Brief Exercise 235 Shamrock Corporation had the following 20

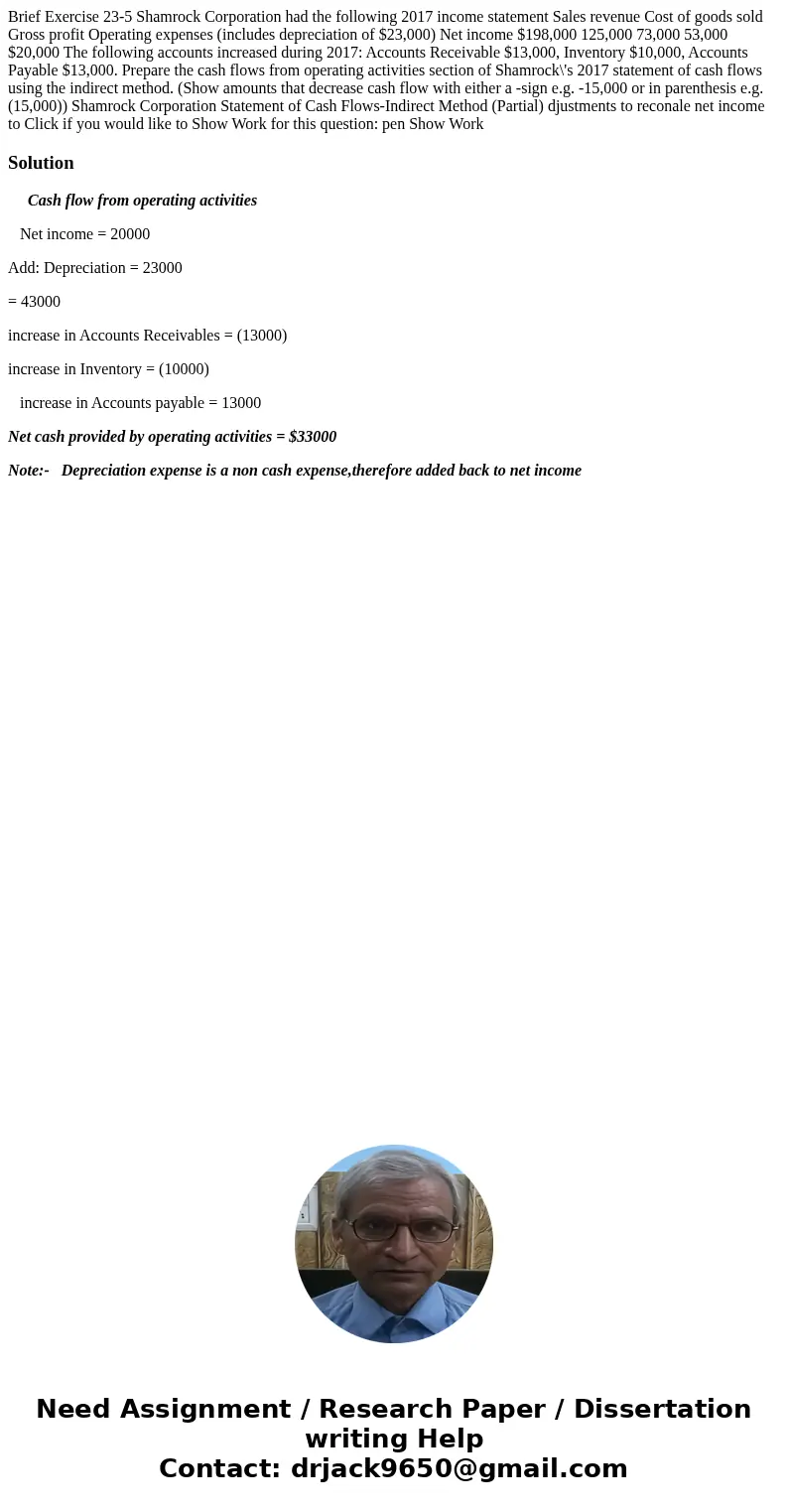

Brief Exercise 23-5 Shamrock Corporation had the following 2017 income statement Sales revenue Cost of goods sold Gross profit Operating expenses (includes depreciation of $23,000) Net income $198,000 125,000 73,000 53,000 $20,000 The following accounts increased during 2017: Accounts Receivable $13,000, Inventory $10,000, Accounts Payable $13,000. Prepare the cash flows from operating activities section of Shamrock\'s 2017 statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a -sign e.g. -15,000 or in parenthesis e.g. (15,000)) Shamrock Corporation Statement of Cash Flows-Indirect Method (Partial) djustments to reconale net income to Click if you would like to Show Work for this question: pen Show Work

Solution

Cash flow from operating activities

Net income = 20000

Add: Depreciation = 23000

= 43000

increase in Accounts Receivables = (13000)

increase in Inventory = (10000)

increase in Accounts payable = 13000

Net cash provided by operating activities = $33000

Note:- Depreciation expense is a non cash expense,therefore added back to net income

Homework Sourse

Homework Sourse