2 Suppose XYZ considering expanding business Hire investment

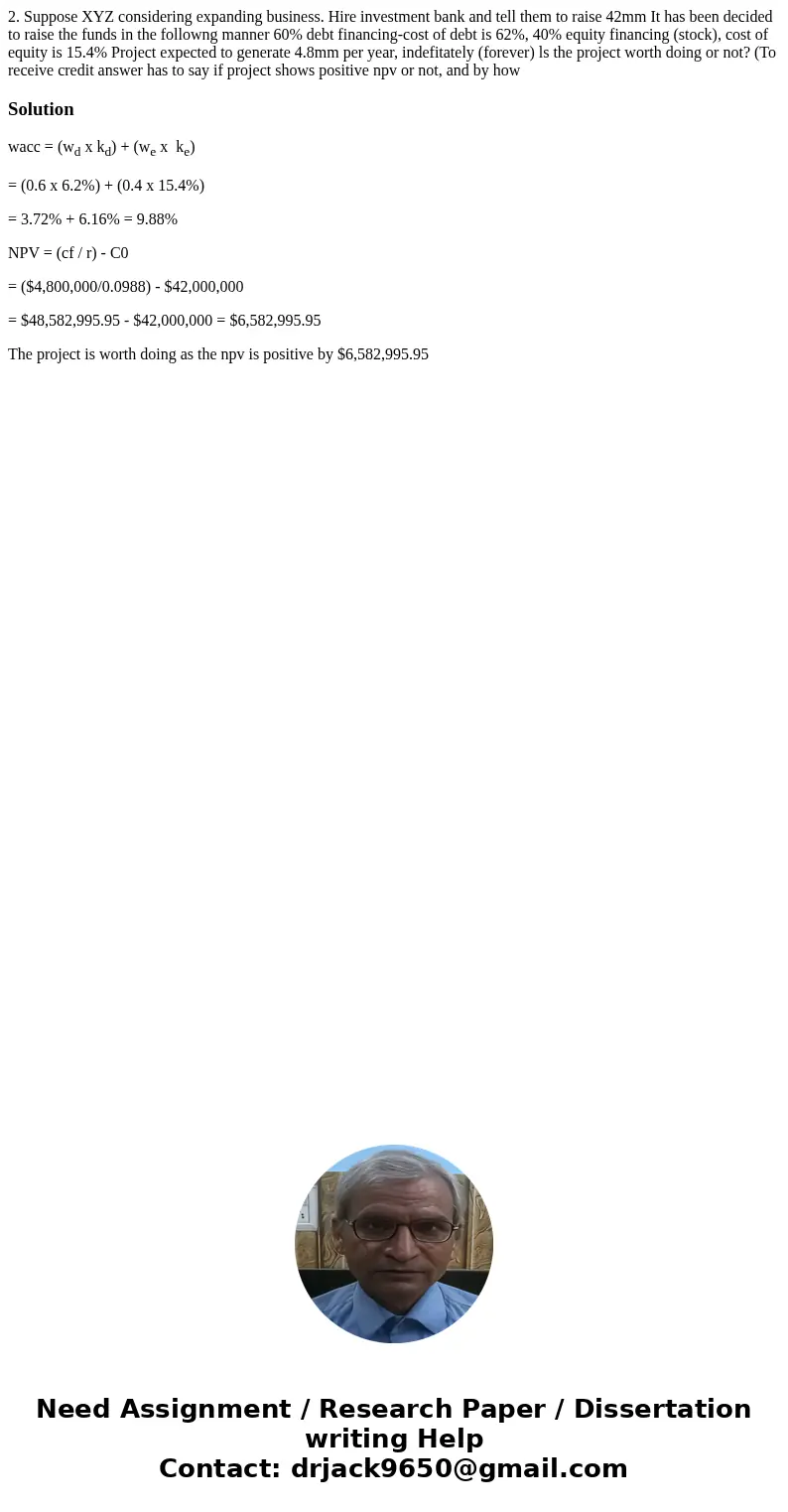

2. Suppose XYZ considering expanding business. Hire investment bank and tell them to raise 42mm It has been decided to raise the funds in the followng manner 60% debt financing-cost of debt is 62%, 40% equity financing (stock), cost of equity is 15.4% Project expected to generate 4.8mm per year, indefitately (forever) ls the project worth doing or not? (To receive credit answer has to say if project shows positive npv or not, and by how

Solution

wacc = (wd x kd) + (we x ke)

= (0.6 x 6.2%) + (0.4 x 15.4%)

= 3.72% + 6.16% = 9.88%

NPV = (cf / r) - C0

= ($4,800,000/0.0988) - $42,000,000

= $48,582,995.95 - $42,000,000 = $6,582,995.95

The project is worth doing as the npv is positive by $6,582,995.95

Homework Sourse

Homework Sourse