2 Assume that you are in one of the 7 federal tax brackets h

Solution

Tax rate bracket in %

10%

12%

22%

24%

32%

35%

37%

Tax equivalent Yield = municipal Yield/(100%-tax bracket)

Municipal Bond Yield in %

4%

4.44%

4.55%

5.13%

5.26%

5.88%

6.15%

6.35%

5%

5.56%

5.68%

6.41%

6.58%

7.35%

7.69%

7.94%

6%

6.67%

6.82%

7.69%

7.89%

8.82%

9.23%

9.52%

7%

7.78%

7.95%

8.97%

9.21%

10.29%

10.77%

11.11%

8%

8.89%

9.09%

10.26%

10.53%

11.76%

12.31%

12.70%

I choose 10% as income tax rate so Municipal bond tax equivalent Yield

Municipal Bond Yield in %

tax rate-10%

Tax equivalent Yield = municipal Yield/(100%-tax bracket)

4%

10%

4.44%

5%

10%

5.56%

6%

10%

6.67%

7%

10%

7.78%

8%

10%

8.89%

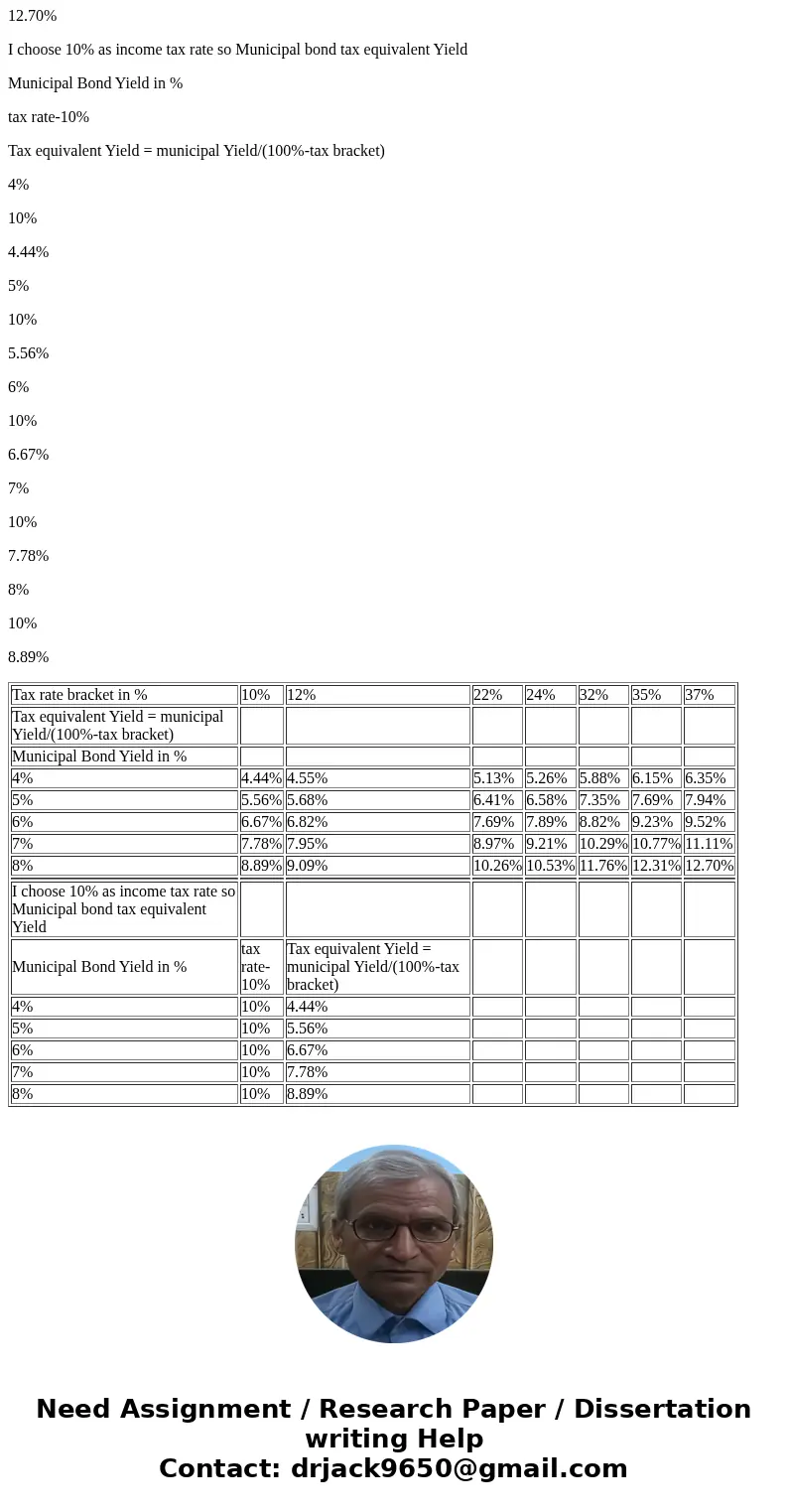

| Tax rate bracket in % | 10% | 12% | 22% | 24% | 32% | 35% | 37% |

| Tax equivalent Yield = municipal Yield/(100%-tax bracket) | |||||||

| Municipal Bond Yield in % | |||||||

| 4% | 4.44% | 4.55% | 5.13% | 5.26% | 5.88% | 6.15% | 6.35% |

| 5% | 5.56% | 5.68% | 6.41% | 6.58% | 7.35% | 7.69% | 7.94% |

| 6% | 6.67% | 6.82% | 7.69% | 7.89% | 8.82% | 9.23% | 9.52% |

| 7% | 7.78% | 7.95% | 8.97% | 9.21% | 10.29% | 10.77% | 11.11% |

| 8% | 8.89% | 9.09% | 10.26% | 10.53% | 11.76% | 12.31% | 12.70% |

| I choose 10% as income tax rate so Municipal bond tax equivalent Yield | |||||||

| Municipal Bond Yield in % | tax rate-10% | Tax equivalent Yield = municipal Yield/(100%-tax bracket) | |||||

| 4% | 10% | 4.44% | |||||

| 5% | 10% | 5.56% | |||||

| 6% | 10% | 6.67% | |||||

| 7% | 10% | 7.78% | |||||

| 8% | 10% | 8.89% |

Homework Sourse

Homework Sourse