Modern Artifacts can produce keepsakes that will be sold for

Solution

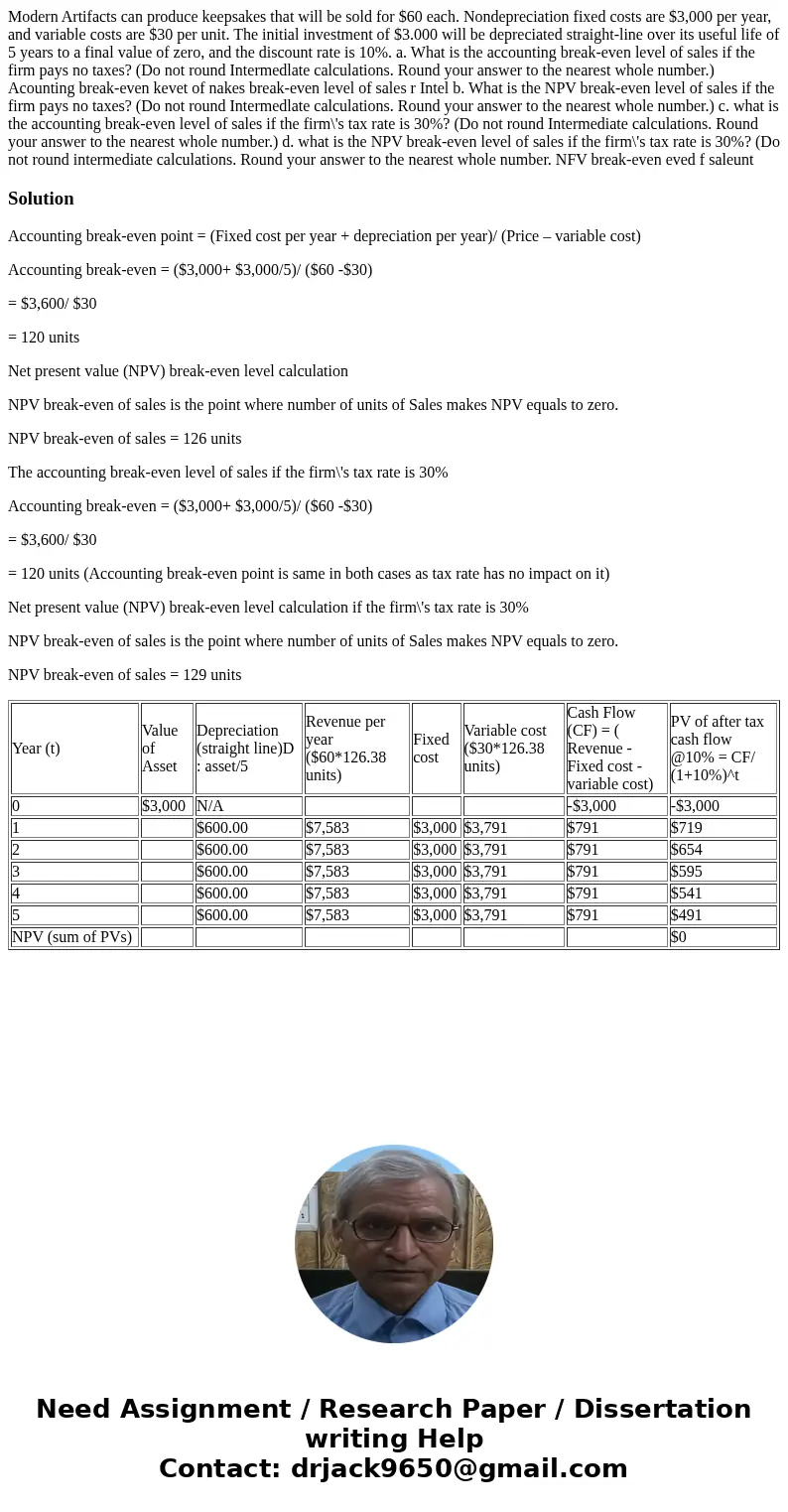

Accounting break-even point = (Fixed cost per year + depreciation per year)/ (Price – variable cost)

Accounting break-even = ($3,000+ $3,000/5)/ ($60 -$30)

= $3,600/ $30

= 120 units

Net present value (NPV) break-even level calculation

NPV break-even of sales is the point where number of units of Sales makes NPV equals to zero.

NPV break-even of sales = 126 units

The accounting break-even level of sales if the firm\'s tax rate is 30%

Accounting break-even = ($3,000+ $3,000/5)/ ($60 -$30)

= $3,600/ $30

= 120 units (Accounting break-even point is same in both cases as tax rate has no impact on it)

Net present value (NPV) break-even level calculation if the firm\'s tax rate is 30%

NPV break-even of sales is the point where number of units of Sales makes NPV equals to zero.

NPV break-even of sales = 129 units

| Year (t) | Value of Asset | Depreciation (straight line)D : asset/5 | Revenue per year ($60*126.38 units) | Fixed cost | Variable cost ($30*126.38 units) | Cash Flow (CF) = ( Revenue -Fixed cost -variable cost) | PV of after tax cash flow @10% = CF/ (1+10%)^t |

| 0 | $3,000 | N/A | -$3,000 | -$3,000 | |||

| 1 | $600.00 | $7,583 | $3,000 | $3,791 | $791 | $719 | |

| 2 | $600.00 | $7,583 | $3,000 | $3,791 | $791 | $654 | |

| 3 | $600.00 | $7,583 | $3,000 | $3,791 | $791 | $595 | |

| 4 | $600.00 | $7,583 | $3,000 | $3,791 | $791 | $541 | |

| 5 | $600.00 | $7,583 | $3,000 | $3,791 | $791 | $491 | |

| NPV (sum of PVs) | $0 |

Homework Sourse

Homework Sourse