Karlson Software Company is located in State H which enables

Karlson Software Company is located in State H, which enables employers to reduce their contribution rates under the experience-rating system. From 2004 to 2013, inclusive, the company\'s total contributions to state unemployment compensation amounted to $14,730. For the calendar years 2014 to 2017, inclusive, the contribution rate for Karlson was 2.7%.

The contributions of each employer are credited to an account maintained by the State Unemployment Compensation Commission. This account is credited with contributions paid into the account by the employer and is charged with unemployment benefits that are paid from the account. Starting January 1, 2018, the contributions rate for all employers in State H will be based on the following tax-rate schedule:

The annual payroll for calculation purposes is the total wages payable during a 12-month period ending with the last day of the third quarter of any calendar year. The average annual payroll is the average of the last three annual payrolls. The SUTA tax rate for the year is computed using the information available (benefits received and taxes paid) as of September 30 of the preceding year.

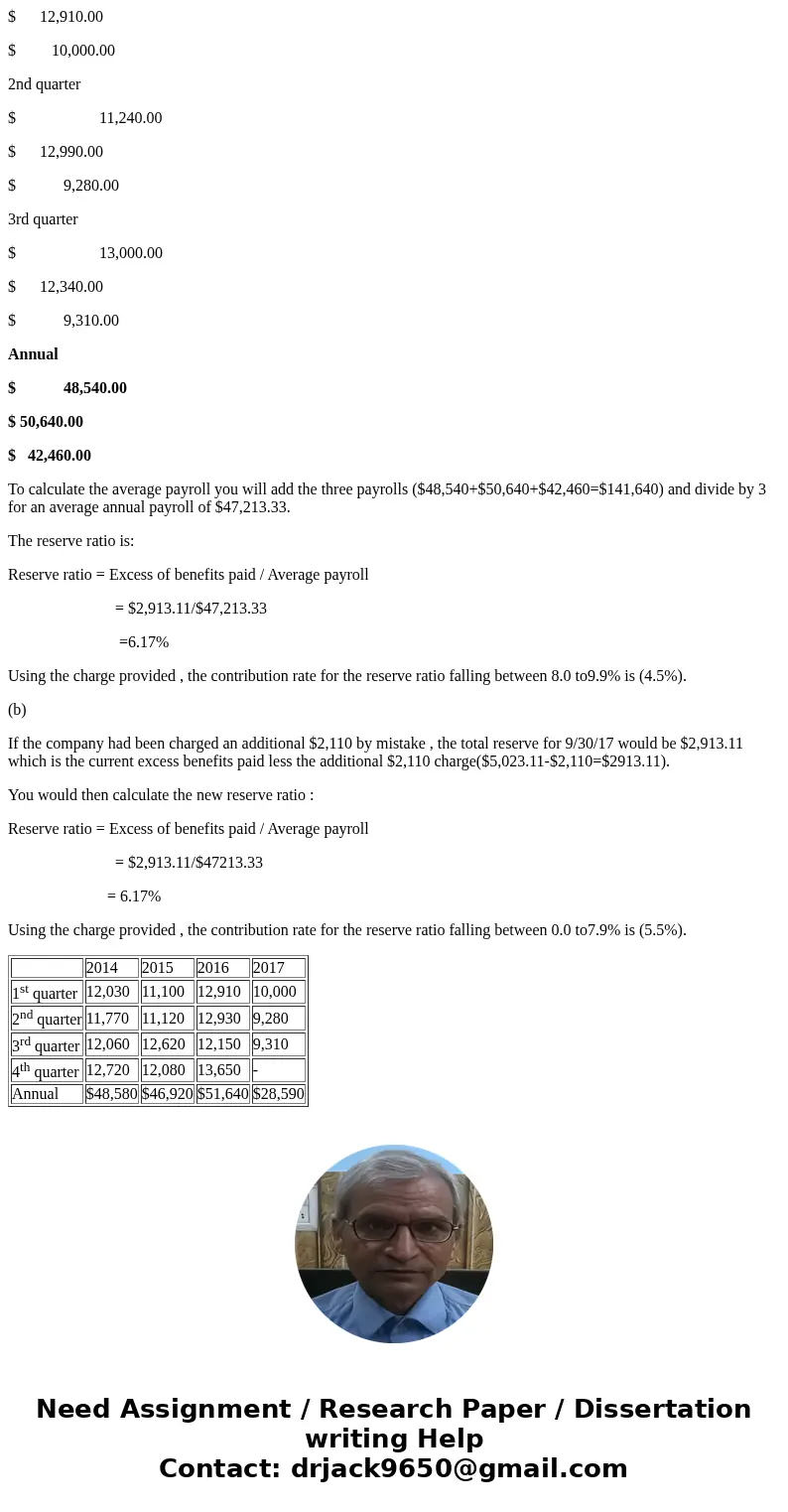

The schedule below shows the total payroll and the taxable payroll for the calendar years 2014 to 2017.

