Enterprises is considering replacing the latex molding machi

Enterprises is considering replacing the latex molding machine it uses to fabricate rubber chickens with a newer, more efficient model. The old machine has a book value of $800,000 and a remaining useful life of 5 years. The current machine would be worn out and worthless in 5 years, but DeYoung can sell it now to a Halloween mask manufacturer for $270,000. The old machine is being depreciated by $160,000 per year for each year of its remaining life.

The new machine has a purchase price of $1,185,000, an estimated useful life and MACRS class life of 5 years, and an estimated salvage value of $105,000. The applicable depreciation rates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. Being highly efficient, it is expected to economize on electric power usage, labor, and repair costs, and, most importantly, to reduce the number of defective chickens. In total, an annual savings of $245,000 will be realized if the new machine is installed. The company\'s marginal tax rate is 35% and the project cost of capital is 15%.

What is the initial net cash flow if the new machine is purchased and the old one is replaced? Round your answer to the nearest dollar.

$

Calculate the annual depreciation allowances for both machines, and compute the change in the annual depreciation expense if the replacement is made. Do not round intermediate calculations. Round your answers to the nearest dollar.

What are the incremental net cash flows in Years 1 through 5? Do not round intermediate calculations. Round your answers to the nearest dollar.

Should the firm purchase the new machine?

NPV: $

Year | Depreciation Allowance, New | Depreciation Allowance, Old | Change in Depreciation |

