The adjusted trial balance for Tybalt Construction as of Dec

The adjusted trial balance for Tybalt Construction as of December 31, 2015, follows.

Prepare the income statement for the calendar year 2015.

Prepare the statement of owner\'s equity for the calendar year 2015.

Prepare the classified balance sheet at December 31, 2015.

Closing entries (all dated December 31, 2015):

Use the information in the financial statements to compute the following ratios:

Denominator:=Return on total assets/=Return on total assets 0 (b) Debt ratioNumerator:/Denominator:=Debt ratio/=Debt ratio 0 (c) Profit margin ratio (use total revenues as the denominator)Numerator:/Denominator:=Profit margin/=Profit margin 0%(d) Current ratioNumerator:/Denominator:=Current ratio/=Current ratio 0

| The adjusted trial balance for Tybalt Construction as of December 31, 2015, follows. |

Solution

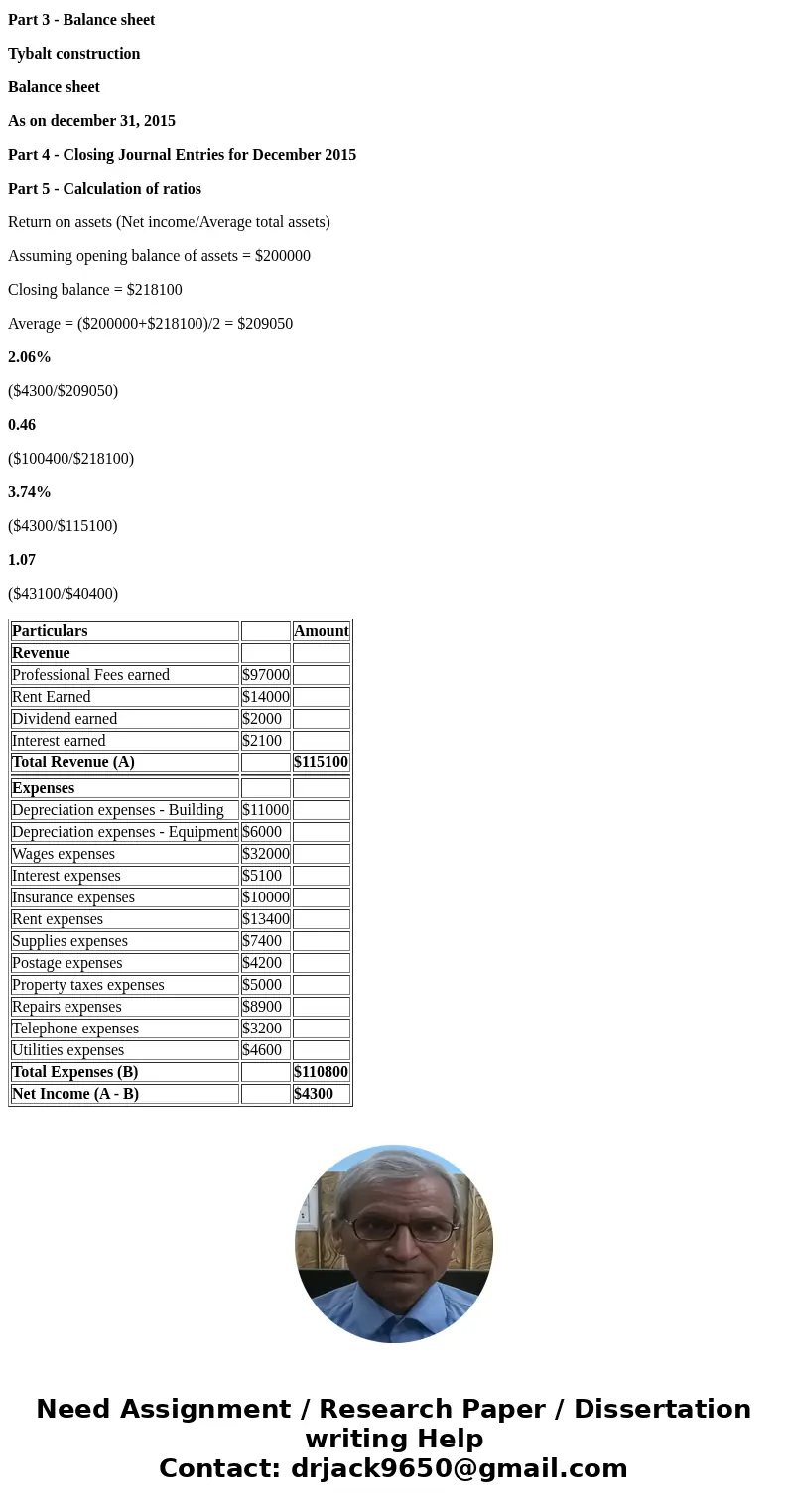

Part 1 - Income Statement

Tybalt Construction

Income Statement

For the year ended December 31, 2015

Part 2 - Statement of owners equity

Tybalt construction

Statement of owners equity

For the year ended December 2015

Part 3 - Balance sheet

Tybalt construction

Balance sheet

As on december 31, 2015

Part 4 - Closing Journal Entries for December 2015

Part 5 - Calculation of ratios

Return on assets (Net income/Average total assets)

Assuming opening balance of assets = $200000

Closing balance = $218100

Average = ($200000+$218100)/2 = $209050

2.06%

($4300/$209050)

0.46

($100400/$218100)

3.74%

($4300/$115100)

1.07

($43100/$40400)

| Particulars | Amount | |

| Revenue | ||

| Professional Fees earned | $97000 | |

| Rent Earned | $14000 | |

| Dividend earned | $2000 | |

| Interest earned | $2100 | |

| Total Revenue (A) | $115100 | |

| Expenses | ||

| Depreciation expenses - Building | $11000 | |

| Depreciation expenses - Equipment | $6000 | |

| Wages expenses | $32000 | |

| Interest expenses | $5100 | |

| Insurance expenses | $10000 | |

| Rent expenses | $13400 | |

| Supplies expenses | $7400 | |

| Postage expenses | $4200 | |

| Property taxes expenses | $5000 | |

| Repairs expenses | $8900 | |

| Telephone expenses | $3200 | |

| Utilities expenses | $4600 | |

| Total Expenses (B) | $110800 | |

| Net Income (A - B) | $4300 |

Homework Sourse

Homework Sourse