Question 14 30 points Niglow Corporation produces metal cast

Solution

1-

If the expansion is all equity financed then ROCE will equal RNOA of 10%

2-

50% debt and 50% equity

debt equity ratio

5/(10+5)

0.333333

rate of interest if debt equity ratio is less than or equal to 50%

9%

after tax cost of debt

9*(1-tax rate)

5.4

EBIT

20*10%

2

less interst on debt

5*5.4%

0.27

EBT

1.73

ROCE = EBT/capital employed

1.73/15

11.53%

3-

All debt

100% debt financing

debt equity ratio

10-Oct

1

rate of interest if debt equity ratio is 1

10%

after tax cost of debt

10*(1-.4)

6

EBIT

20*10%

2

less interst on debt

10*6%

0.6

EBT

1.4

ROCE = EBT/capital employed

1.4/10

14%

B-

If return on equity is decreased by using all debt this means that the after tax cost of debtwould be higher than return on net operating assets. An all debt financed expansion has anafter tax cost of 6% (10 x (1-.4)). Therefore, if return on net operating assets was less than 6%this would result in a decrease in the return on equity

Lets assume return on net operating assets = 6% so EBIT after expansion =20*6% = 1.2and after tax cost of debt = 10*(1-tax rate) =10*(1-.4)= 6%

EBIT

20*6%

1.2

less interst on debt

10*6%

0.6

EBT

0.6

ROCE = EBT/capital employed

.6/10

6%

Thus if RNOA is 6% and after-tax cost of debt is6%, the RNOA remains the same. If it is less than 6%, ROCE decreases

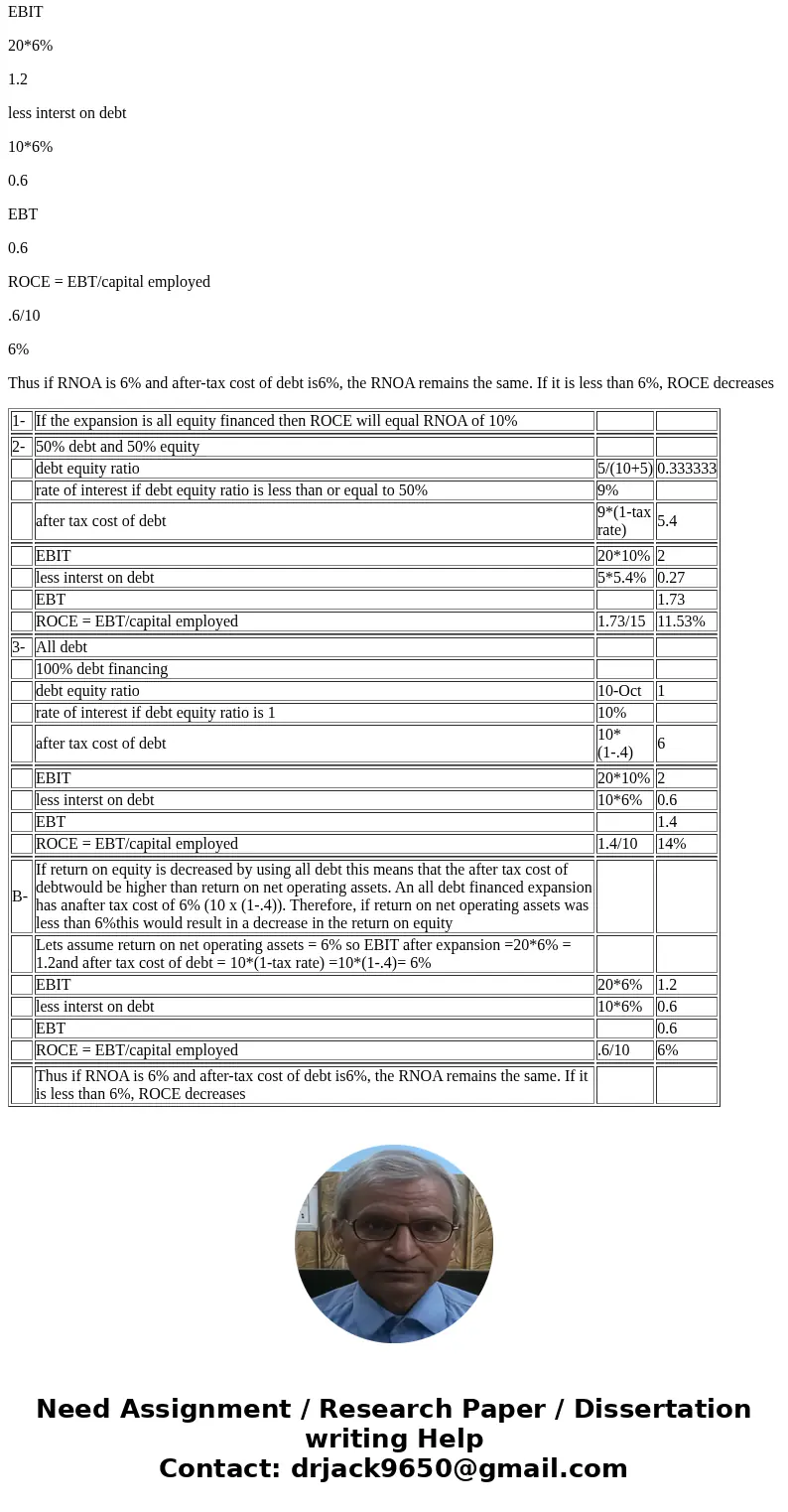

| 1- | If the expansion is all equity financed then ROCE will equal RNOA of 10% | ||

| 2- | 50% debt and 50% equity | ||

| debt equity ratio | 5/(10+5) | 0.333333 | |

| rate of interest if debt equity ratio is less than or equal to 50% | 9% | ||

| after tax cost of debt | 9*(1-tax rate) | 5.4 | |

| EBIT | 20*10% | 2 | |

| less interst on debt | 5*5.4% | 0.27 | |

| EBT | 1.73 | ||

| ROCE = EBT/capital employed | 1.73/15 | 11.53% | |

| 3- | All debt | ||

| 100% debt financing | |||

| debt equity ratio | 10-Oct | 1 | |

| rate of interest if debt equity ratio is 1 | 10% | ||

| after tax cost of debt | 10*(1-.4) | 6 | |

| EBIT | 20*10% | 2 | |

| less interst on debt | 10*6% | 0.6 | |

| EBT | 1.4 | ||

| ROCE = EBT/capital employed | 1.4/10 | 14% | |

| B- | If return on equity is decreased by using all debt this means that the after tax cost of debtwould be higher than return on net operating assets. An all debt financed expansion has anafter tax cost of 6% (10 x (1-.4)). Therefore, if return on net operating assets was less than 6%this would result in a decrease in the return on equity | ||

| Lets assume return on net operating assets = 6% so EBIT after expansion =20*6% = 1.2and after tax cost of debt = 10*(1-tax rate) =10*(1-.4)= 6% | |||

| EBIT | 20*6% | 1.2 | |

| less interst on debt | 10*6% | 0.6 | |

| EBT | 0.6 | ||

| ROCE = EBT/capital employed | .6/10 | 6% | |

| Thus if RNOA is 6% and after-tax cost of debt is6%, the RNOA remains the same. If it is less than 6%, ROCE decreases |

Homework Sourse

Homework Sourse