P1948 m da a wer taken from the records of Goodman Manufactu

Solution

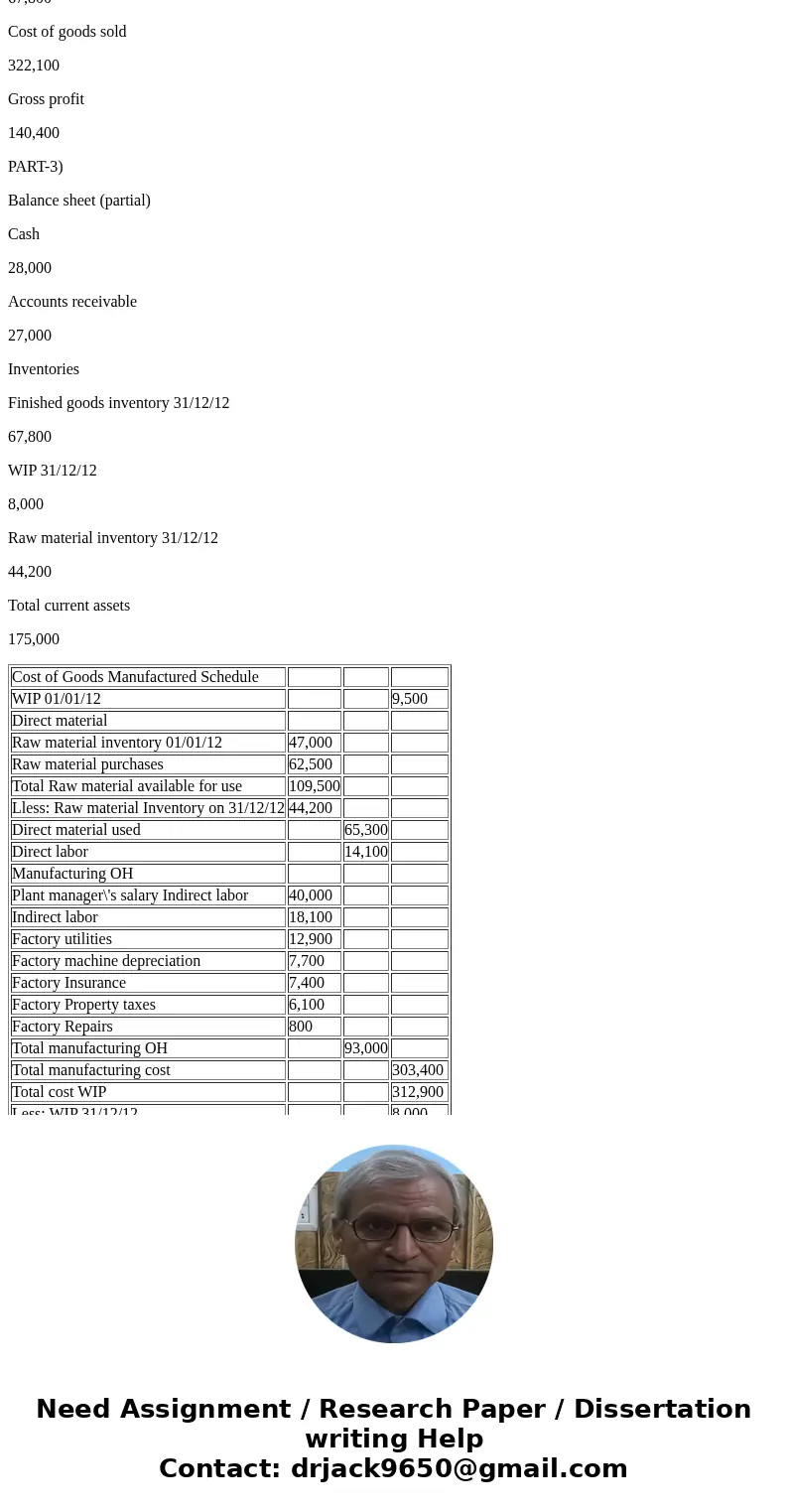

PART-1)

Cost of Goods Manufactured Schedule

WIP 01/01/12

9,500

Direct material

Raw material inventory 01/01/12

47,000

Raw material purchases

62,500

Total Raw material available for use

109,500

Lless: Raw material Inventory on 31/12/12

44,200

Direct material used

65,300

Direct labor

14,100

Manufacturing OH

Plant manager\'s salary Indirect labor

40,000

Indirect labor

18,100

Factory utilities

12,900

Factory machine depreciation

7,700

Factory Insurance

7,400

Factory Property taxes

6,100

Factory Repairs

800

Total manufacturing OH

93,000

Total manufacturing cost

303,400

Total cost WIP

312,900

Less: WIP 31/12/12

8,000

Cost of goods manufactured

3,04,900

PART-2)

Income statement (Partial)

Sales revenue

Sales

465,000

Minus: Discount

2,500

Net sales

462,500

COGS

Finished goods inventory 01/01/12

85000

Cost of goods manufactured

304,900

Cost of goods for sale

389,900

Finished goods inventory 31/12/12

67,800

Cost of goods sold

322,100

Gross profit

140,400

PART-3)

Balance sheet (partial)

Cash

28,000

Accounts receivable

27,000

Inventories

Finished goods inventory 31/12/12

67,800

WIP 31/12/12

8,000

Raw material inventory 31/12/12

44,200

Total current assets

175,000

| Cost of Goods Manufactured Schedule | |||

| WIP 01/01/12 | 9,500 | ||

| Direct material | |||

| Raw material inventory 01/01/12 | 47,000 | ||

| Raw material purchases | 62,500 | ||

| Total Raw material available for use | 109,500 | ||

| Lless: Raw material Inventory on 31/12/12 | 44,200 | ||

| Direct material used | 65,300 | ||

| Direct labor | 14,100 | ||

| Manufacturing OH | |||

| Plant manager\'s salary Indirect labor | 40,000 | ||

| Indirect labor | 18,100 | ||

| Factory utilities | 12,900 | ||

| Factory machine depreciation | 7,700 | ||

| Factory Insurance | 7,400 | ||

| Factory Property taxes | 6,100 | ||

| Factory Repairs | 800 | ||

| Total manufacturing OH | 93,000 | ||

| Total manufacturing cost | 303,400 | ||

| Total cost WIP | 312,900 | ||

| Less: WIP 31/12/12 | 8,000 | ||

| Cost of goods manufactured | 3,04,900 |

Homework Sourse

Homework Sourse