In 2017 Elaine paid 2800 of tuition and 640 for books for he

In 2017, Elaine paid $2,800 of tuition and $640 for books for her dependent son to attend State University this past fall as a freshman. Elaine files a joint return with her husband. What is the maximum American opportunity credit that Elaine can claim for the tuition payment and books in each of the following alternative situations?

a. what is Elaine AGI at $83,200.

b. what is Elaine AGI at $166,000

Solution

a.

b. since AGI is between 160000-180000, it is subject to phase out.

credit limit amount is subject to phase out

amount of phase out= 2500* (163000-160000)/(180000 -160000) = 2500* 0.15= 375

Maximum eligible credit = 2500-375= 2125

since calculated credit 2360 is more than eligible credit of 2125, hence maximum allowable credit is only 2125.

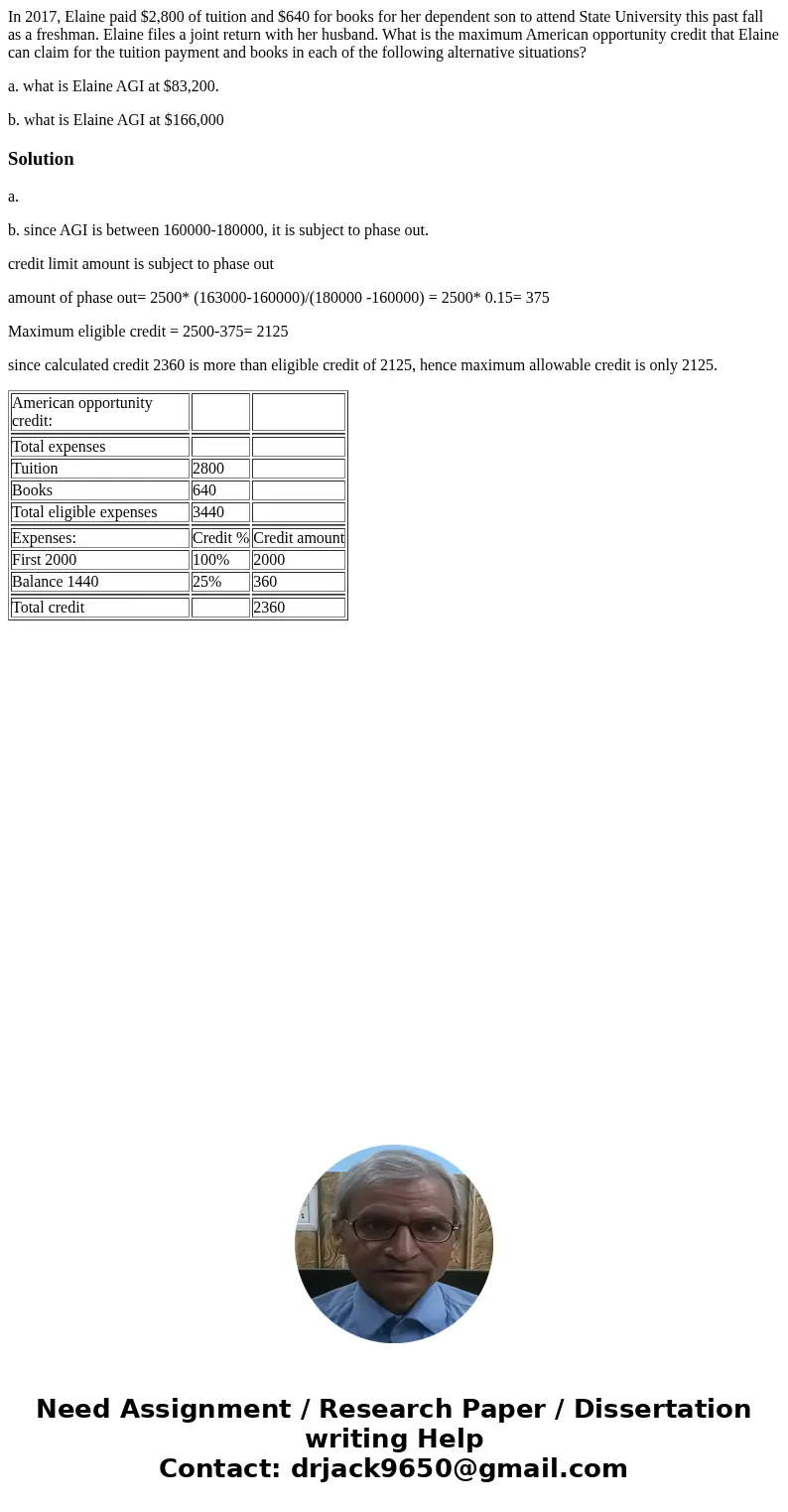

| American opportunity credit: | ||

| Total expenses | ||

| Tuition | 2800 | |

| Books | 640 | |

| Total eligible expenses | 3440 | |

| Expenses: | Credit % | Credit amount |

| First 2000 | 100% | 2000 |

| Balance 1440 | 25% | 360 |

| Total credit | 2360 |

Homework Sourse

Homework Sourse