Caleb Co owns a machine that costs 42800 with accumulated de

Caleb Co. owns a machine that costs $42,800 with accumulated depreciation of $18,600. Caleb exchanges the machine for a newer model that has a market value of $53,000.

1. Record the exchange assuming Caleb paid $30,200 cash and the exchange has commercial substance.

2. Record the exchange assuming Caleb paid $22,200 cash and the exchange has commercial substance.

Solution

Journal entry :

1. Record the exchange assuming Caleb paid $30,200 cash and the exchange has commercial substance.

Journal entry :

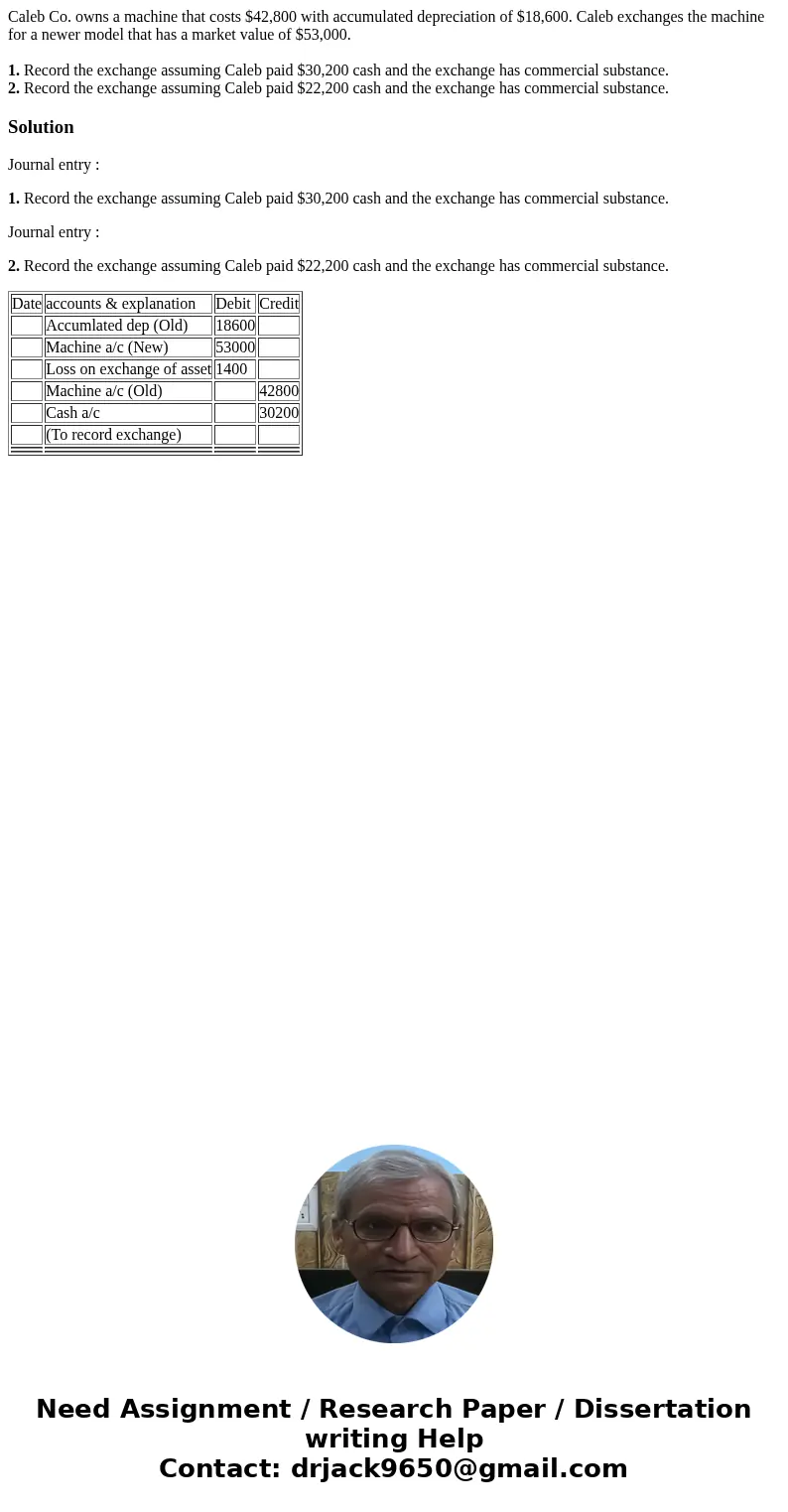

2. Record the exchange assuming Caleb paid $22,200 cash and the exchange has commercial substance.

| Date | accounts & explanation | Debit | Credit |

| Accumlated dep (Old) | 18600 | ||

| Machine a/c (New) | 53000 | ||

| Loss on exchange of asset | 1400 | ||

| Machine a/c (Old) | 42800 | ||

| Cash a/c | 30200 | ||

| (To record exchange) | |||

Homework Sourse

Homework Sourse