3 On November 30 a desk was purchased for 2200 The desk has

3. On November 30, a desk was purchased for $2,200. The desk has a seven year useful life, no salvage value. For the adjusting journal entry (if there is one) the effect on each of the following of not recording the adj entry is: [Write O (Overstates), U (Understates), or NE (No Effect) next to each account type.] Asset: Liability: Revenue: Expense: Net Income:

Solution

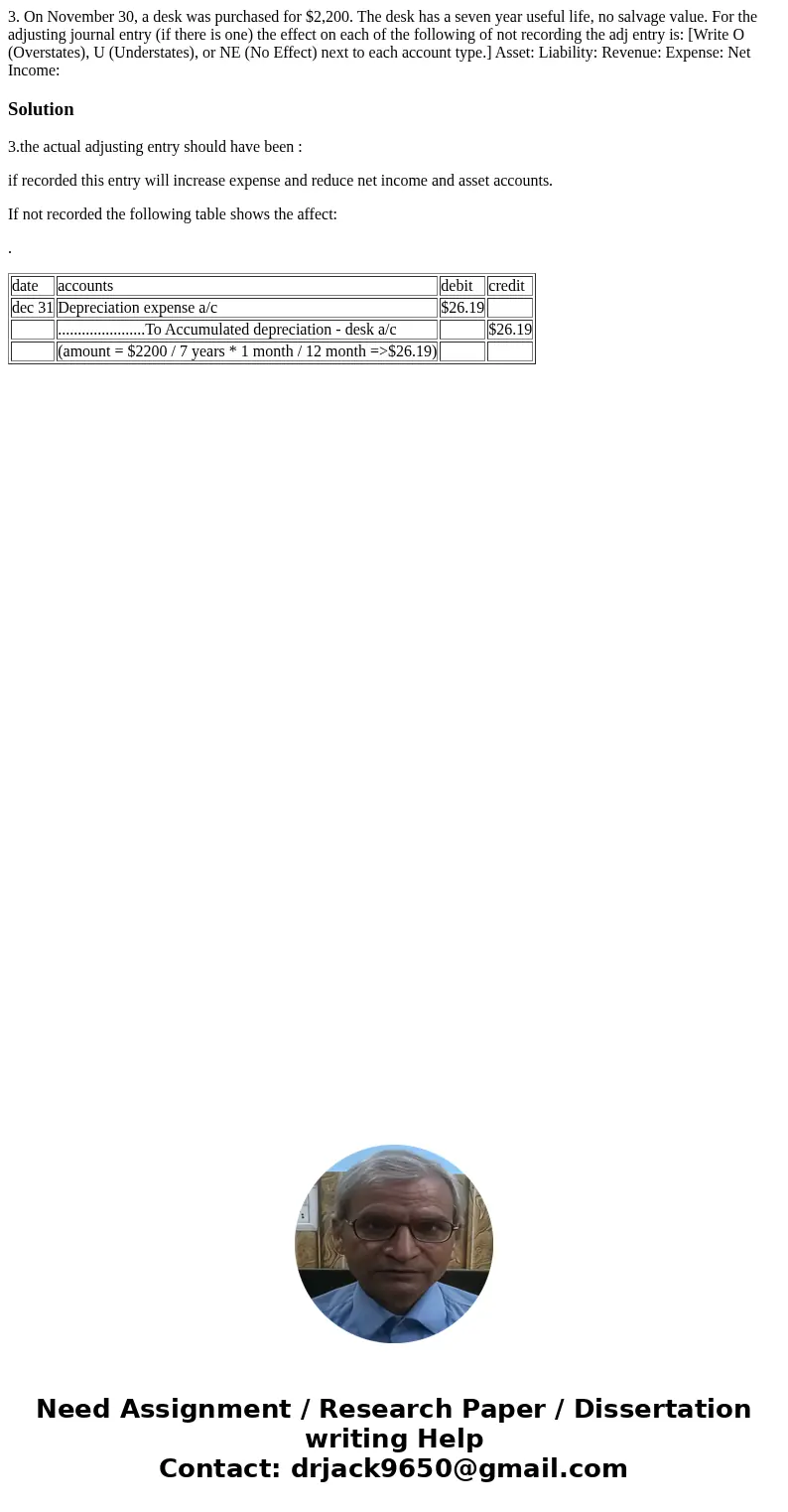

3.the actual adjusting entry should have been :

if recorded this entry will increase expense and reduce net income and asset accounts.

If not recorded the following table shows the affect:

.

| date | accounts | debit | credit |

| dec 31 | Depreciation expense a/c | $26.19 | |

| ......................To Accumulated depreciation - desk a/c | $26.19 | ||

| (amount = $2200 / 7 years * 1 month / 12 month =>$26.19) |

Homework Sourse

Homework Sourse