| 1 | $ | $ | $ |

| 2 | $ | $ | $ |

| 3 | $ | $ | $ |

| 4 | $ | $ | $ |

| 5 | $ | $ | $ |

Solution

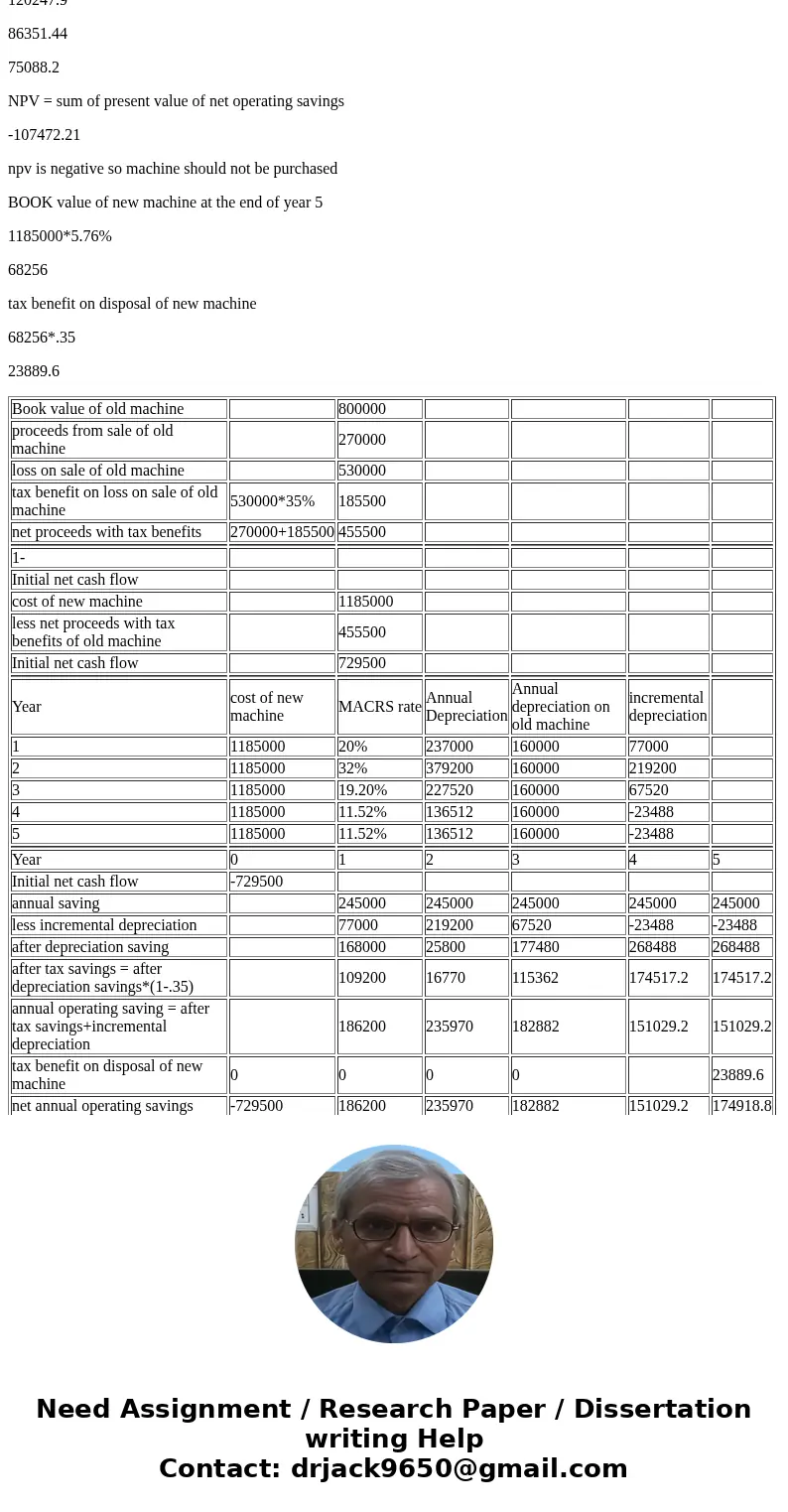

Book value of old machine

800000

proceeds from sale of old machine

270000

loss on sale of old machine

530000

tax benefit on loss on sale of old machine

530000*35%

185500

net proceeds with tax benefits

270000+185500

455500

1-

Initial net cash flow

cost of new machine

1185000

less net proceeds with tax benefits of old machine

455500

Initial net cash flow

729500

Year

cost of new machine

MACRS rate

Annual Depreciation

Annual depreciation on old machine

incremental depreciation

1

1185000

20%

237000

160000

77000

2

1185000

32%

379200

160000

219200

3

1185000

19.20%

227520

160000

67520

4

1185000

11.52%

136512

160000

-23488

5

1185000

11.52%

136512

160000

-23488

Year

0

1

2

3

4

5

Initial net cash flow

-729500

annual saving

245000

245000

245000

245000

245000

less incremental depreciation

77000

219200

67520

-23488

-23488

after depreciation saving

168000

25800

177480

268488

268488

after tax savings = after depreciation savings*(1-.35)

