The unadjusted trial balance and adjustment data of Marys Mo

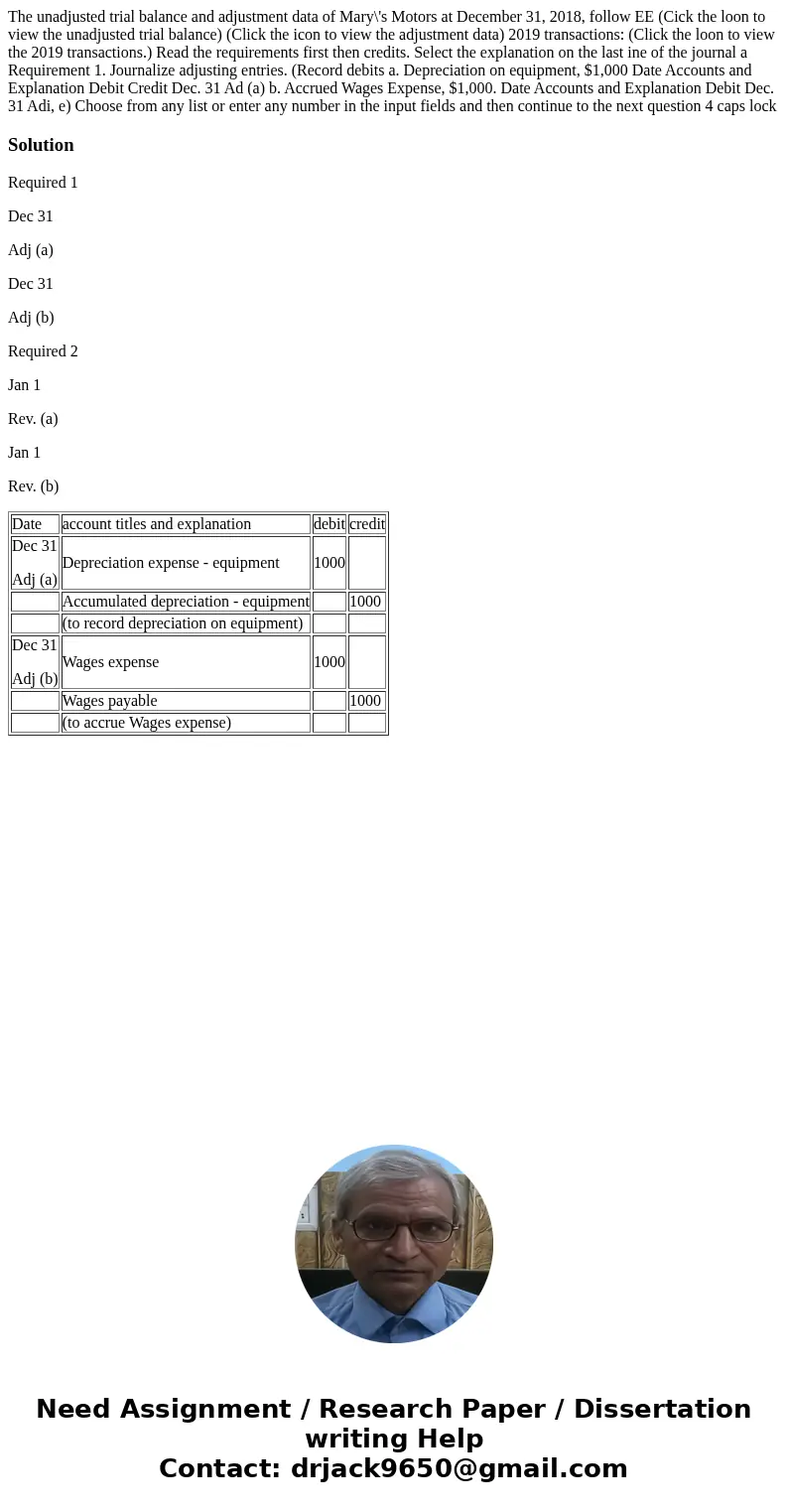

The unadjusted trial balance and adjustment data of Mary\'s Motors at December 31, 2018, follow EE (Cick the loon to view the unadjusted trial balance) (Click the icon to view the adjustment data) 2019 transactions: (Click the loon to view the 2019 transactions.) Read the requirements first then credits. Select the explanation on the last ine of the journal a Requirement 1. Journalize adjusting entries. (Record debits a. Depreciation on equipment, $1,000 Date Accounts and Explanation Debit Credit Dec. 31 Ad (a) b. Accrued Wages Expense, $1,000. Date Accounts and Explanation Debit Dec. 31 Adi, e) Choose from any list or enter any number in the input fields and then continue to the next question 4 caps lock

Solution

Required 1

Dec 31

Adj (a)

Dec 31

Adj (b)

Required 2

Jan 1

Rev. (a)

Jan 1

Rev. (b)

| Date | account titles and explanation | debit | credit |

| Dec 31 Adj (a) | Depreciation expense - equipment | 1000 | |

| Accumulated depreciation - equipment | 1000 | ||

| (to record depreciation on equipment) | |||

| Dec 31 Adj (b) | Wages expense | 1000 | |

| Wages payable | 1000 | ||

| (to accrue Wages expense) |

Homework Sourse

Homework Sourse