Instruction Please answer all questions below including the

Instruction: Please answer all questions below including the ratios and the intrepretation for each ratio. I have attached the financial statement for Sprint Corp. I can\'t award credit if all sections are not answered.

1] Please search a company (example as Google, facebook, Macy’s and others) with a set of current financial statements and apply the ratios listed above to analyze a company financial performance

2] Please provide the interpretation on each ratio analysis reflecting a company current financial situation.

3) Using the following ratios to analyze a company financial performance.

-Profitability Analysis

-Profit Margin Analysis

-Asset Turnover

-Fixed Asset Turnover

-Rate of Return on Common Shareholders’ Equity

-Earning Per Common Share

INCOME STATEMENT BALANCE SHEET CASH FLOWW Annual Download View Previous Years Quarter Fiscal year is Apr - Mar. Sprint Revenues or Net Sales Cost Of Goods Sold (COGS) 2017 2016 2015 2014 2013 33.35B 32.18B 34.53B 25.77B 35.35B 4.94B 15.23B 18.97B 14.44B 20.84B Sprint Gross Profit Research & Development Expense Selling General & Admin Expense Income Before Depreciation Depletion Amortization Depreciation Depletion Amortization 18.41B 16.95B 15.56B 11.33B 14.5B 8.5B 9.55B 9.98B 7.63B 9.78B 9.91B 7.4B 5.59B 3.7B 4.72B 8.15B 7.09B 7.48B 4.23B 6.54B Non Operating Income 40M 18M 27M 68M 924M Interest Expense 2.5B 2.18B 2.05B 1.43B 1.43B Sprint Pretax Income 1.85B 3.92B 1.9B -4.17B Provision for Income Taxes 435M 141 M 574M 100MM 154M Minority Interest Investment Gains Losses Other Income Income Before Extraordinaries & Disc Operations 1.21B-2B .35B -2B -4.33BSolution

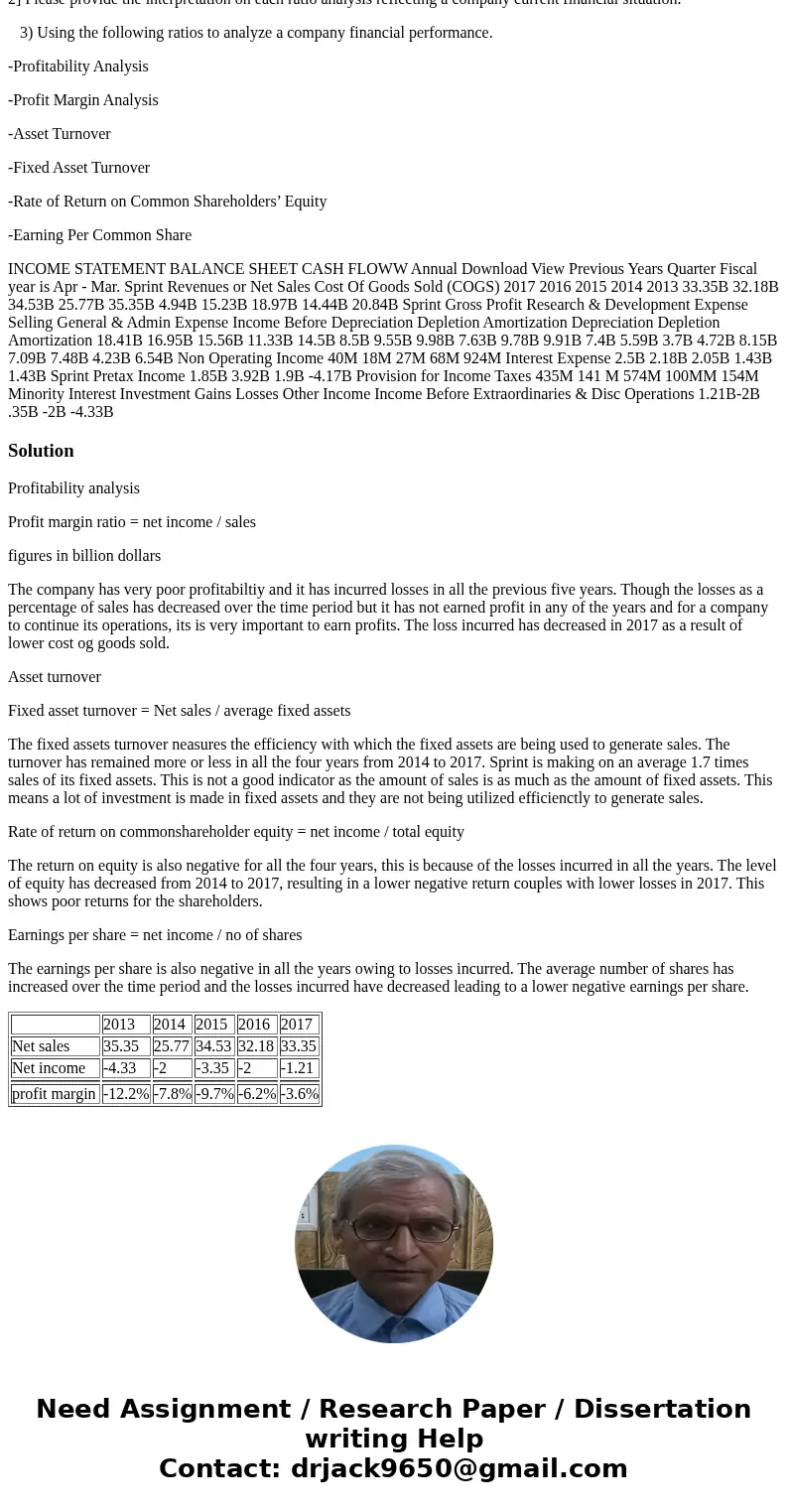

Profitability analysis

Profit margin ratio = net income / sales

figures in billion dollars

The company has very poor profitabiltiy and it has incurred losses in all the previous five years. Though the losses as a percentage of sales has decreased over the time period but it has not earned profit in any of the years and for a company to continue its operations, its is very important to earn profits. The loss incurred has decreased in 2017 as a result of lower cost og goods sold.

Asset turnover

Fixed asset turnover = Net sales / average fixed assets

The fixed assets turnover neasures the efficiency with which the fixed assets are being used to generate sales. The turnover has remained more or less in all the four years from 2014 to 2017. Sprint is making on an average 1.7 times sales of its fixed assets. This is not a good indicator as the amount of sales is as much as the amount of fixed assets. This means a lot of investment is made in fixed assets and they are not being utilized efficienctly to generate sales.

Rate of return on commonshareholder equity = net income / total equity

The return on equity is also negative for all the four years, this is because of the losses incurred in all the years. The level of equity has decreased from 2014 to 2017, resulting in a lower negative return couples with lower losses in 2017. This shows poor returns for the shareholders.

Earnings per share = net income / no of shares

The earnings per share is also negative in all the years owing to losses incurred. The average number of shares has increased over the time period and the losses incurred have decreased leading to a lower negative earnings per share.

| 2013 | 2014 | 2015 | 2016 | 2017 | |

| Net sales | 35.35 | 25.77 | 34.53 | 32.18 | 33.35 |

| Net income | -4.33 | -2 | -3.35 | -2 | -1.21 |

| profit margin | -12.2% | -7.8% | -9.7% | -6.2% | -3.6% |

Homework Sourse

Homework Sourse