ook Show Me How Calculator Present Value Tables Chart of Acc

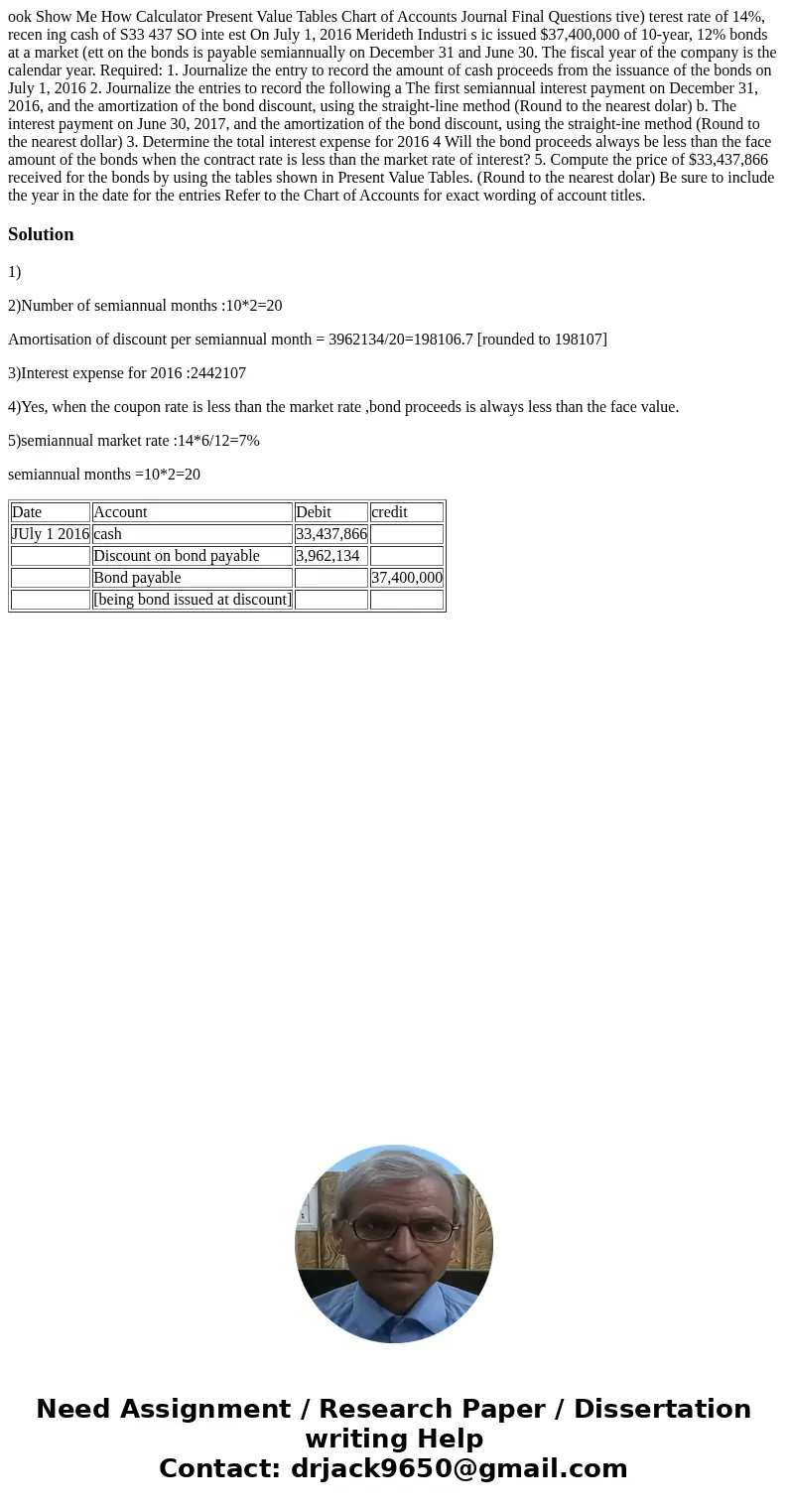

ook Show Me How Calculator Present Value Tables Chart of Accounts Journal Final Questions tive) terest rate of 14%, recen ing cash of S33 437 SO inte est On July 1, 2016 Merideth Industri s ic issued $37,400,000 of 10-year, 12% bonds at a market (ett on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Required: 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds on July 1, 2016 2. Journalize the entries to record the following a The first semiannual interest payment on December 31, 2016, and the amortization of the bond discount, using the straight-line method (Round to the nearest dolar) b. The interest payment on June 30, 2017, and the amortization of the bond discount, using the straight-ine method (Round to the nearest dollar) 3. Determine the total interest expense for 2016 4 Will the bond proceeds always be less than the face amount of the bonds when the contract rate is less than the market rate of interest? 5. Compute the price of $33,437,866 received for the bonds by using the tables shown in Present Value Tables. (Round to the nearest dolar) Be sure to include the year in the date for the entries Refer to the Chart of Accounts for exact wording of account titles.

Solution

1)

2)Number of semiannual months :10*2=20

Amortisation of discount per semiannual month = 3962134/20=198106.7 [rounded to 198107]

3)Interest expense for 2016 :2442107

4)Yes, when the coupon rate is less than the market rate ,bond proceeds is always less than the face value.

5)semiannual market rate :14*6/12=7%

semiannual months =10*2=20

| Date | Account | Debit | credit |

| JUly 1 2016 | cash | 33,437,866 | |

| Discount on bond payable | 3,962,134 | ||

| Bond payable | 37,400,000 | ||

| [being bond issued at discount] |

Homework Sourse

Homework Sourse