Retractable Technologies just paid a dividend of D0 180 and

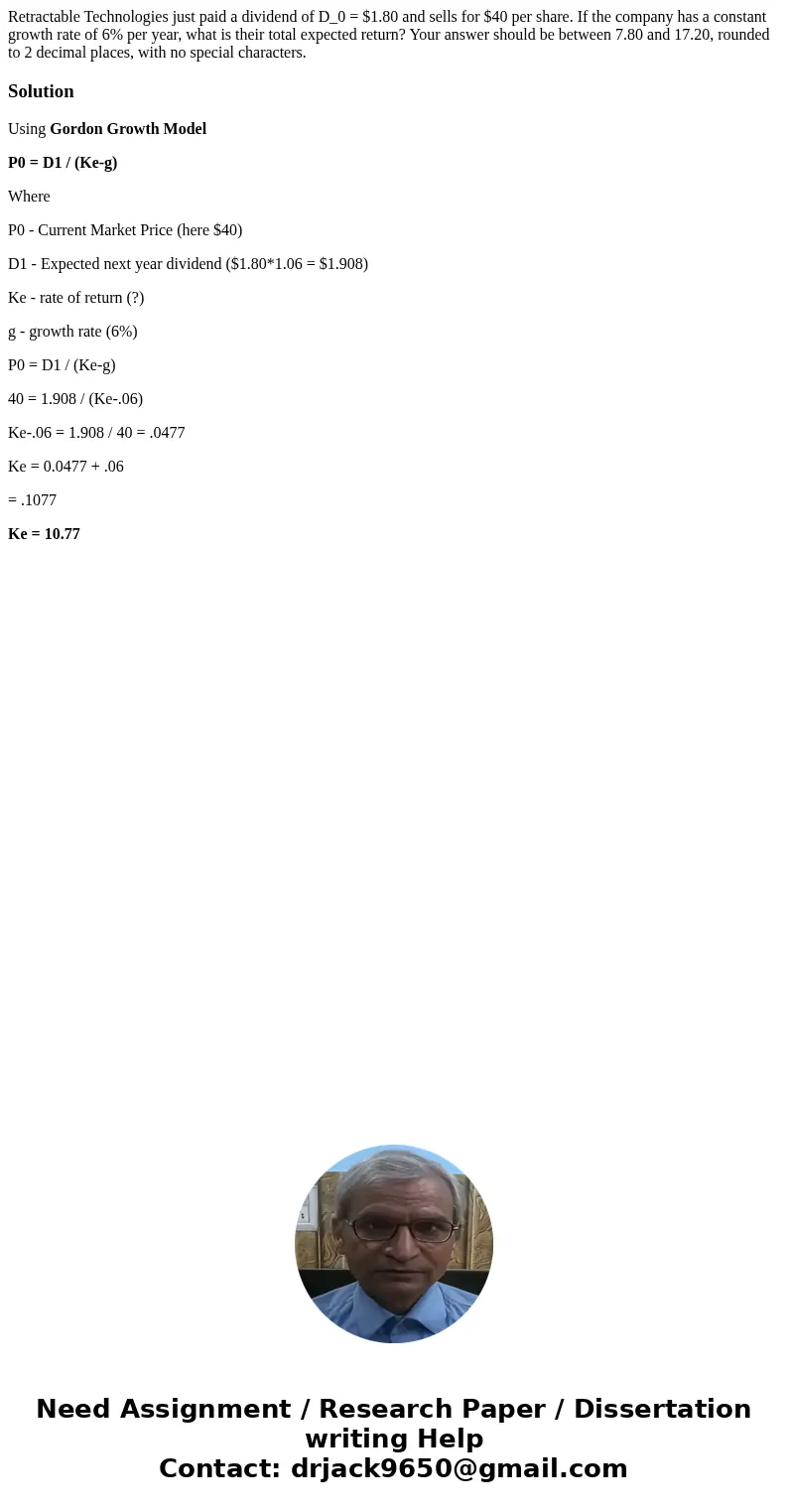

Retractable Technologies just paid a dividend of D_0 = $1.80 and sells for $40 per share. If the company has a constant growth rate of 6% per year, what is their total expected return? Your answer should be between 7.80 and 17.20, rounded to 2 decimal places, with no special characters.

Solution

Using Gordon Growth Model

P0 = D1 / (Ke-g)

Where

P0 - Current Market Price (here $40)

D1 - Expected next year dividend ($1.80*1.06 = $1.908)

Ke - rate of return (?)

g - growth rate (6%)

P0 = D1 / (Ke-g)

40 = 1.908 / (Ke-.06)

Ke-.06 = 1.908 / 40 = .0477

Ke = 0.0477 + .06

= .1077

Ke = 10.77

Homework Sourse

Homework Sourse