Please show all working 45 An asset costing 40000 was instal

Please show all working

4.5. An asset costing $40,000 was installed in 1989 and depreciated using MACRS per- centages for the 5-year property class. In 1991 the asset was sold. Calculate the net cash flow after taxes resulting from the sale of the asset. The company is a large, stable, profitable corporation with a marginal tax rate of 34%. The selling price of the asset was (a) $25,000; (b) $10,000.Solution

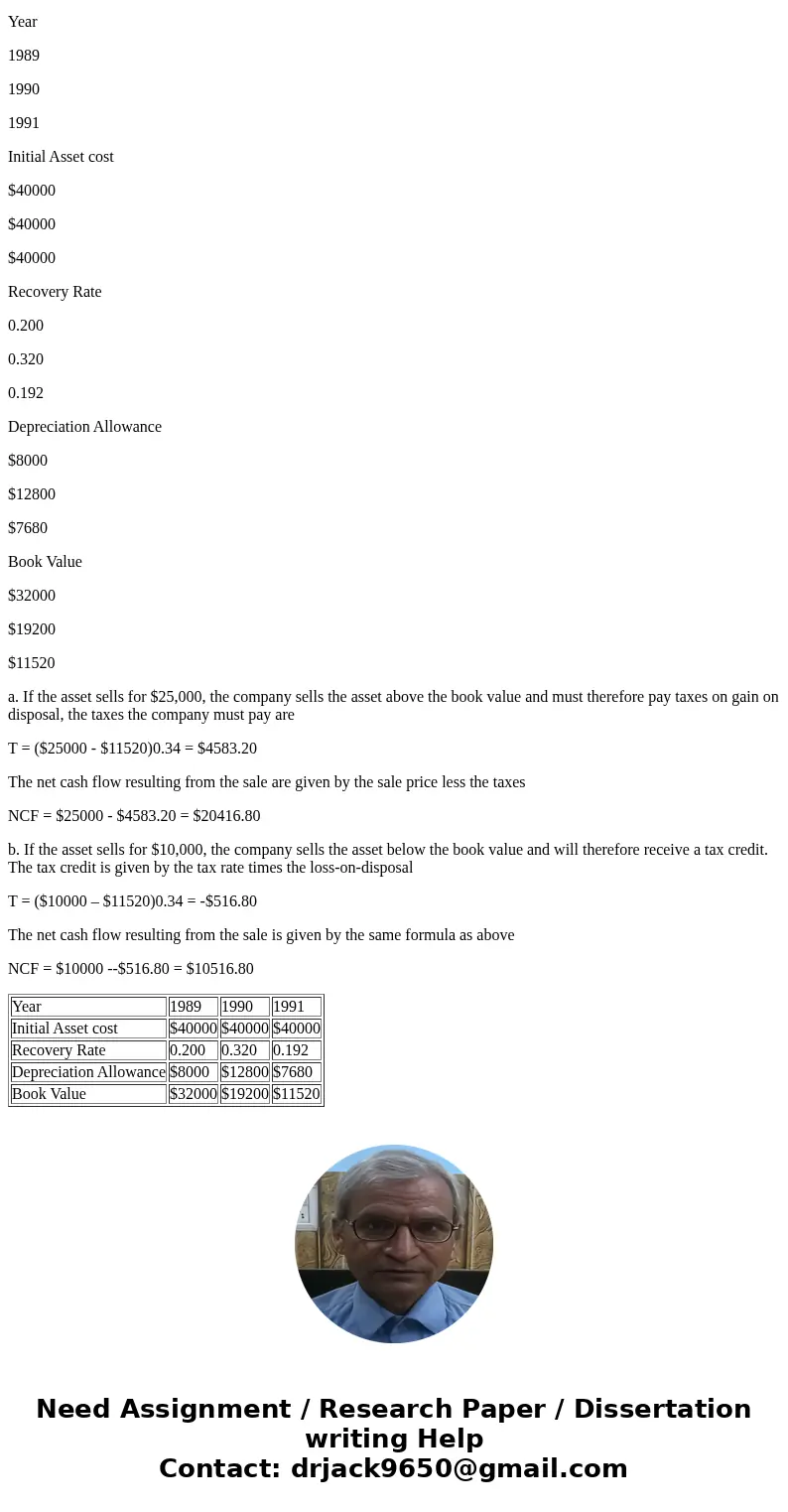

The following table summarizes the recovery rates from MACRS and calculates the depreciation allowance based on the initial cost of the asset and the book value.

Year

1989

1990

1991

Initial Asset cost

$40000

$40000

$40000

Recovery Rate

0.200

0.320

0.192

Depreciation Allowance

$8000

$12800

$7680

Book Value

$32000

$19200

$11520

a. If the asset sells for $25,000, the company sells the asset above the book value and must therefore pay taxes on gain on disposal, the taxes the company must pay are

T = ($25000 - $11520)0.34 = $4583.20

The net cash flow resulting from the sale are given by the sale price less the taxes

NCF = $25000 - $4583.20 = $20416.80

b. If the asset sells for $10,000, the company sells the asset below the book value and will therefore receive a tax credit. The tax credit is given by the tax rate times the loss-on-disposal

T = ($10000 – $11520)0.34 = -$516.80

The net cash flow resulting from the sale is given by the same formula as above

NCF = $10000 --$516.80 = $10516.80

| Year | 1989 | 1990 | 1991 |

| Initial Asset cost | $40000 | $40000 | $40000 |

| Recovery Rate | 0.200 | 0.320 | 0.192 |

| Depreciation Allowance | $8000 | $12800 | $7680 |

| Book Value | $32000 | $19200 | $11520 |

Homework Sourse

Homework Sourse