You own a bond with an annual coupon rate of 7 maturing in t

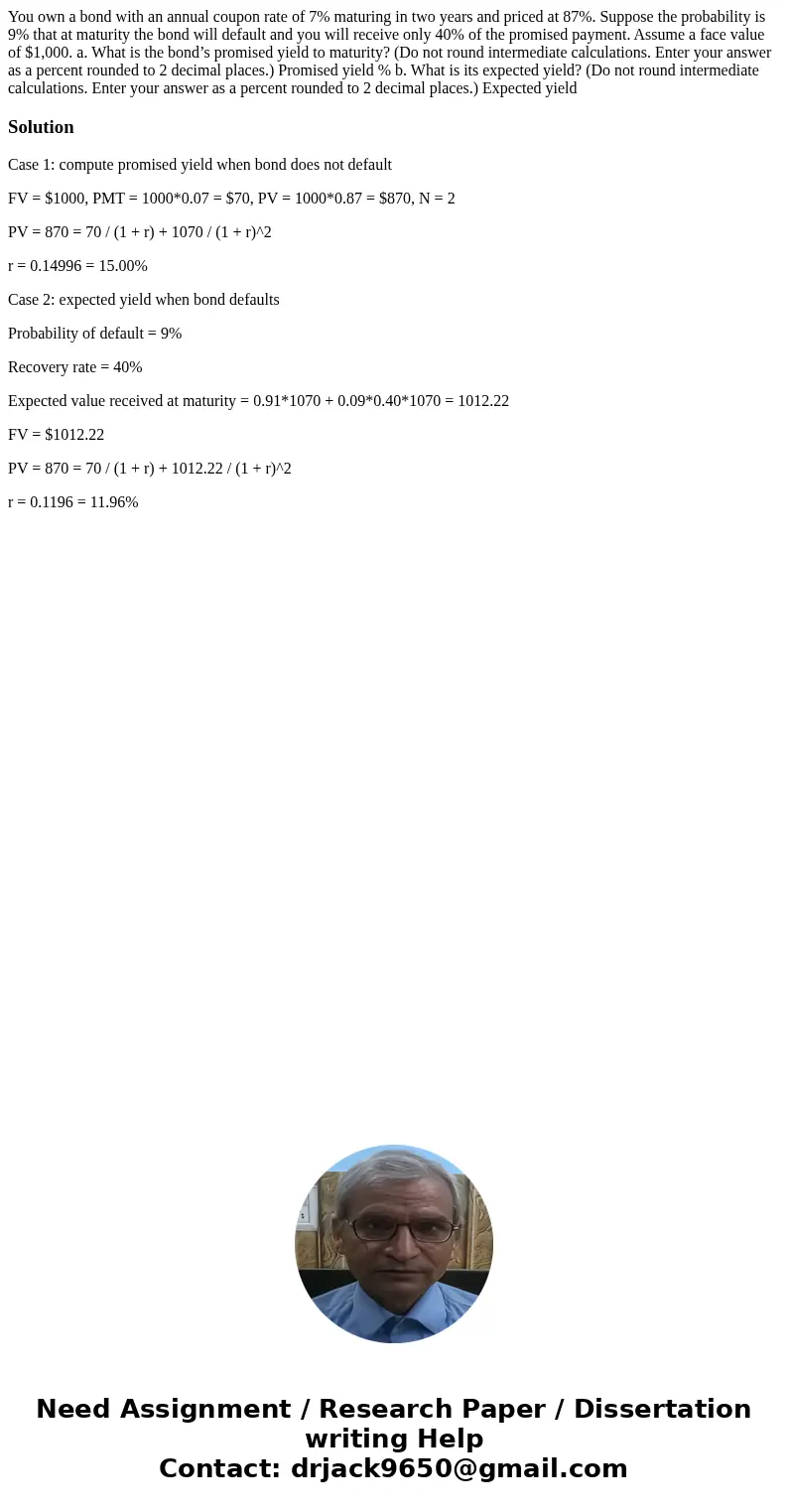

You own a bond with an annual coupon rate of 7% maturing in two years and priced at 87%. Suppose the probability is 9% that at maturity the bond will default and you will receive only 40% of the promised payment. Assume a face value of $1,000. a. What is the bond’s promised yield to maturity? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Promised yield % b. What is its expected yield? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Expected yield

Solution

Case 1: compute promised yield when bond does not default

FV = $1000, PMT = 1000*0.07 = $70, PV = 1000*0.87 = $870, N = 2

PV = 870 = 70 / (1 + r) + 1070 / (1 + r)^2

r = 0.14996 = 15.00%

Case 2: expected yield when bond defaults

Probability of default = 9%

Recovery rate = 40%

Expected value received at maturity = 0.91*1070 + 0.09*0.40*1070 = 1012.22

FV = $1012.22

PV = 870 = 70 / (1 + r) + 1012.22 / (1 + r)^2

r = 0.1196 = 11.96%

Homework Sourse

Homework Sourse