A new washer costs 15000 The old one is fully depreciated an

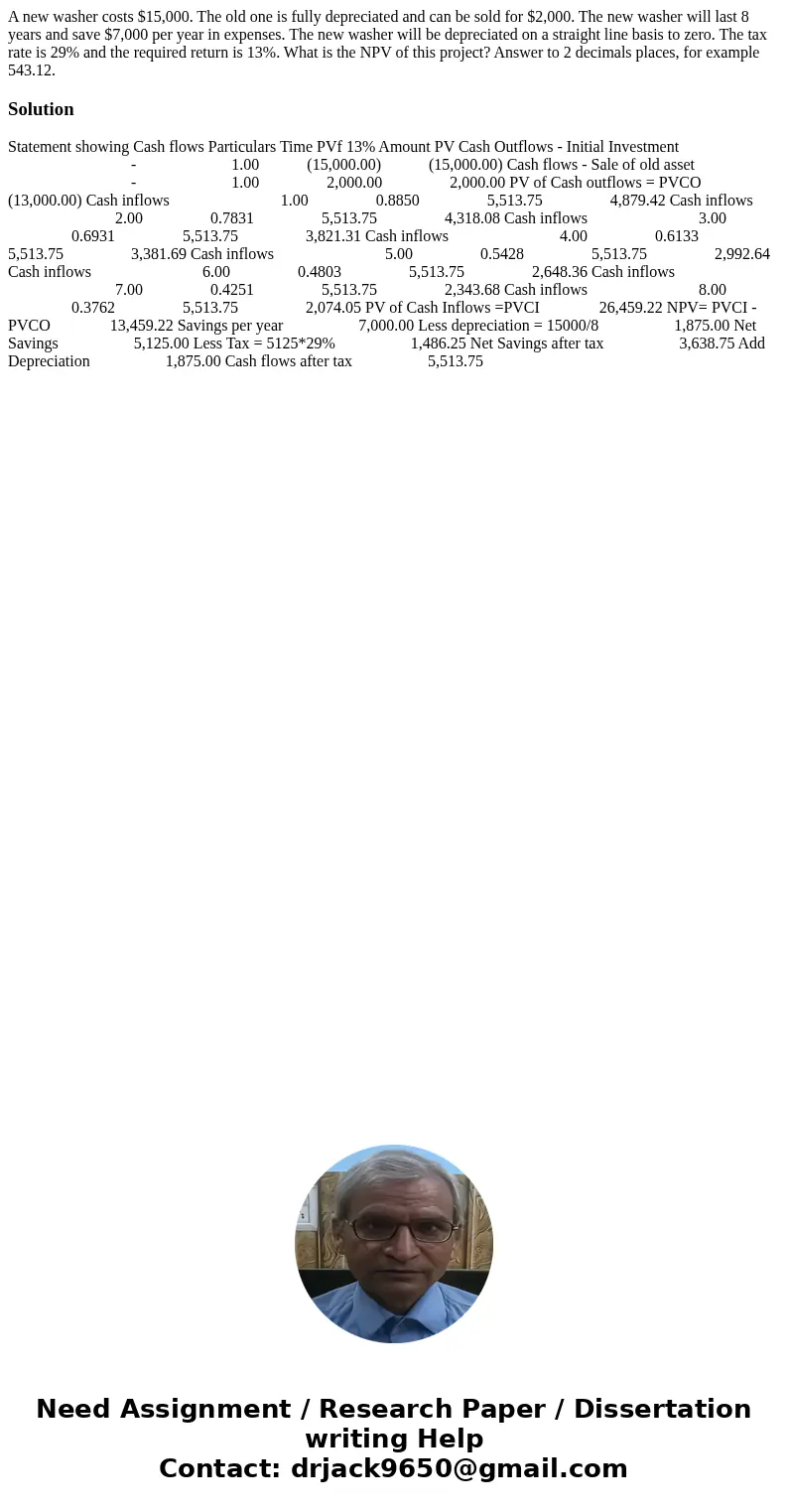

A new washer costs $15,000. The old one is fully depreciated and can be sold for $2,000. The new washer will last 8 years and save $7,000 per year in expenses. The new washer will be depreciated on a straight line basis to zero. The tax rate is 29% and the required return is 13%. What is the NPV of this project? Answer to 2 decimals places, for example 543.12.

Solution

Statement showing Cash flows Particulars Time PVf 13% Amount PV Cash Outflows - Initial Investment - 1.00 (15,000.00) (15,000.00) Cash flows - Sale of old asset - 1.00 2,000.00 2,000.00 PV of Cash outflows = PVCO (13,000.00) Cash inflows 1.00 0.8850 5,513.75 4,879.42 Cash inflows 2.00 0.7831 5,513.75 4,318.08 Cash inflows 3.00 0.6931 5,513.75 3,821.31 Cash inflows 4.00 0.6133 5,513.75 3,381.69 Cash inflows 5.00 0.5428 5,513.75 2,992.64 Cash inflows 6.00 0.4803 5,513.75 2,648.36 Cash inflows 7.00 0.4251 5,513.75 2,343.68 Cash inflows 8.00 0.3762 5,513.75 2,074.05 PV of Cash Inflows =PVCI 26,459.22 NPV= PVCI - PVCO 13,459.22 Savings per year 7,000.00 Less depreciation = 15000/8 1,875.00 Net Savings 5,125.00 Less Tax = 5125*29% 1,486.25 Net Savings after tax 3,638.75 Add Depreciation 1,875.00 Cash flows after tax 5,513.75

Homework Sourse

Homework Sourse