Unemployment benefits became payable to the company\'s qualified unemployed workers on January 1, 2004. Between that time and September 30, 2017, total benefits amounting to $14,451.60 were charged against the employer\'s account. Compute:

In your computations, round amounts to the nearest cent. Round your final percentage answers to one decimal place.

a. Contribution rate for 2018.

%

b. Rate for 2018 if $2,110 additional benefits had been charged by mistake to the account of Karlson Software Company by the State Unemployment Compensation.

%

| Reserve Ratio | Contribution Rate |

| Contributions falling below benefits paid | 7.0% |

| 0.0% to 7.9% | 5.5% |

| 8.0% to 9.9% | 4.5% |

| 10.0% to 11.9% | 3.5% |

| 12.0% to 14.9% | 2.5% |

| 15.0% or more | 1.5% |

Solution

(a)

Contribution rate for 2018 :

There are several steps that an employer needs to go through to calculate the contribution rate that thay will use for the coming year.The amount varies by state and is based on the amount of the reserve ratio. The annual contribution per year are calculated by adding each quarter‘s taxable payroll for the year.

2014

2015

2016

2017

1st quarter

12,030

11,100

12,910

10,000

2nd quarter

11,770

11,120

12,930

9,280

3rd quarter

12,060

12,620

12,150

9,310

4th quarter

12,720

12,080

13,650

-

Annual

$48,580

$46,920

$51,640

$28,590

The state contribution rate for 2014-2017 is 2.7%, so you can calculate each year’s required contribution by multiplying the annual taxable payroll by 2.7%:

2004 to 2013 inclusive

$ 14,730.00

2014

$48,580*0.027

=

$ 1,311.66

2015

$46,920*0.027

=

$ 1,266.84

2016

$51,640*0.027

=

$ 1,394.28

2017

$28,590*0.027

=

$ 771.93

Total reserve 9/30/17

$ 19,474.71

Less: Benefits paid

$ 14,451.60

Balance in reserve account 9/30/17

$ 5,023.11

You then compare the actual benefits paid to the total contributions. The calculations for this company result in a reserve balance of $5,023.11. Which means the total reserve of $19,474.71 was greater than the benefits paid of $14,451.60.

Now, that you have this information , you can continue on with working through the calculation to determine the contribution rate for 2016.The next step is to come up with the average annual payroll . Companies will vary in what quarters are included in calculating annual payroll. For our example, each year’s annual payroll includes the 4th quarter total payroll from the previous year along with the first three quarters of the year being calculated.

2015

2016

2017

Previous year 4th quarter

$ 13,200.00

$ 12,400.00

$ 13,870.00

1st quarter

$ 11,100.00

$ 12,910.00

$ 10,000.00

2nd quarter

$ 11,240.00

$ 12,990.00

$ 9,280.00

3rd quarter

$ 13,000.00

$ 12,340.00

$ 9,310.00

Annual

$ 48,540.00

$ 50,640.00

$ 42,460.00

To calculate the average payroll you will add the three payrolls ($48,540+$50,640+$42,460=$141,640) and divide by 3 for an average annual payroll of $47,213.33.

The reserve ratio is:

Reserve ratio = Excess of benefits paid / Average payroll

= $2,913.11/$47,213.33

=6.17%

Using the charge provided , the contribution rate for the reserve ratio falling between 8.0 to9.9% is (4.5%).

(b)

If the company had been charged an additional $2,110 by mistake , the total reserve for 9/30/17 would be $2,913.11 which is the current excess benefits paid less the additional $2,110 charge($5,023.11-$2,110=$2913.11).

You would then calculate the new reserve ratio :

Reserve ratio = Excess of benefits paid / Average payroll

= $2,913.11/$47213.33

= 6.17%

Using the charge provided , the contribution rate for the reserve ratio falling between 0.0 to7.9% is (5.5%).

| 2014 | 2015 | 2016 | 2017 | |

| 1st quarter | 12,030 | 11,100 | 12,910 | 10,000 |

| 2nd quarter | 11,770 | 11,120 | 12,930 | 9,280 |

| 3rd quarter | 12,060 | 12,620 | 12,150 | 9,310 |

| 4th quarter | 12,720 | 12,080 | 13,650 | - |

| Annual | $48,580 | $46,920 | $51,640 | $28,590 |

Homework Sourse

Homework Sourse