Acme Manufacturing Corporation has two divisions L and H Div

Solution

(1)

Acme Manufacturing Corporation should accept the project.

Division L\'s project should be accepted since its return is greater than the risk based cost of capital for the division.

(2)

Before tax cost of debt = 11.1%

Tax rate = 40%

After tax cost of debt (Kd) = Before tax cost of debt (1 - tax rate)

= 11.1% ( 1 - 0.40)

= 11.1% x 0.60

= 6.6%

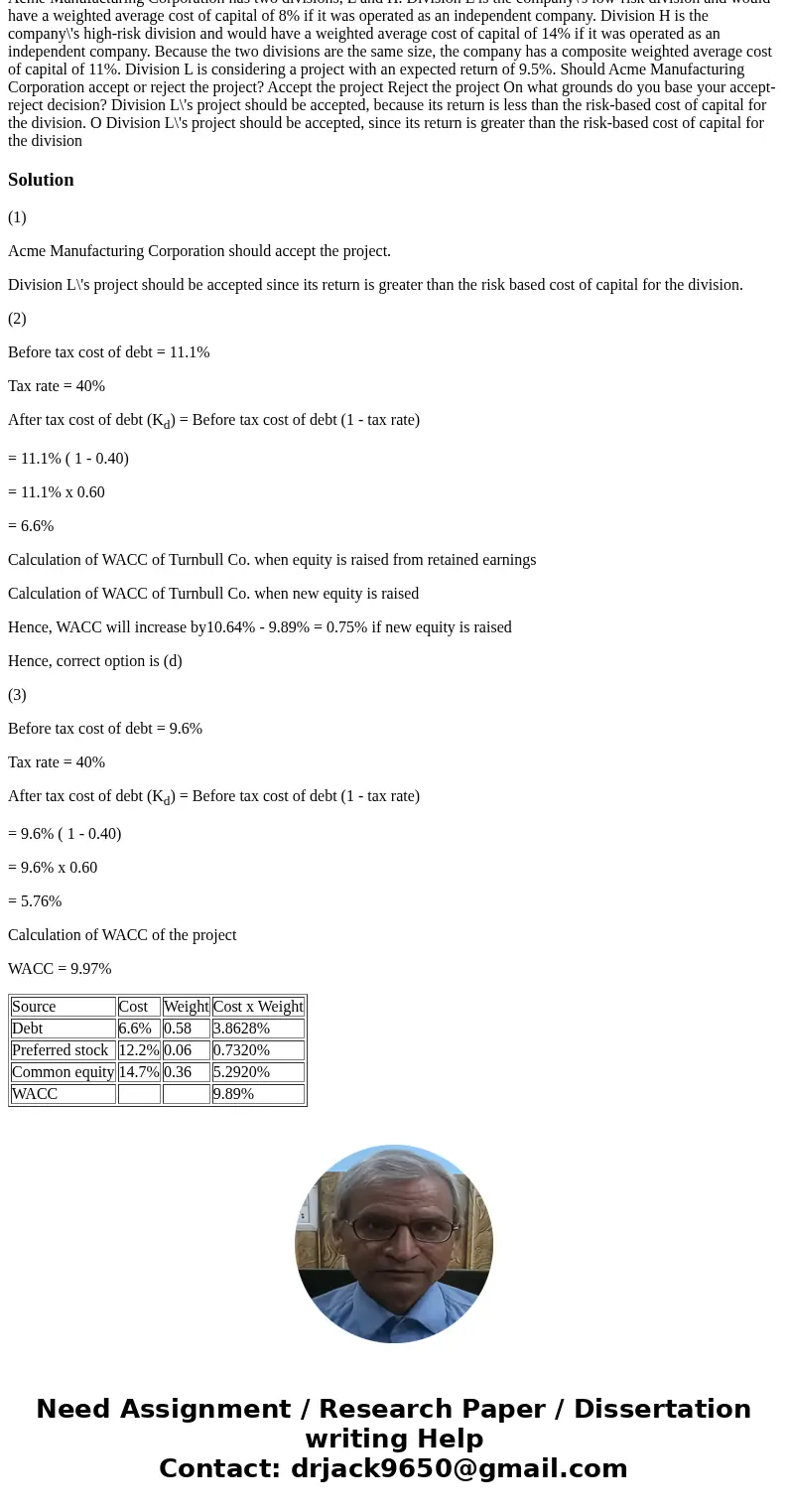

Calculation of WACC of Turnbull Co. when equity is raised from retained earnings

Calculation of WACC of Turnbull Co. when new equity is raised

Hence, WACC will increase by10.64% - 9.89% = 0.75% if new equity is raised

Hence, correct option is (d)

(3)

Before tax cost of debt = 9.6%

Tax rate = 40%

After tax cost of debt (Kd) = Before tax cost of debt (1 - tax rate)

= 9.6% ( 1 - 0.40)

= 9.6% x 0.60

= 5.76%

Calculation of WACC of the project

WACC = 9.97%

| Source | Cost | Weight | Cost x Weight |

| Debt | 6.6% | 0.58 | 3.8628% |

| Preferred stock | 12.2% | 0.06 | 0.7320% |

| Common equity | 14.7% | 0.36 | 5.2920% |

| WACC | 9.89% |

Homework Sourse

Homework Sourse