On January 1 2017 Marin Corporation issued 690000 of 9 bonds

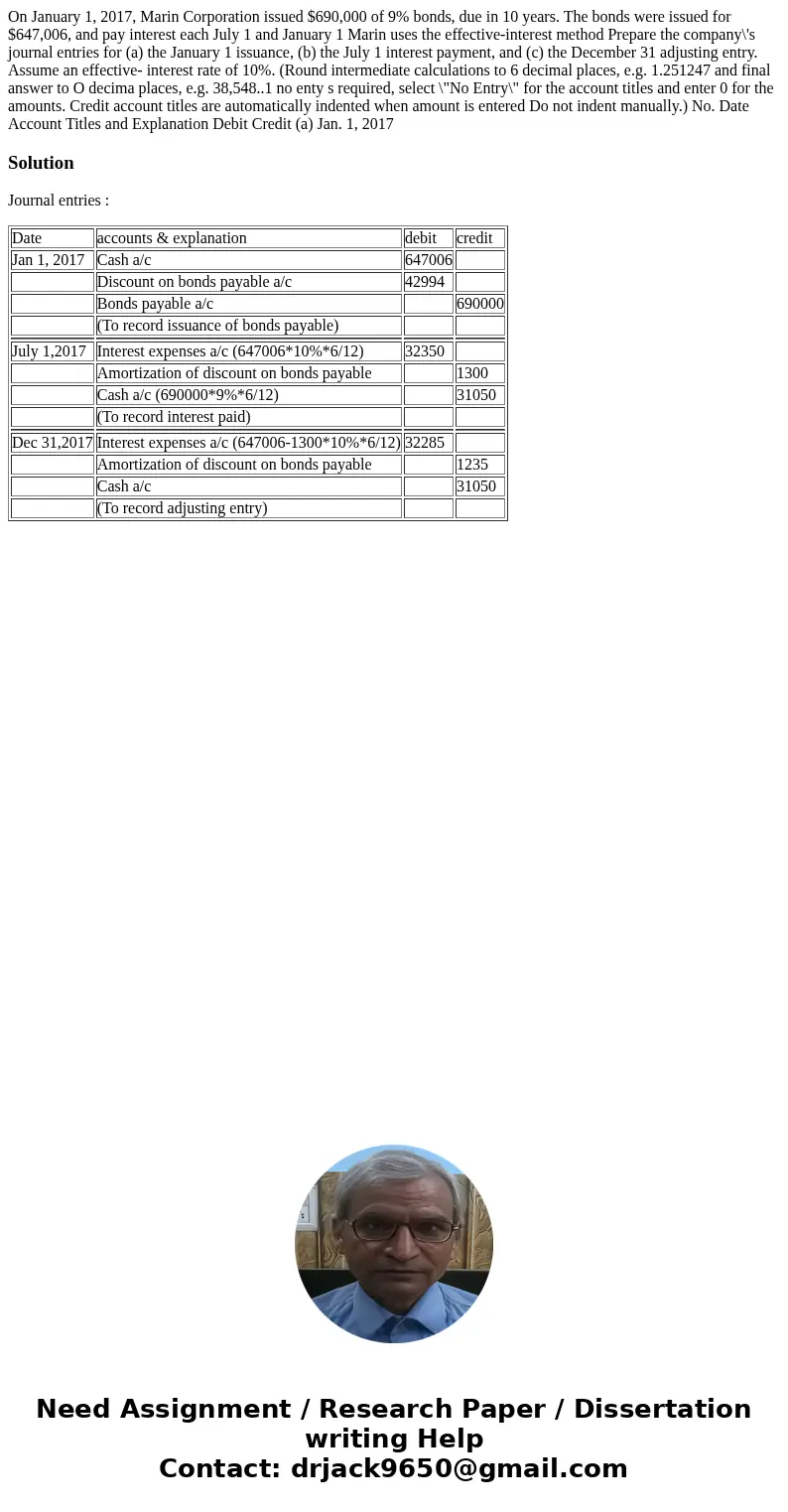

On January 1, 2017, Marin Corporation issued $690,000 of 9% bonds, due in 10 years. The bonds were issued for $647,006, and pay interest each July 1 and January 1 Marin uses the effective-interest method Prepare the company\'s journal entries for (a) the January 1 issuance, (b) the July 1 interest payment, and (c) the December 31 adjusting entry. Assume an effective- interest rate of 10%. (Round intermediate calculations to 6 decimal places, e.g. 1.251247 and final answer to O decima places, e.g. 38,548..1 no enty s required, select \"No Entry\" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered Do not indent manually.) No. Date Account Titles and Explanation Debit Credit (a) Jan. 1, 2017

Solution

Journal entries :

| Date | accounts & explanation | debit | credit |

| Jan 1, 2017 | Cash a/c | 647006 | |

| Discount on bonds payable a/c | 42994 | ||

| Bonds payable a/c | 690000 | ||

| (To record issuance of bonds payable) | |||

| July 1,2017 | Interest expenses a/c (647006*10%*6/12) | 32350 | |

| Amortization of discount on bonds payable | 1300 | ||

| Cash a/c (690000*9%*6/12) | 31050 | ||

| (To record interest paid) | |||

| Dec 31,2017 | Interest expenses a/c (647006-1300*10%*6/12) | 32285 | |

| Amortization of discount on bonds payable | 1235 | ||

| Cash a/c | 31050 | ||

| (To record adjusting entry) |

Homework Sourse

Homework Sourse