Problem 331 LO 2 Determine the amount of the 2017 standard d

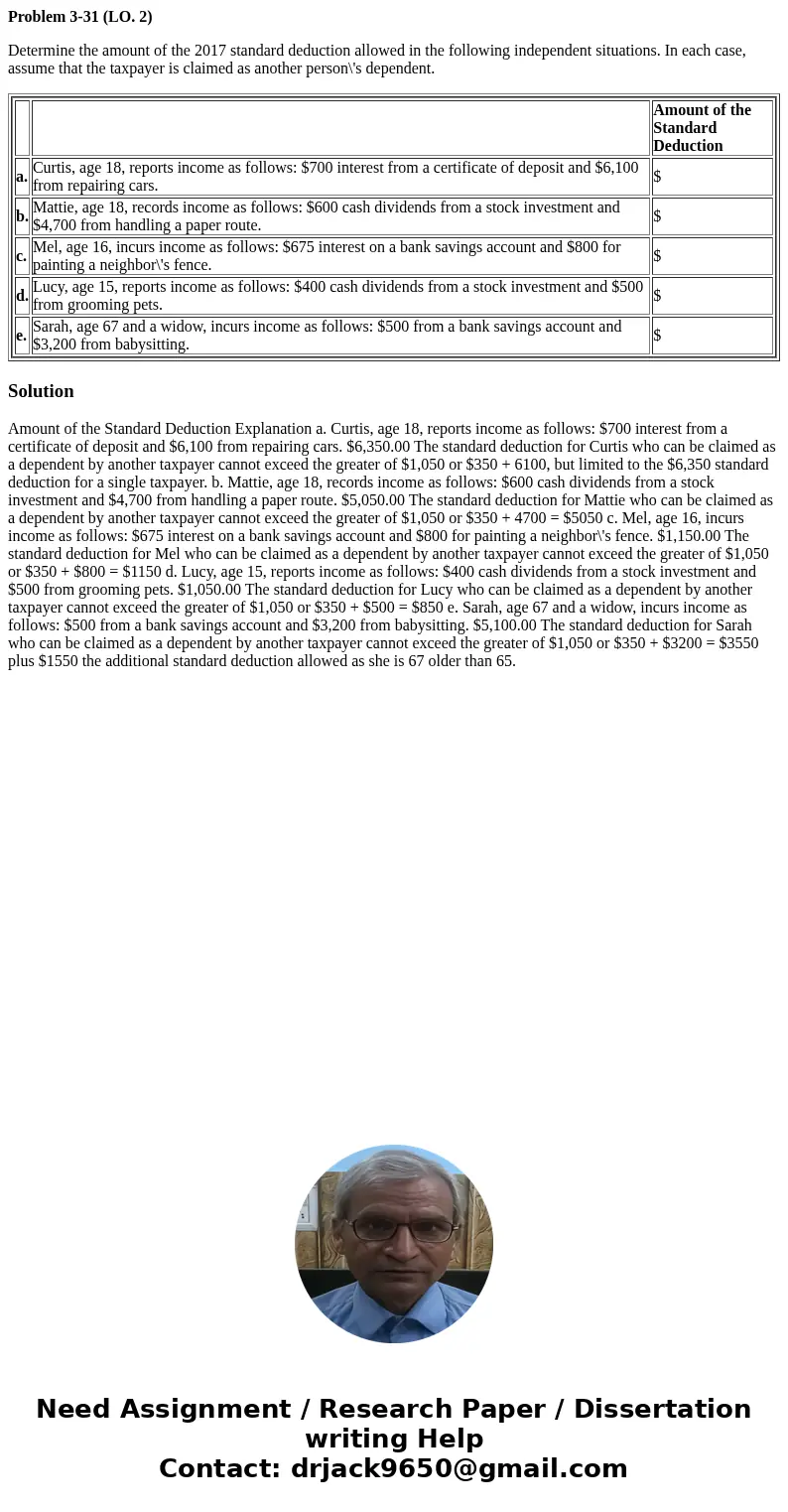

Problem 3-31 (LO. 2)

Determine the amount of the 2017 standard deduction allowed in the following independent situations. In each case, assume that the taxpayer is claimed as another person\'s dependent.

|

Solution

Amount of the Standard Deduction Explanation a. Curtis, age 18, reports income as follows: $700 interest from a certificate of deposit and $6,100 from repairing cars. $6,350.00 The standard deduction for Curtis who can be claimed as a dependent by another taxpayer cannot exceed the greater of $1,050 or $350 + 6100, but limited to the $6,350 standard deduction for a single taxpayer. b. Mattie, age 18, records income as follows: $600 cash dividends from a stock investment and $4,700 from handling a paper route. $5,050.00 The standard deduction for Mattie who can be claimed as a dependent by another taxpayer cannot exceed the greater of $1,050 or $350 + 4700 = $5050 c. Mel, age 16, incurs income as follows: $675 interest on a bank savings account and $800 for painting a neighbor\'s fence. $1,150.00 The standard deduction for Mel who can be claimed as a dependent by another taxpayer cannot exceed the greater of $1,050 or $350 + $800 = $1150 d. Lucy, age 15, reports income as follows: $400 cash dividends from a stock investment and $500 from grooming pets. $1,050.00 The standard deduction for Lucy who can be claimed as a dependent by another taxpayer cannot exceed the greater of $1,050 or $350 + $500 = $850 e. Sarah, age 67 and a widow, incurs income as follows: $500 from a bank savings account and $3,200 from babysitting. $5,100.00 The standard deduction for Sarah who can be claimed as a dependent by another taxpayer cannot exceed the greater of $1,050 or $350 + $3200 = $3550 plus $1550 the additional standard deduction allowed as she is 67 older than 65.

Homework Sourse

Homework Sourse