The following transactions occurred during December 31 2018

Solution

Answer

Date

Dr. $

Cr. $

1.

Interest Receivable

2,325

Interest Revenue

2,325

(Being Interest for 3 months (From Oct to Dec.) i.e. $93,000*10%*3/12 months due

2.

Rent Expense ($10,200 * 2/3 months)

6,800

Prepaid Rent

6,800

(Being rent for 2 months i.e. November and December adjusted)

3.

Rent Revenue ($16,200 * 7/12 months)

9,450

Deferred Rent Revenue

9,450

(Being rent for 7 months credited to rent revenue now adjusted)

4.

Depreciation

5,900

Accumulated Depreciation

5,900

(Being depreciation recorded)

5.

Salaries expense

9,400

Salaries Payable

9,400

(Being vocation expense recorded)

6.

Supplies expense (3400 + 7900 - 3950)

7,350

Supplies

7,350

(Being supplies expense recorded)

Supplies expense = Opening balance + purchased - closing

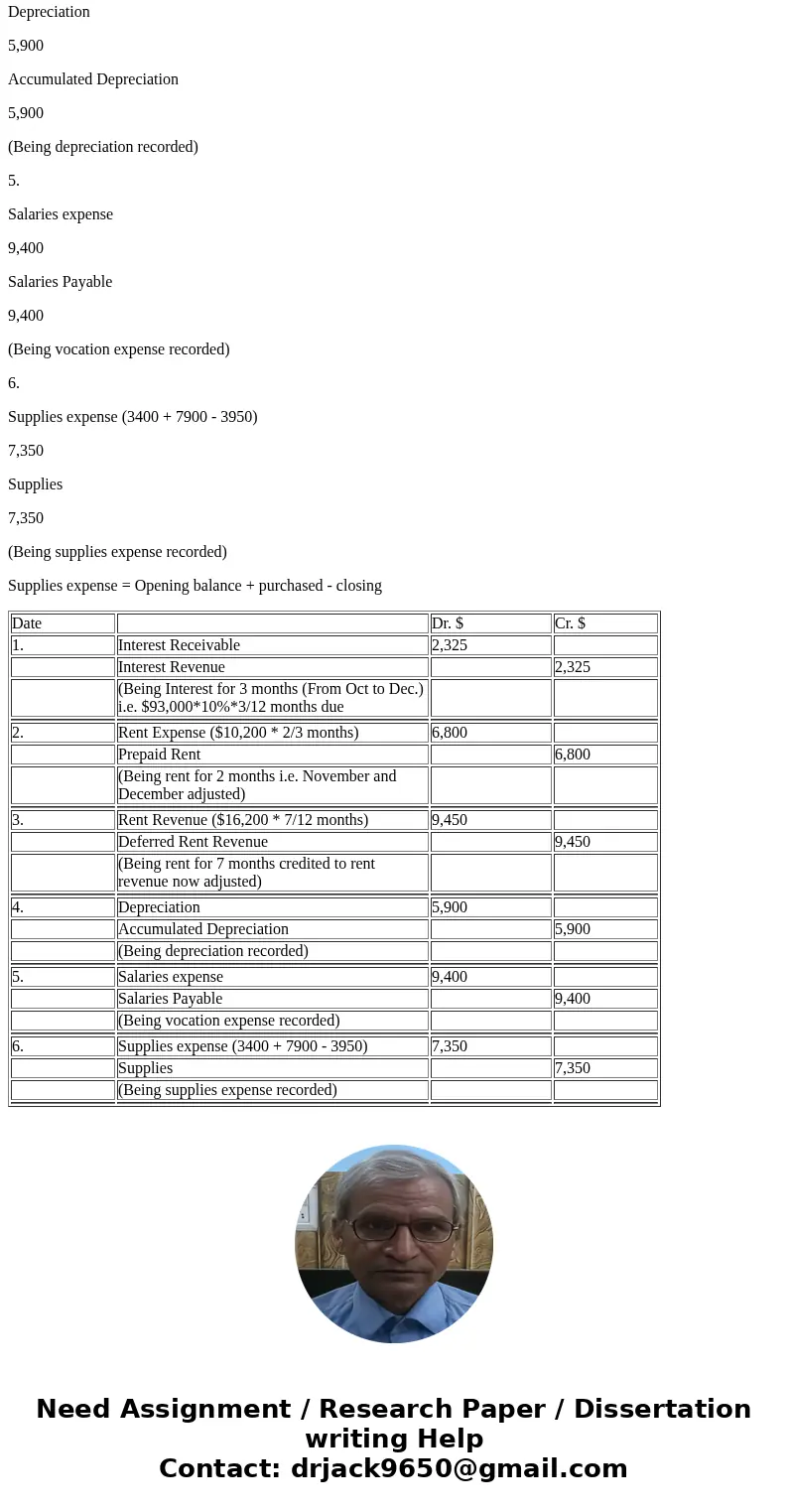

| Date | Dr. $ | Cr. $ | |

| 1. | Interest Receivable | 2,325 | |

| Interest Revenue | 2,325 | ||

| (Being Interest for 3 months (From Oct to Dec.) i.e. $93,000*10%*3/12 months due | |||

| 2. | Rent Expense ($10,200 * 2/3 months) | 6,800 | |

| Prepaid Rent | 6,800 | ||

| (Being rent for 2 months i.e. November and December adjusted) | |||

| 3. | Rent Revenue ($16,200 * 7/12 months) | 9,450 | |

| Deferred Rent Revenue | 9,450 | ||

| (Being rent for 7 months credited to rent revenue now adjusted) | |||

| 4. | Depreciation | 5,900 | |

| Accumulated Depreciation | 5,900 | ||

| (Being depreciation recorded) | |||

| 5. | Salaries expense | 9,400 | |

| Salaries Payable | 9,400 | ||

| (Being vocation expense recorded) | |||

| 6. | Supplies expense (3400 + 7900 - 3950) | 7,350 | |

| Supplies | 7,350 | ||

| (Being supplies expense recorded) | |||

Homework Sourse

Homework Sourse