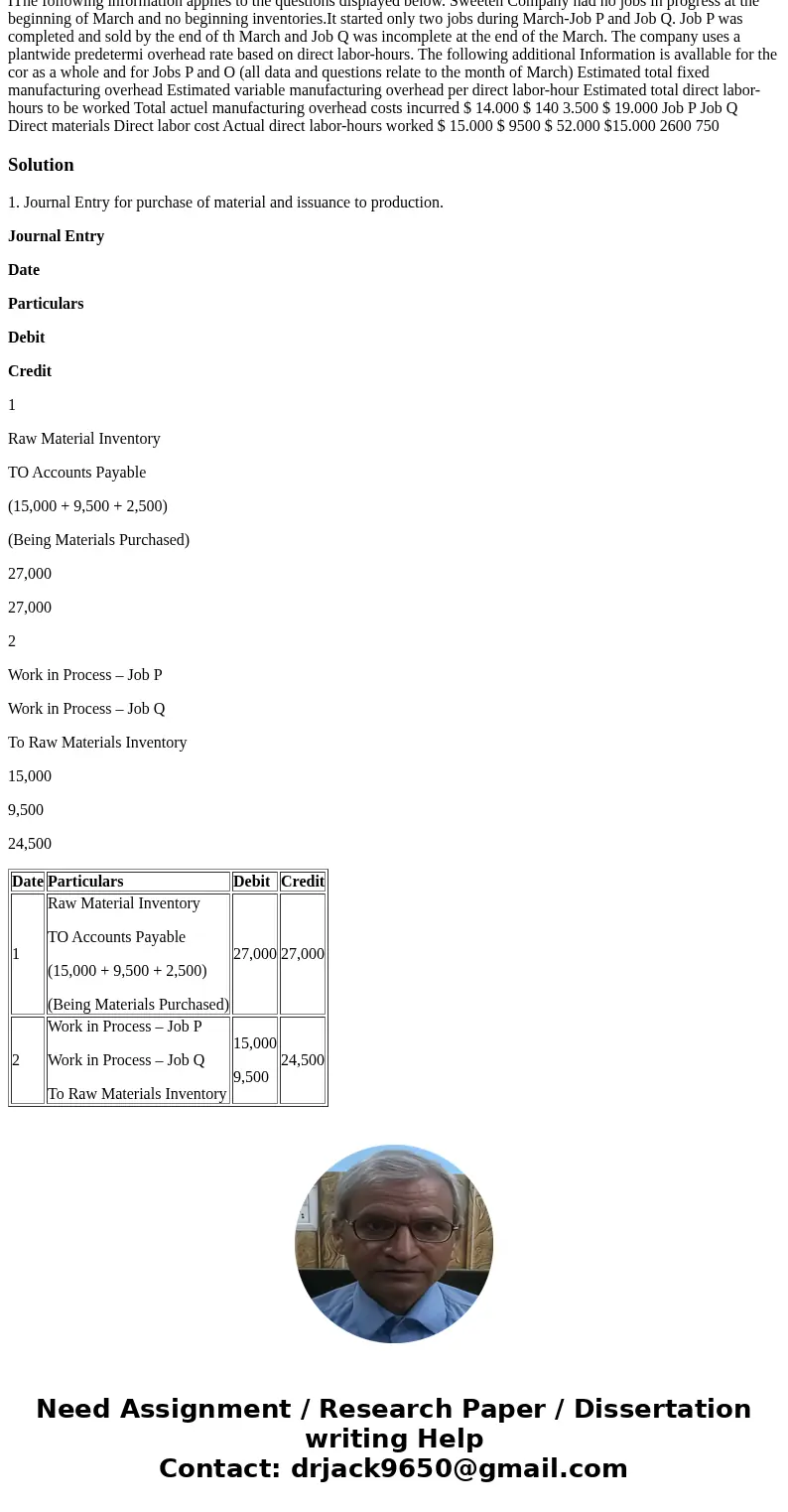

1. Journal Entry for purchase of material and issuance to production.

Journal Entry

Date

Particulars

Debit

Credit

1

Raw Material Inventory

TO Accounts Payable

(15,000 + 9,500 + 2,500)

(Being Materials Purchased)

27,000

27,000

2

Work in Process – Job P

Work in Process – Job Q

To Raw Materials Inventory

15,000

9,500

24,500

| Date | Particulars | Debit | Credit |

| 1 | Raw Material Inventory TO Accounts Payable (15,000 + 9,500 + 2,500) (Being Materials Purchased) | 27,000 | 27,000 |

| 2 | Work in Process – Job P Work in Process – Job Q To Raw Materials Inventory | 15,000 9,500 | 24,500 |

Homework Sourse

Homework Sourse