Question 3 010 pts A firm is considering the purchase of a m

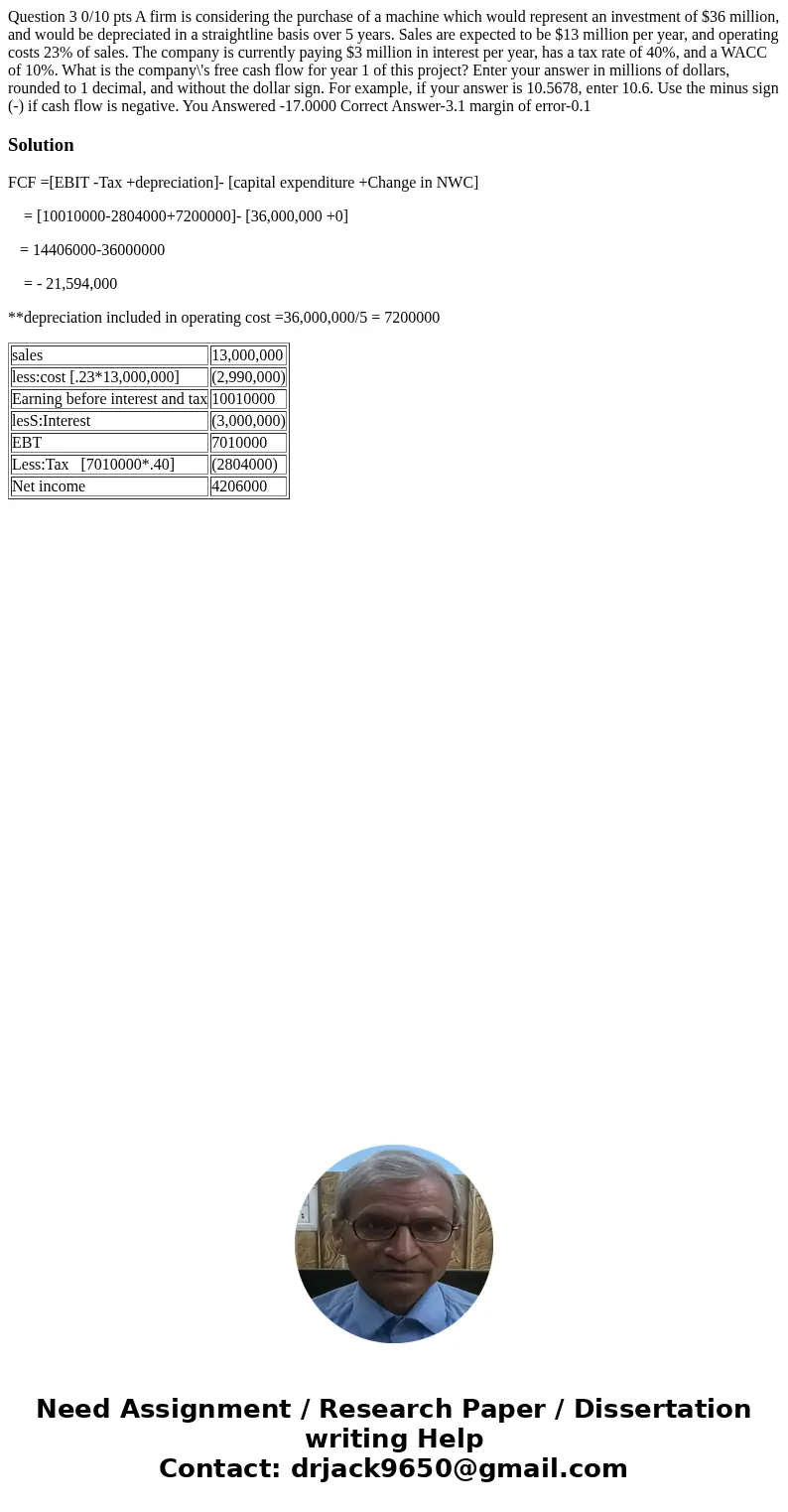

Question 3 0/10 pts A firm is considering the purchase of a machine which would represent an investment of $36 million, and would be depreciated in a straightline basis over 5 years. Sales are expected to be $13 million per year, and operating costs 23% of sales. The company is currently paying $3 million in interest per year, has a tax rate of 40%, and a WACC of 10%. What is the company\'s free cash flow for year 1 of this project? Enter your answer in millions of dollars, rounded to 1 decimal, and without the dollar sign. For example, if your answer is 10.5678, enter 10.6. Use the minus sign (-) if cash flow is negative. You Answered -17.0000 Correct Answer-3.1 margin of error-0.1

Solution

FCF =[EBIT -Tax +depreciation]- [capital expenditure +Change in NWC]

= [10010000-2804000+7200000]- [36,000,000 +0]

= 14406000-36000000

= - 21,594,000

**depreciation included in operating cost =36,000,000/5 = 7200000

| sales | 13,000,000 |

| less:cost [.23*13,000,000] | (2,990,000) |

| Earning before interest and tax | 10010000 |

| lesS:Interest | (3,000,000) |

| EBT | 7010000 |

| Less:Tax [7010000*.40] | (2804000) |

| Net income | 4206000 |

Homework Sourse

Homework Sourse