Bonita Co is building a new hockey arena at a cost of 263000

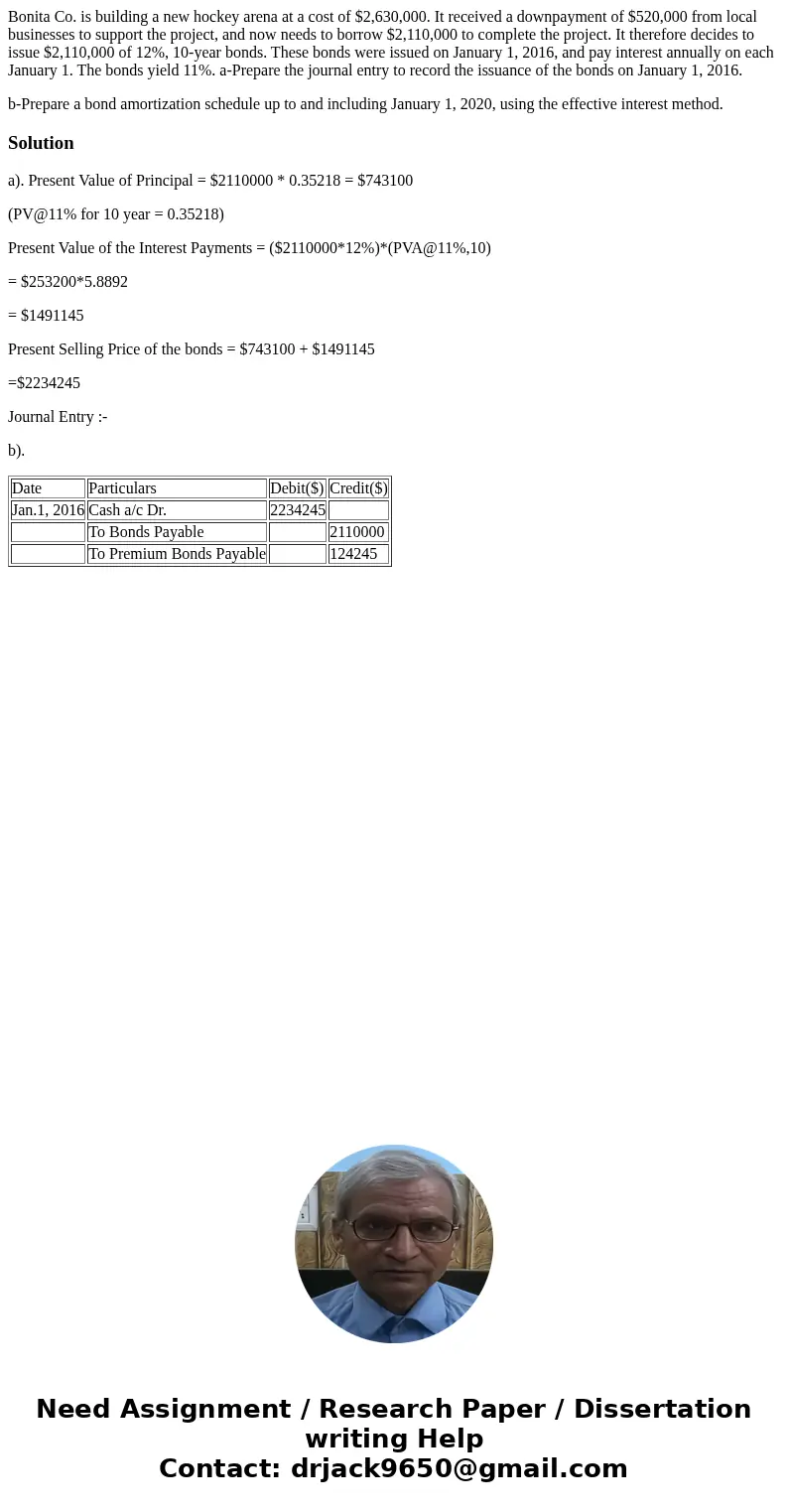

Bonita Co. is building a new hockey arena at a cost of $2,630,000. It received a downpayment of $520,000 from local businesses to support the project, and now needs to borrow $2,110,000 to complete the project. It therefore decides to issue $2,110,000 of 12%, 10-year bonds. These bonds were issued on January 1, 2016, and pay interest annually on each January 1. The bonds yield 11%. a-Prepare the journal entry to record the issuance of the bonds on January 1, 2016.

b-Prepare a bond amortization schedule up to and including January 1, 2020, using the effective interest method.

Solution

a). Present Value of Principal = $2110000 * 0.35218 = $743100

(PV@11% for 10 year = 0.35218)

Present Value of the Interest Payments = ($2110000*12%)*(PVA@11%,10)

= $253200*5.8892

= $1491145

Present Selling Price of the bonds = $743100 + $1491145

=$2234245

Journal Entry :-

b).

| Date | Particulars | Debit($) | Credit($) |

| Jan.1, 2016 | Cash a/c Dr. | 2234245 | |

| To Bonds Payable | 2110000 | ||

| To Premium Bonds Payable | 124245 |

Homework Sourse

Homework Sourse