109200

16770

115362

174517.2

174517.2

annual operating saving = after tax savings+incremental depreciation

186200

235970

182882

151029.2

151029.2

tax benefit on disposal of new machine

0

0

0

0

23889.6

net annual operating savings

-729500

186200

235970

182882

151029.2

174918.8

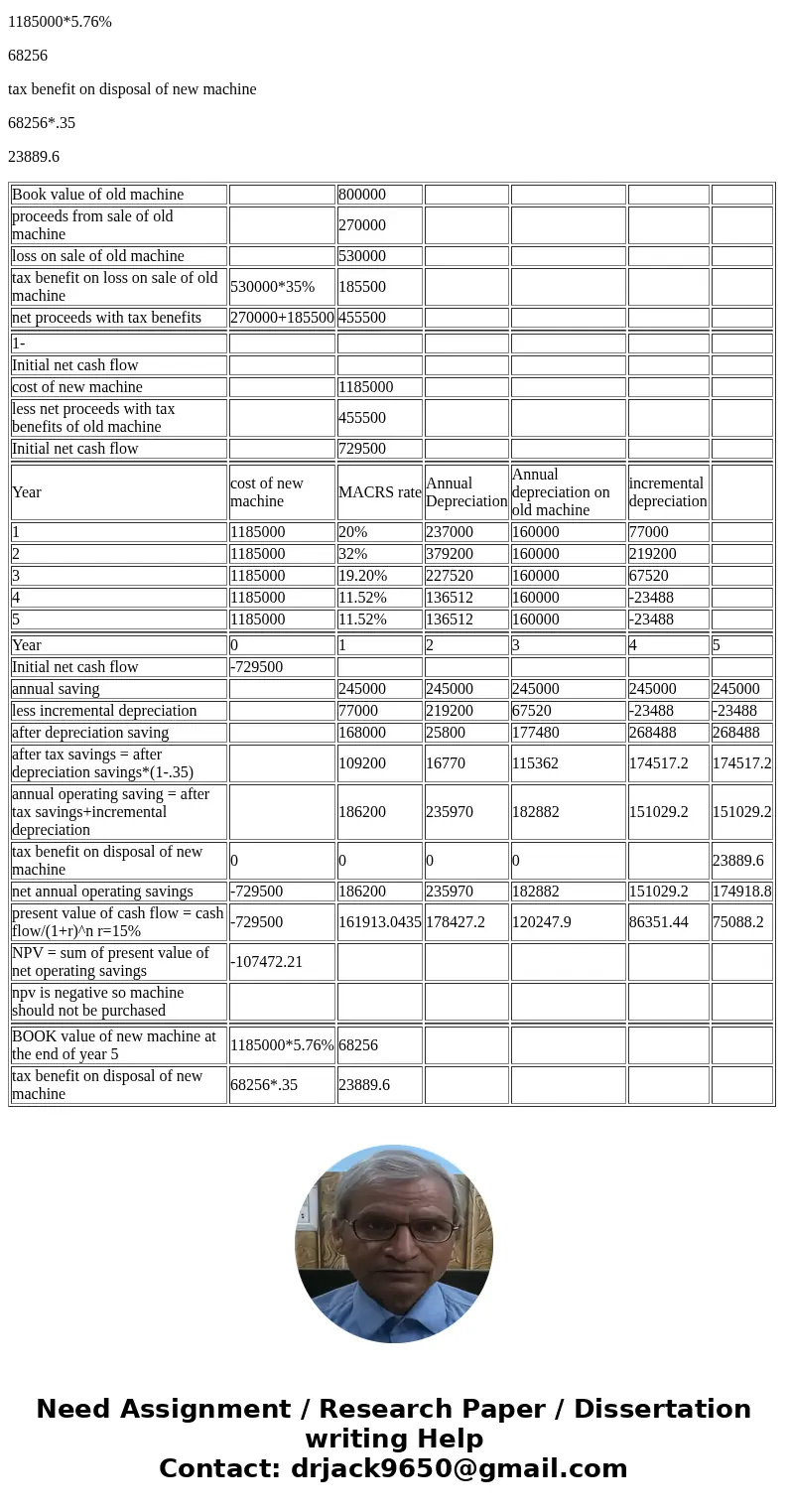

present value of cash flow = cash flow/(1+r)^n r=15%

-729500

161913.0435

178427.2

120247.9

86351.44

75088.2

NPV = sum of present value of net operating savings

-107472.21

npv is negative so machine should not be purchased

BOOK value of new machine at the end of year 5

1185000*5.76%

68256

tax benefit on disposal of new machine

68256*.35

23889.6

| Book value of old machine | 800000 | |||||

| proceeds from sale of old machine | 270000 | |||||

| loss on sale of old machine | 530000 | |||||

| tax benefit on loss on sale of old machine | 530000*35% | 185500 | ||||

| net proceeds with tax benefits | 270000+185500 | 455500 | ||||

| 1- | ||||||

| Initial net cash flow | ||||||

| cost of new machine | 1185000 | |||||

| less net proceeds with tax benefits of old machine | 455500 | |||||

| Initial net cash flow | 729500 | |||||

| Year | cost of new machine | MACRS rate | Annual Depreciation | Annual depreciation on old machine | incremental depreciation | |

| 1 | 1185000 | 20% | 237000 | 160000 | 77000 | |

| 2 | 1185000 | 32% | 379200 | 160000 | 219200 | |

| 3 | 1185000 | 19.20% | 227520 | 160000 | 67520 | |

| 4 | 1185000 | 11.52% | 136512 | 160000 | -23488 | |

| 5 | 1185000 | 11.52% | 136512 | 160000 | -23488 | |

| Year | 0 | 1 | 2 | 3 | 4 | 5 |

| Initial net cash flow | -729500 | |||||

| annual saving | 245000 | 245000 | 245000 | 245000 | 245000 | |

| less incremental depreciation | 77000 | 219200 | 67520 | -23488 | -23488 | |

| after depreciation saving | 168000 | 25800 | 177480 | 268488 | 268488 | |

| after tax savings = after depreciation savings*(1-.35) | 109200 | 16770 | 115362 | 174517.2 | 174517.2 | |

| annual operating saving = after tax savings+incremental depreciation | 186200 | 235970 | 182882 | 151029.2 | 151029.2 | |

| tax benefit on disposal of new machine | 0 | 0 | 0 | 0 | 23889.6 | |

| net annual operating savings | -729500 | 186200 | 235970 | 182882 | 151029.2 | 174918.8 |

| present value of cash flow = cash flow/(1+r)^n r=15% | -729500 | 161913.0435 | 178427.2 | 120247.9 | 86351.44 | 75088.2 |

| NPV = sum of present value of net operating savings | -107472.21 | |||||

| npv is negative so machine should not be purchased | ||||||

| BOOK value of new machine at the end of year 5 | 1185000*5.76% | 68256 | ||||

| tax benefit on disposal of new machine | 68256*.35 | 23889.6 |

Homework Sourse

Homework Sourse