Please assist me with question 4 Crop and straighten your qu

Please assist me with question 4

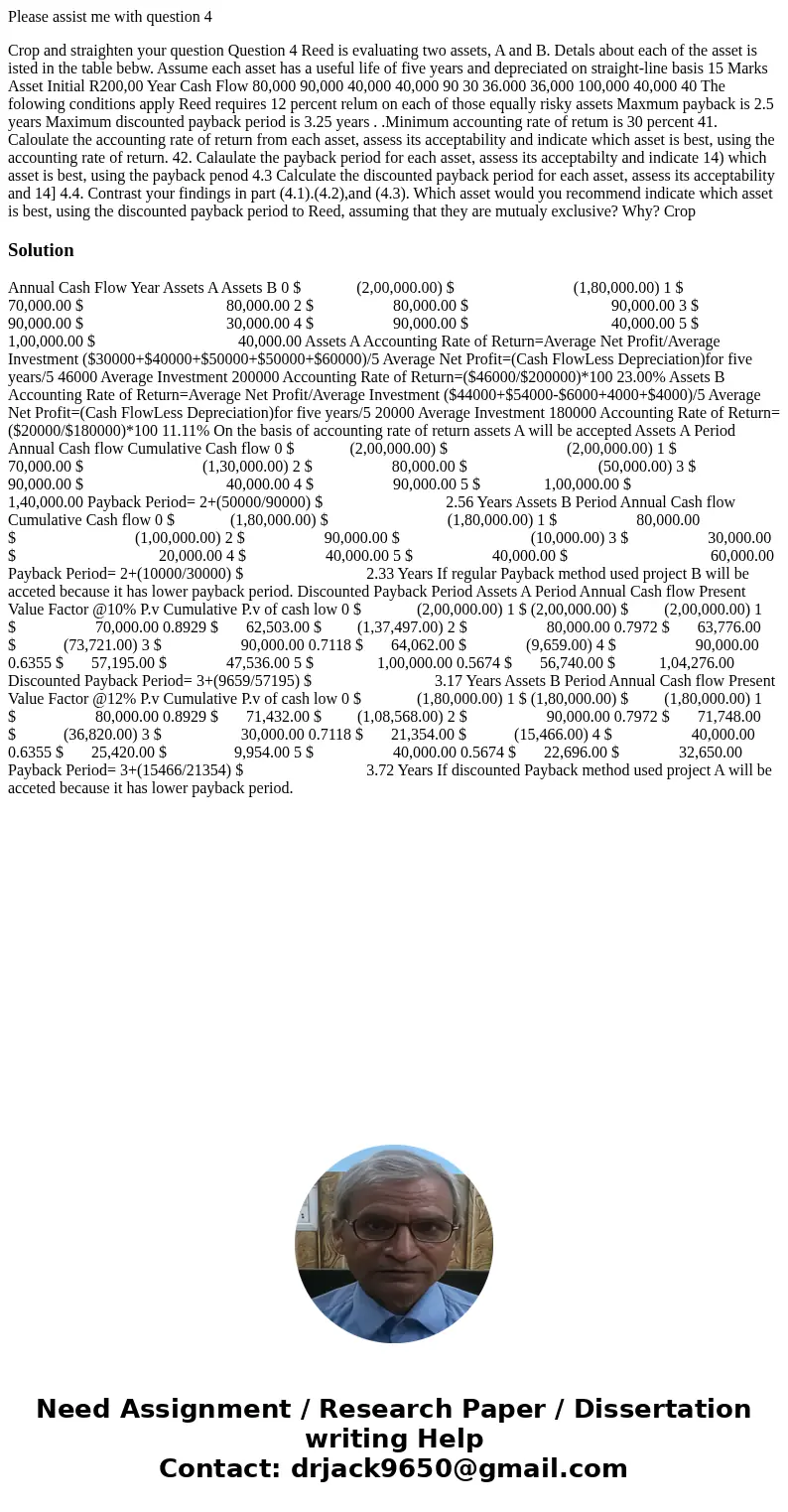

Crop and straighten your question Question 4 Reed is evaluating two assets, A and B. Detals about each of the asset is isted in the table bebw. Assume each asset has a useful life of five years and depreciated on straight-line basis 15 Marks Asset Initial R200,00 Year Cash Flow 80,000 90,000 40,000 40,000 90 30 36.000 36,000 100,000 40,000 40 The folowing conditions apply Reed requires 12 percent relum on each of those equally risky assets Maxmum payback is 2.5 years Maximum discounted payback period is 3.25 years . .Minimum accounting rate of retum is 30 percent 41. Caloulate the accounting rate of return from each asset, assess its acceptability and indicate which asset is best, using the accounting rate of return. 42. Calaulate the payback period for each asset, assess its acceptabilty and indicate 14) which asset is best, using the payback penod 4.3 Calculate the discounted payback period for each asset, assess its acceptability and 14] 4.4. Contrast your findings in part (4.1).(4.2),and (4.3). Which asset would you recommend indicate which asset is best, using the discounted payback period to Reed, assuming that they are mutualy exclusive? Why? CropSolution

Annual Cash Flow Year Assets A Assets B 0 $ (2,00,000.00) $ (1,80,000.00) 1 $ 70,000.00 $ 80,000.00 2 $ 80,000.00 $ 90,000.00 3 $ 90,000.00 $ 30,000.00 4 $ 90,000.00 $ 40,000.00 5 $ 1,00,000.00 $ 40,000.00 Assets A Accounting Rate of Return=Average Net Profit/Average Investment ($30000+$40000+$50000+$50000+$60000)/5 Average Net Profit=(Cash FlowLess Depreciation)for five years/5 46000 Average Investment 200000 Accounting Rate of Return=($46000/$200000)*100 23.00% Assets B Accounting Rate of Return=Average Net Profit/Average Investment ($44000+$54000-$6000+4000+$4000)/5 Average Net Profit=(Cash FlowLess Depreciation)for five years/5 20000 Average Investment 180000 Accounting Rate of Return=($20000/$180000)*100 11.11% On the basis of accounting rate of return assets A will be accepted Assets A Period Annual Cash flow Cumulative Cash flow 0 $ (2,00,000.00) $ (2,00,000.00) 1 $ 70,000.00 $ (1,30,000.00) 2 $ 80,000.00 $ (50,000.00) 3 $ 90,000.00 $ 40,000.00 4 $ 90,000.00 5 $ 1,00,000.00 $ 1,40,000.00 Payback Period= 2+(50000/90000) $ 2.56 Years Assets B Period Annual Cash flow Cumulative Cash flow 0 $ (1,80,000.00) $ (1,80,000.00) 1 $ 80,000.00 $ (1,00,000.00) 2 $ 90,000.00 $ (10,000.00) 3 $ 30,000.00 $ 20,000.00 4 $ 40,000.00 5 $ 40,000.00 $ 60,000.00 Payback Period= 2+(10000/30000) $ 2.33 Years If regular Payback method used project B will be acceted because it has lower payback period. Discounted Payback Period Assets A Period Annual Cash flow Present Value Factor @10% P.v Cumulative P.v of cash low 0 $ (2,00,000.00) 1 $ (2,00,000.00) $ (2,00,000.00) 1 $ 70,000.00 0.8929 $ 62,503.00 $ (1,37,497.00) 2 $ 80,000.00 0.7972 $ 63,776.00 $ (73,721.00) 3 $ 90,000.00 0.7118 $ 64,062.00 $ (9,659.00) 4 $ 90,000.00 0.6355 $ 57,195.00 $ 47,536.00 5 $ 1,00,000.00 0.5674 $ 56,740.00 $ 1,04,276.00 Discounted Payback Period= 3+(9659/57195) $ 3.17 Years Assets B Period Annual Cash flow Present Value Factor @12% P.v Cumulative P.v of cash low 0 $ (1,80,000.00) 1 $ (1,80,000.00) $ (1,80,000.00) 1 $ 80,000.00 0.8929 $ 71,432.00 $ (1,08,568.00) 2 $ 90,000.00 0.7972 $ 71,748.00 $ (36,820.00) 3 $ 30,000.00 0.7118 $ 21,354.00 $ (15,466.00) 4 $ 40,000.00 0.6355 $ 25,420.00 $ 9,954.00 5 $ 40,000.00 0.5674 $ 22,696.00 $ 32,650.00 Payback Period= 3+(15466/21354) $ 3.72 Years If discounted Payback method used project A will be acceted because it has lower payback period.

Homework Sourse

Homework Sourse