PROBLEM SET 5 NAME eniba and Yubaba 1 You are given the hist

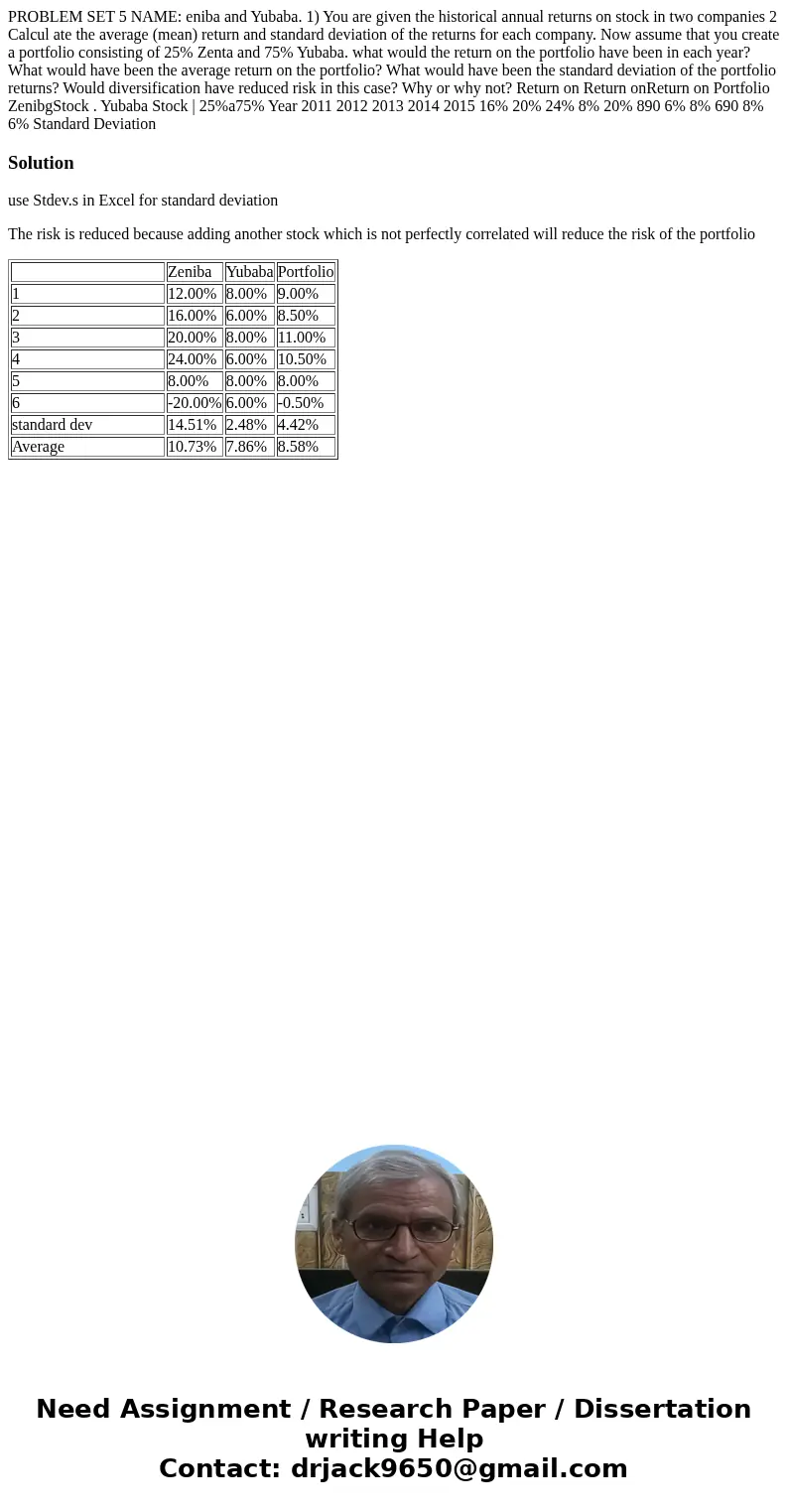

PROBLEM SET 5 NAME: eniba and Yubaba. 1) You are given the historical annual returns on stock in two companies 2 Calcul ate the average (mean) return and standard deviation of the returns for each company. Now assume that you create a portfolio consisting of 25% Zenta and 75% Yubaba. what would the return on the portfolio have been in each year? What would have been the average return on the portfolio? What would have been the standard deviation of the portfolio returns? Would diversification have reduced risk in this case? Why or why not? Return on Return onReturn on Portfolio ZenibgStock . Yubaba Stock | 25%a75% Year 2011 2012 2013 2014 2015 16% 20% 24% 8% 20% 890 6% 8% 690 8% 6% Standard Deviation

Solution

use Stdev.s in Excel for standard deviation

The risk is reduced because adding another stock which is not perfectly correlated will reduce the risk of the portfolio

| Zeniba | Yubaba | Portfolio | |

| 1 | 12.00% | 8.00% | 9.00% |

| 2 | 16.00% | 6.00% | 8.50% |

| 3 | 20.00% | 8.00% | 11.00% |

| 4 | 24.00% | 6.00% | 10.50% |

| 5 | 8.00% | 8.00% | 8.00% |

| 6 | -20.00% | 6.00% | -0.50% |

| standard dev | 14.51% | 2.48% | 4.42% |

| Average | 10.73% | 7.86% | 8.58% |

Homework Sourse

Homework Sourse