A machine with a 5year property class life has an initial co

A machine with a 5-year property class life has an initial cost of $20,000 and $5,000 salvage value. Its annual operating cost is $7,000 per year. Determine the depreciation charges using the Straight Line and MACRS methods. Then determine which method is preferred based on the NPW of the Straight Line and MACRS depreciation charges. The MARR is 12%.

Solution

(1)

SLM annual depreciation = (Cost - Salvage value) / Useful life = $(20,000 - 5,000) / 5 = $15,000 / 5 = $3,000

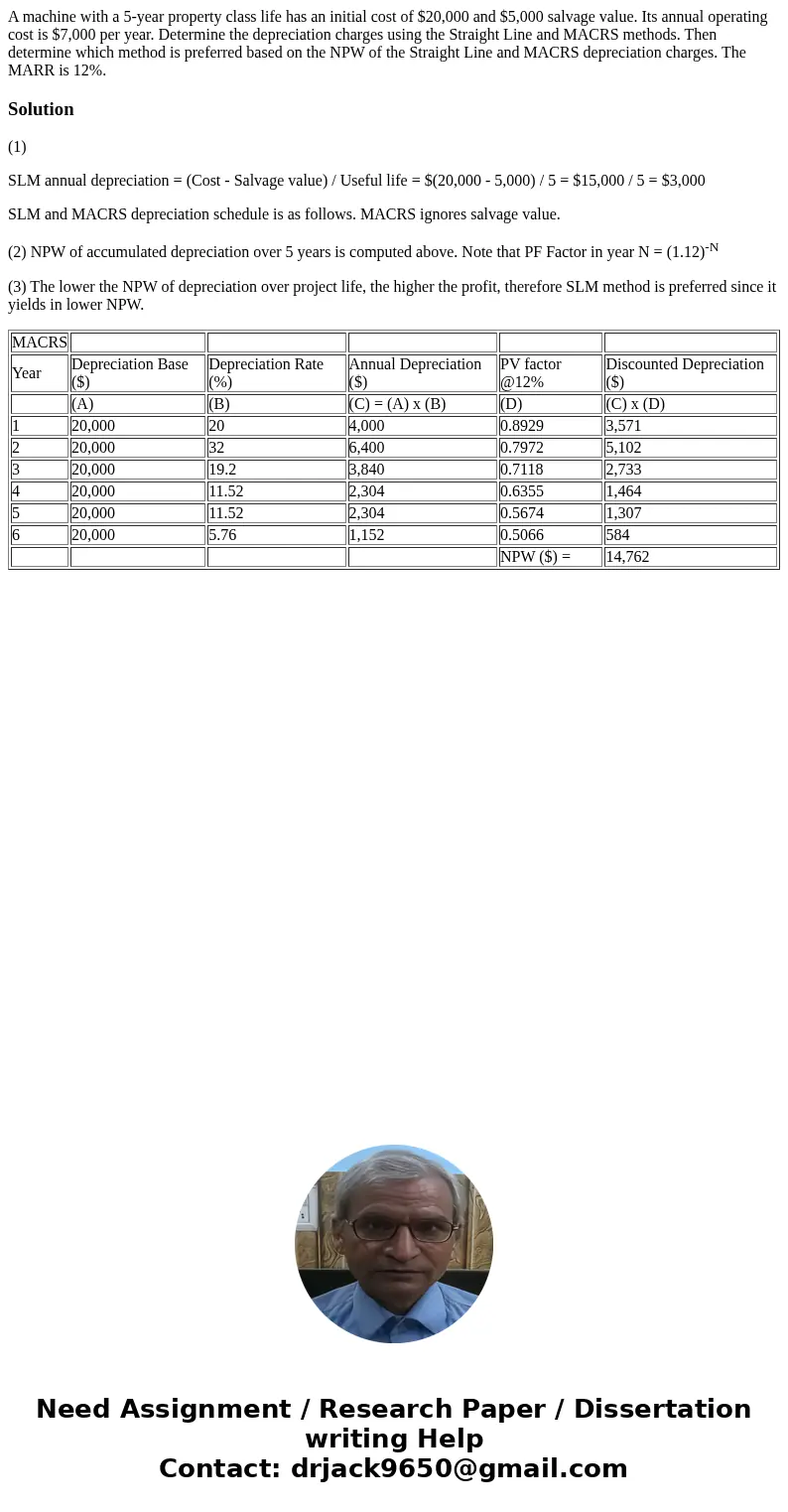

SLM and MACRS depreciation schedule is as follows. MACRS ignores salvage value.

(2) NPW of accumulated depreciation over 5 years is computed above. Note that PF Factor in year N = (1.12)-N

(3) The lower the NPW of depreciation over project life, the higher the profit, therefore SLM method is preferred since it yields in lower NPW.

| MACRS | |||||

| Year | Depreciation Base ($) | Depreciation Rate (%) | Annual Depreciation ($) | PV factor @12% | Discounted Depreciation ($) |

| (A) | (B) | (C) = (A) x (B) | (D) | (C) x (D) | |

| 1 | 20,000 | 20 | 4,000 | 0.8929 | 3,571 |

| 2 | 20,000 | 32 | 6,400 | 0.7972 | 5,102 |

| 3 | 20,000 | 19.2 | 3,840 | 0.7118 | 2,733 |

| 4 | 20,000 | 11.52 | 2,304 | 0.6355 | 1,464 |

| 5 | 20,000 | 11.52 | 2,304 | 0.5674 | 1,307 |

| 6 | 20,000 | 5.76 | 1,152 | 0.5066 | 584 |

| NPW ($) = | 14,762 |

Homework Sourse

Homework Sourse