Simon Companys yearend balance sheets follow Express the bal

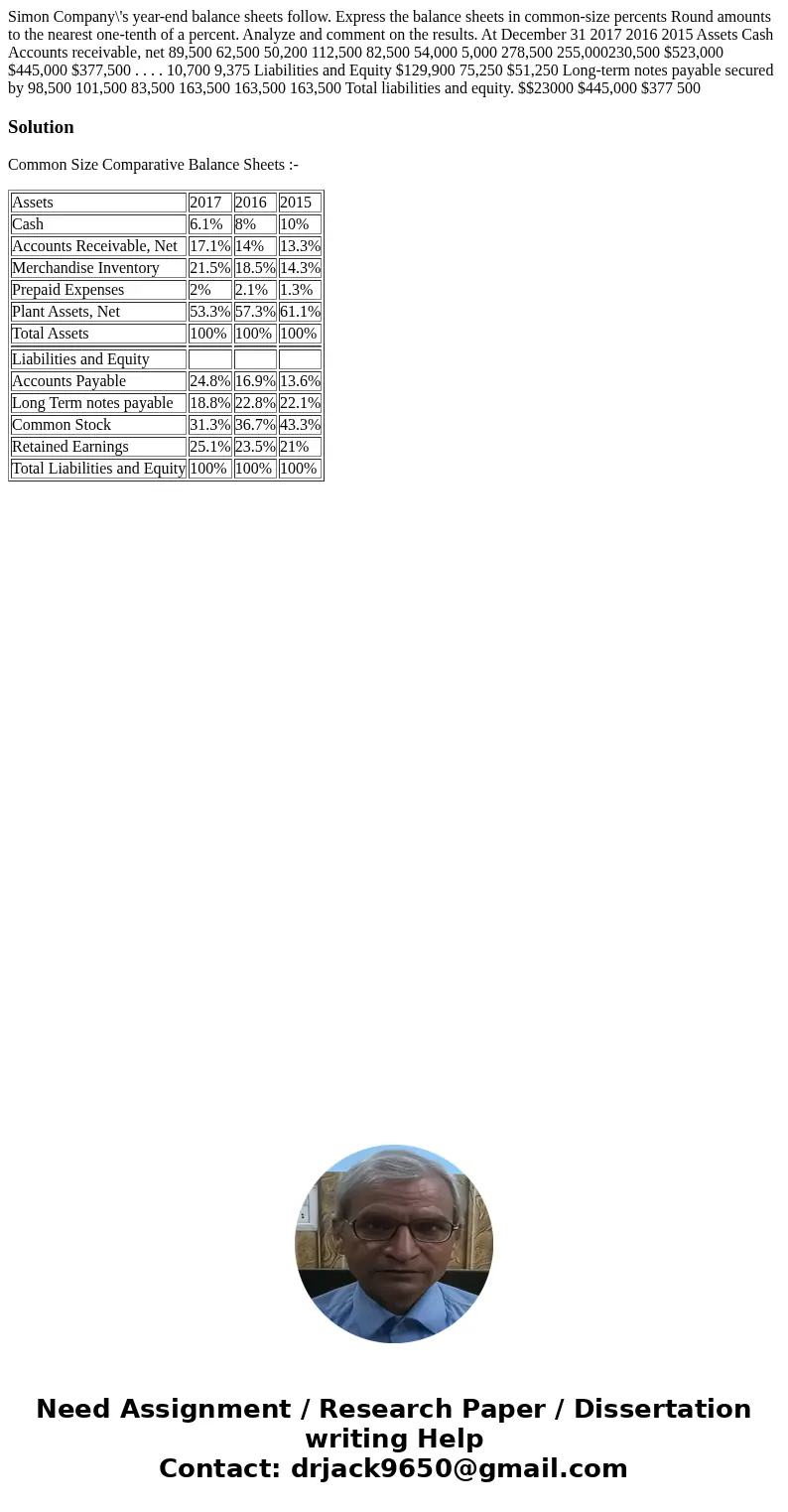

Simon Company\'s year-end balance sheets follow. Express the balance sheets in common-size percents Round amounts to the nearest one-tenth of a percent. Analyze and comment on the results. At December 31 2017 2016 2015 Assets Cash Accounts receivable, net 89,500 62,500 50,200 112,500 82,500 54,000 5,000 278,500 255,000230,500 $523,000 $445,000 $377,500 . . . . 10,700 9,375 Liabilities and Equity $129,900 75,250 $51,250 Long-term notes payable secured by 98,500 101,500 83,500 163,500 163,500 163,500 Total liabilities and equity. $$23000 $445,000 $377 500

Solution

Common Size Comparative Balance Sheets :-

| Assets | 2017 | 2016 | 2015 |

| Cash | 6.1% | 8% | 10% |

| Accounts Receivable, Net | 17.1% | 14% | 13.3% |

| Merchandise Inventory | 21.5% | 18.5% | 14.3% |

| Prepaid Expenses | 2% | 2.1% | 1.3% |

| Plant Assets, Net | 53.3% | 57.3% | 61.1% |

| Total Assets | 100% | 100% | 100% |

| Liabilities and Equity | |||

| Accounts Payable | 24.8% | 16.9% | 13.6% |

| Long Term notes payable | 18.8% | 22.8% | 22.1% |

| Common Stock | 31.3% | 36.7% | 43.3% |

| Retained Earnings | 25.1% | 23.5% | 21% |

| Total Liabilities and Equity | 100% | 100% | 100% |

Homework Sourse

Homework Sourse