bappsdiscussionboarddoconferencetoggle modereadtactionlist f

Solution

company Name

Forward Industries, Inc. (FORD)

1-

company\'s net income

579.346

30/09/2016 to 30/09/2017

2-

Company\'s total revenue

24,764.61

30/09/2016 to 30/09/2017

3-

total operating expenses

3,593.17

30/09/2016 to 30/09/2017

4-

EPS

0.05

5-

company\'s total assets

13,153.95

30/09/2017

6-

company\'s total liabilities

4,223.52

30/09/2017

7-

company\'s shareholders equity

8,930.42

30/09/2017

8-

total current assets

13,120.45

9-

total current liabilities

4,186.56

10-

working capital = current assets-current liabilities

8,933.88

11-

current ratio = current assets/current liabilities

1.47

12-

cash flow from operating activities

-137.639

30/09/2016 to 30/09/2017

13-

cash flow from investing activities

0

data not provided

30/09/2016 to 30/09/2017

14-

cash flow from financing activities

0

data not provided

30/09/2016 to 30/09/2017

15-

company Liquidity, profitability and solvency is good as its current ratio is more than 1

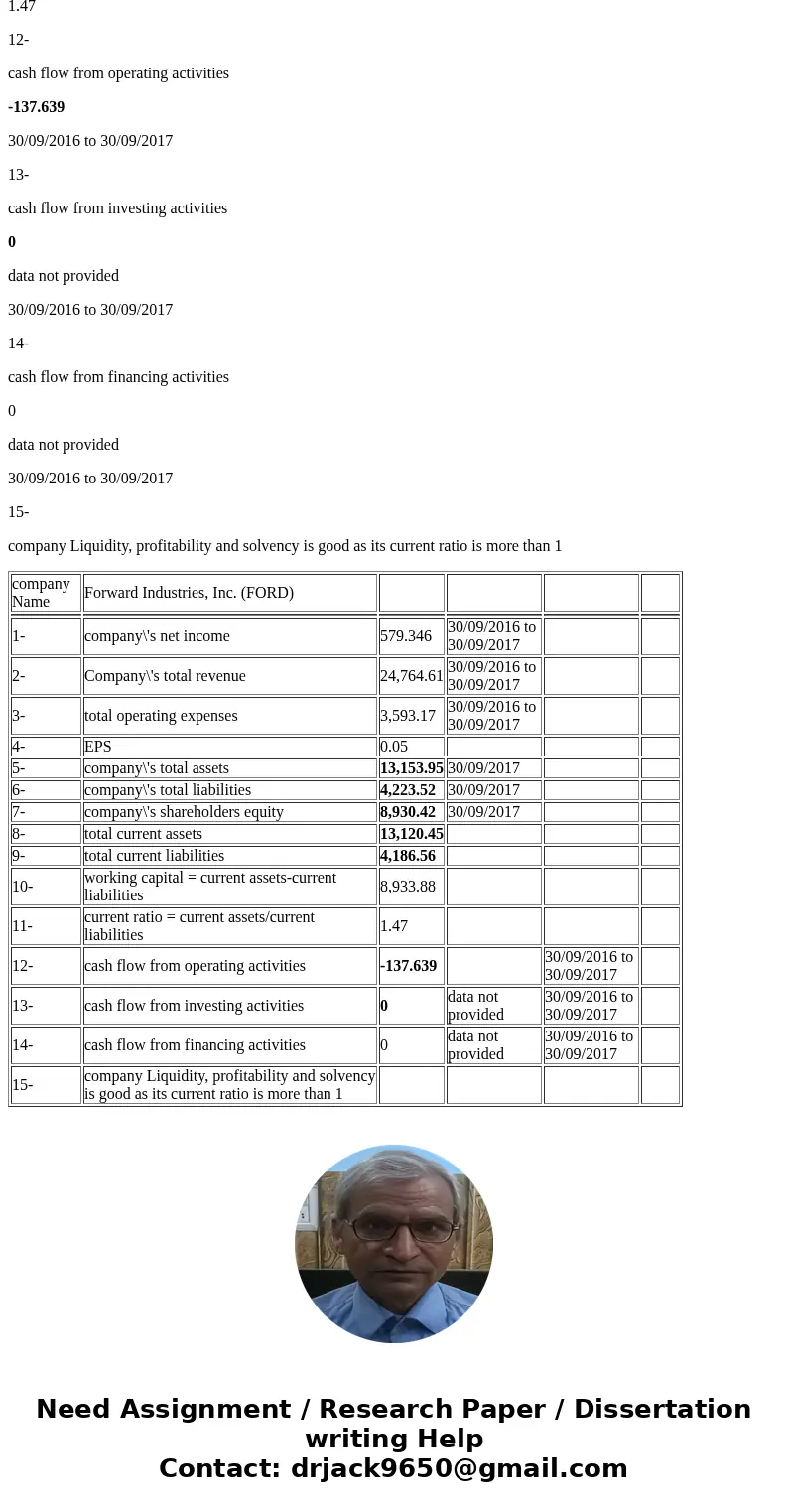

| company Name | Forward Industries, Inc. (FORD) | ||||

| 1- | company\'s net income | 579.346 | 30/09/2016 to 30/09/2017 | ||

| 2- | Company\'s total revenue | 24,764.61 | 30/09/2016 to 30/09/2017 | ||

| 3- | total operating expenses | 3,593.17 | 30/09/2016 to 30/09/2017 | ||

| 4- | EPS | 0.05 | |||

| 5- | company\'s total assets | 13,153.95 | 30/09/2017 | ||

| 6- | company\'s total liabilities | 4,223.52 | 30/09/2017 | ||

| 7- | company\'s shareholders equity | 8,930.42 | 30/09/2017 | ||

| 8- | total current assets | 13,120.45 | |||

| 9- | total current liabilities | 4,186.56 | |||

| 10- | working capital = current assets-current liabilities | 8,933.88 | |||

| 11- | current ratio = current assets/current liabilities | 1.47 | |||

| 12- | cash flow from operating activities | -137.639 | 30/09/2016 to 30/09/2017 | ||

| 13- | cash flow from investing activities | 0 | data not provided | 30/09/2016 to 30/09/2017 | |

| 14- | cash flow from financing activities | 0 | data not provided | 30/09/2016 to 30/09/2017 | |

| 15- | company Liquidity, profitability and solvency is good as its current ratio is more than 1 |

Homework Sourse

Homework Sourse